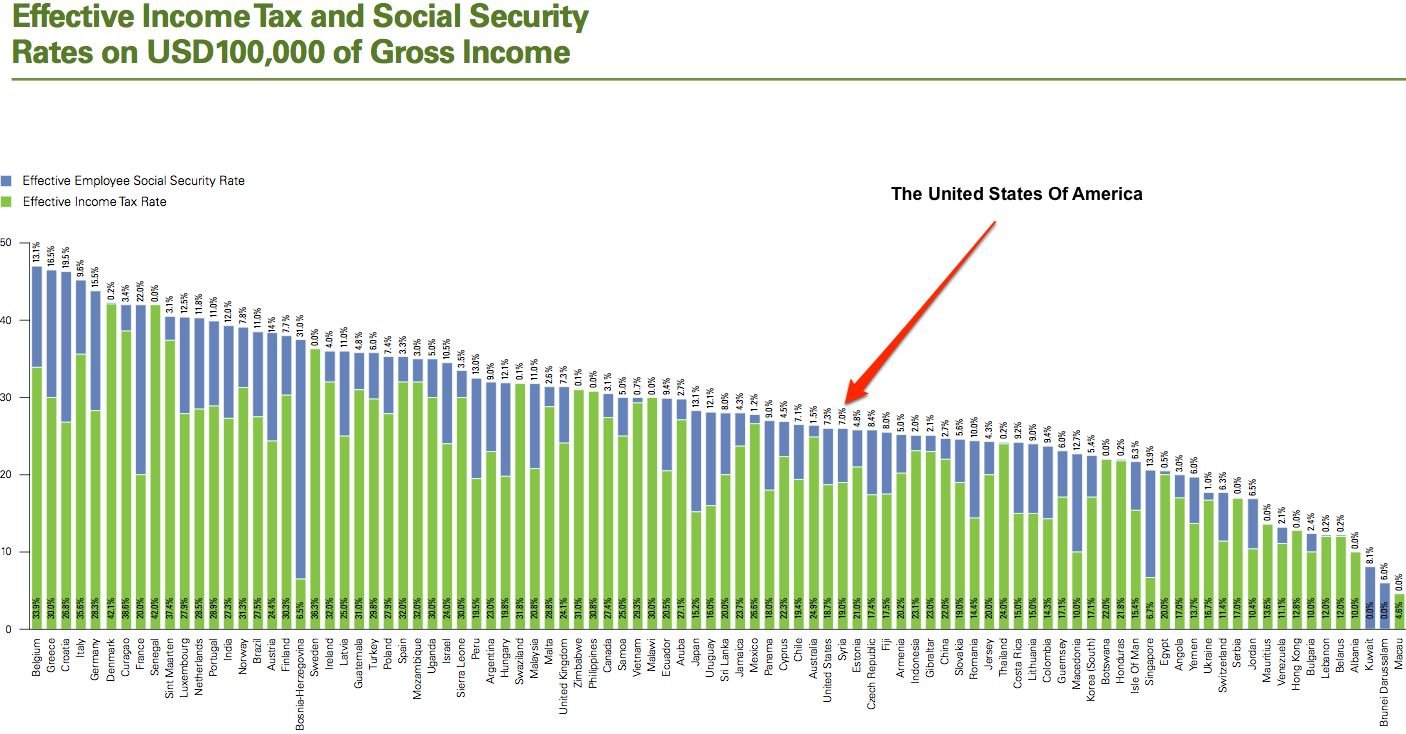

Corporate tax individual income tax and sales tax including vat and gst but does not list capital gains tax. It shows personal tax rates on 100000 around the world.

How Low Are U S Taxes Compared To Other Countries The Atlantic

How Low Are U S Taxes Compared To Other Countries The Atlantic

american tax rates compared to other countries

american tax rates compared to other countries is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in american tax rates compared to other countries content depends on the source site. We hope you do not use it for commercial purposes.

The list focuses on the main indicative types of taxes.

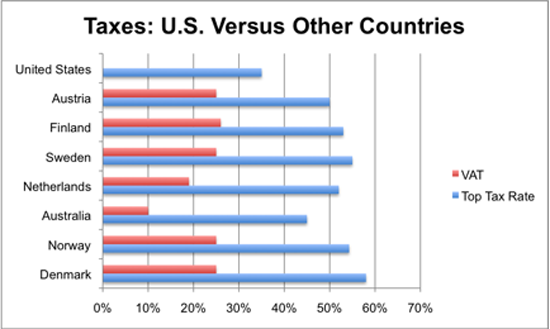

American tax rates compared to other countries. Some other taxes for instance property tax substantial in many countries such as the united states and payroll tax are not shown here. Dropped to 37 percent in 2018 under the provisions of the tax cuts and jobs act and only significantly wealthy individuals pay this much. In 2015 taxes at all levels of us government represented 26 percent of gross domestic product gdp compared with an average of 33 percent for the 35 member countries of the organisation for economic co operation and development oecd.

