172014 dated 10th december 2014. Income tax rates applicable in case of companies for assessment year 2019 20 and 2020 21 are as follows.

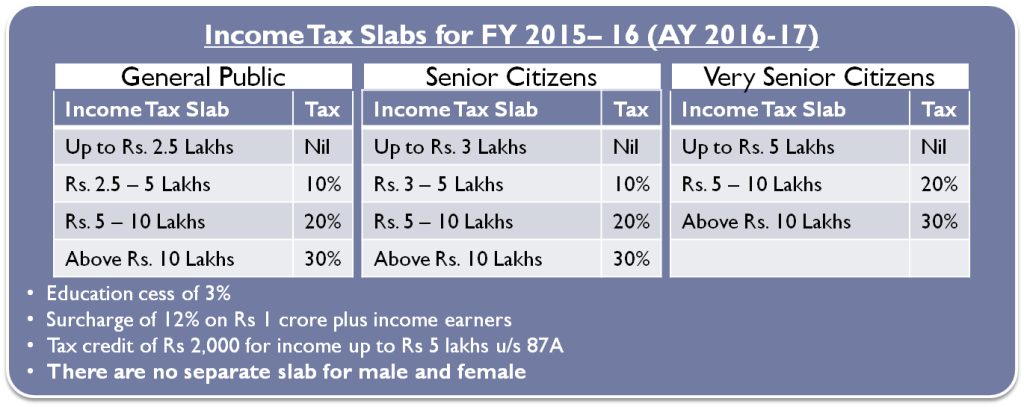

Income Tax Rates For Fy 2015 16 Ay 2016 17

Income Tax Rates For Fy 2015 16 Ay 2016 17

income tax rates in india for assessment year 2015 16

income tax rates in india for assessment year 2015 16 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in income tax rates in india for assessment year 2015 16 content depends on the source site. We hope you do not use it for commercial purposes.

Download income tax calculator for free for previous year 2014 2015.

Income tax rates in india for assessment year 2015 16. The amount of income tax and the applicable surcharge shall be further increased by health and education cess calculated at the rate of four percent of such income tax and surcharge. The income tax rules and slab rates which are applied for the assessment year 2014 15 would be the same as the rules for the financial year 2013 14 and so on. B health and education cess.

Cbdt has released circular no. Now the earlier income tax slab rates as applicable to ay 2014 2015 will also be applicable to assessment year 2015 2016. In this budget he has not changed the income tax rates and kept the earlier rate in place.

I the rates of income tax as applicable for assessment year 2015 16 in the case of every individual below the age of sixty years or hindu undivided family or every association of persons or body of individuals whether incorporated or not or artificial juridical person. The new india income tax rates announced by finance minister of india for individuals and body of individual or association of person while presenting the union budget 2015 16 in the parliament are listed below. Tax rebate of rs 2000 to resident individuals whose total income is less than rs 500000.

Is 10 is income tax payable on individuals whose taxable income is above rs 1 crore education cess of 3 is also applicable to income tax computed as per above slab. Circular helps employer to correctly deduct tds on salary of its. P chidambaram has presented union budget today.

Income tax slab rates are reviewed by the government in budget every year. In simple terms financial year is the year in which the income is earned and assessment year is the year in which the income is assessed to tax and all taxes are paid tax returns filed. Here is a primer on income tax slab rates for ay 2016 17.

Income tax slab for financial year 2017 18 and assessment year 2018 19. Circular contains the rates of deduction of income tax from the payment of income chargeable under the head salaries during the financial year 2014 15 and explains certain related provisions of the act and income tax rules 1962 hereinafter the rules. But the tax slabs have not been changed for the last few years.

Budget 2015 New Tax Slabs And Rates For Fy 2015 16 Ay 2016 17

Budget 2015 New Tax Slabs And Rates For Fy 2015 16 Ay 2016 17

Income Tax Slabs History In India

Income Tax Slabs History In India

Income Tax Rate Slab Chart For 2014 15 Central Government

Income Tax Rate Slab Chart For 2014 15 Central Government

Income Tax Slab For Fy 2014 15 Assessment Year 2015 16

Income Tax Slab For Fy 2014 15 Assessment Year 2015 16

Income Tax Slab Rates For Fy 2016 17 Ay 2017 18 Budget 2016 17

Income Tax For Ay 2016 17 Or Fy 2015 16

Income Tax For Ay 2016 17 Or Fy 2015 16

Online Income Tax Calculator 2014 Ay 2015 16

Income Tax Slab Rates In India Ay 2016 17 Fy 2015 16 Ebizfiling

Income Tax Slab Rates In India Ay 2016 17 Fy 2015 16 Ebizfiling

Tds Tax India Income Tax 15 Years Income Tax Slabs In One Screen

Tds Tax India Income Tax 15 Years Income Tax Slabs In One Screen