Work out your gain and pay your tax on buy to let business agricultural and inherited properties. But done correctly the tax savings can be significant.

Three Different Routes To Save Tax On Long Term Capital Gains

Three Different Routes To Save Tax On Long Term Capital Gains

capital gains tax rate on sale of commercial property

capital gains tax rate on sale of commercial property is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in capital gains tax rate on sale of commercial property content depends on the source site. We hope you do not use it for commercial purposes.

Capital gains tax is a major cost consideration for investors but when it comes to commercial property things can get complicated for the uninitiated.

Capital gains tax rate on sale of commercial property. Also tax from capital gains directly affects investment motives. Currently 15 at the federal level this tax is also applied at the state and local level to the gain realized on the sale of real estate held for business trade or investment. Whether you are buying a home for your start up expanding your business or selling an investment cgt is something you will encounter.

Nrcgt is essentially a levy imposed following a disposal on any gain in value from april 2019 or the original acquisition date on property held by offshore investors. If you bought your real estate asset through a section 1031 tax deferred exchange you were allowed to defer capital gains taxes due to the exchange of your property for a like kind or similar real estate property eg an office building for a shopping mall. Capital gains tax when you sell a property thats not your home.

Commercial property represents a significant capital investment. Non resident capital gains tax nrcgt will be extended to all gains on immovable uk property from 6 april 2019 which means that from this date it will include commercial property. You do not usually pay tax when you sell your home.

Unlike owning your own home investment properties are subject to capital gains tax cgt. Capital gains tax rates you pay a different rate of tax on gains from residential property than you do on other assets. Selling rental property could result in a significant tax bite depending on the profit you realize from the salefor a married couple filing jointly with a taxable income of 480000 and capital.

Under section 54 sell a residential property and invest the gains to buy a new residential property and claim exemption on capital gains tax. Because it is extremely easy for the value of a piece of commercial real estate to reach into the millions if not hundreds of millions of dollars individuals and entities considering a sale of a piece of commercial property should give careful consideration to the tax implications of the transaction. Capital gains tax is an issue for anyone involved in the commercial property market.

Indian income tax rules however contain provisions that in a few scenarios exempt tax from paying long term capital gains tax. Most individuals are aware of the capital gains tax due on the sale of investment real estate.

How To Save Capital Gains Tax On Sale Of Plot Flat House

Real Property Gains Tax Rpgt In Malaysia

Real Property Gains Tax Rpgt In Malaysia

Tips On Lowering Tax Liability Arising Out Of Profit Made By

Tips On Lowering Tax Liability Arising Out Of Profit Made By

How To Save Capital Gains Tax On Sale Of Plot Flat House

How To Save Capital Gains Tax On Sale Of Plot Flat House

What Is Real Property Gains Tax Rpgt In Malaysia How To

What Is Real Property Gains Tax Rpgt In Malaysia How To

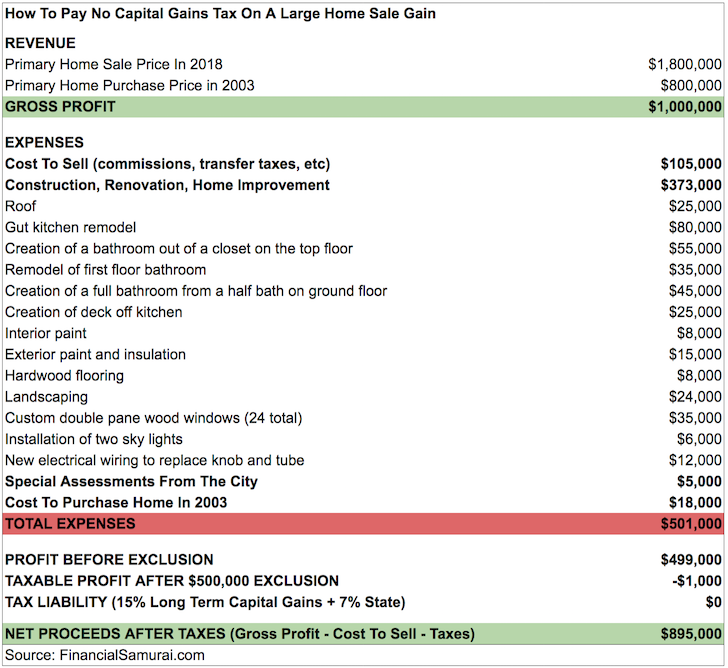

How To Pay No Capital Gains Tax After Selling Your House For Big

How To Pay No Capital Gains Tax After Selling Your House For Big

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Tips On Lowering Tax Liability Arising Out Of Profit Made By

Tips On Lowering Tax Liability Arising Out Of Profit Made By

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gains On Sale Of Gifted Property Examples