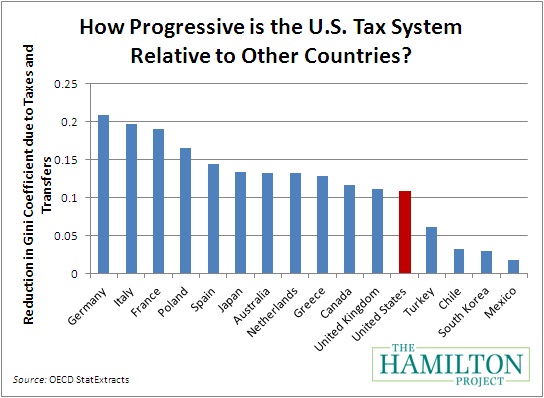

Tax rates compare to other countries. How does the us tax plan compare to other countries. But rich american families face far lower rates and are more likely to take advantage of deductions republicans want to.

The top rates were less in 12 countries. The brexit negotiations will be a walk in the park compared with any attempt to harmonise the eu. Compared with nations in the oecd the organization for economic cooperation and development a group of highly developed countries the us.

Which is higher than most other countries. Has the highest top corporate tax rate in the world. We all love to complain about taxes.

The highest individual income tax rate in hungary is only 15 percent. Is not a high tax country. The top tax rate in the us.

As congress debates a major overhaul of the tax code its an opportune time to take another look at how americans tax bills compare with those of people in other countrieswhile cross national comparisons of tax burdens are complicated and tricky most research has concluded that at least among developed nations the united states is on the low end of the range. Taxes compared to other countries. How low are us.

In a lot of the european countries tax rates and social security contributions are high but the provision of benefits by the state tends to be very generous compared to countries in other parts. Comes in at 55th out of 114. Its easy to grumble when at fica and social security taking money out of a hard earned paycheck paying sales tax in every store and having an expensive and stressful annual pile of paperwork to fill out on top of all that.

A comparison of personal tax rates across. Then there are the tax rates themselvestax brackets. Us taxes are low relative to those in other developed countries figure 1.

How Low Are U S Taxes Compared To Other Countries The Atlantic

How Low Are U S Taxes Compared To Other Countries The Atlantic

Surprise Surprise Folks In Highly Taxed Countries Are Happier

Surprise Surprise Folks In Highly Taxed Countries Are Happier

A Comparison Of The Tax Burden On Labor In The Oecd 2016 Tax

A Comparison Of The Tax Burden On Labor In The Oecd 2016 Tax

A Comparison Of The Tax Burden On Labor In The Oecd 2015 Tax

A Comparison Of The Tax Burden On Labor In The Oecd 2015 Tax

American Taxes Vs The World Stevedennie Com Miscellaneous

The Proposed Us Corporate Tax Rate Compared To Other Countries

The Proposed Us Corporate Tax Rate Compared To Other Countries

Just How Progressive Is The U S Tax Code

Just How Progressive Is The U S Tax Code

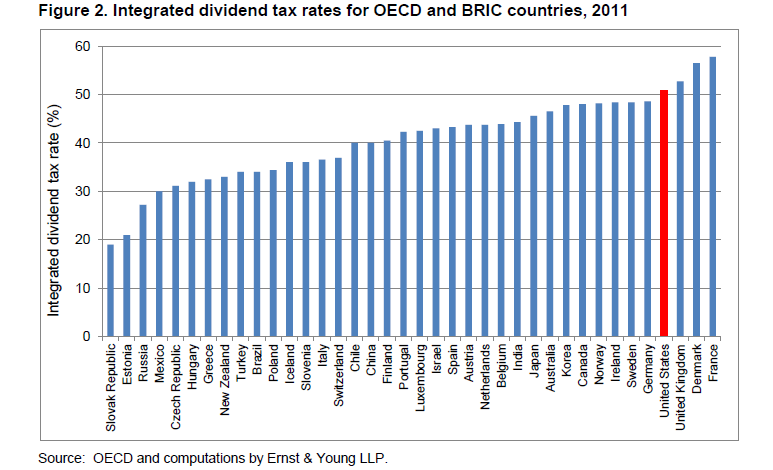

Dividend Tax Rate And Long Term Capital Gains Tax Rate U S Vs

Dividend Tax Rate And Long Term Capital Gains Tax Rate U S Vs

Is The U S The Highest Taxed Nation In The World Committee For

Is The U S The Highest Taxed Nation In The World Committee For

How Do The New Us Corporate Tax Rates Compare Globally

How Do The New Us Corporate Tax Rates Compare Globally

Compare Your Pay After Averaged Taxes To Other Developed Nations

Compare Your Pay After Averaged Taxes To Other Developed Nations