It is calculated by taking the average of the probability distribution of all possible returns. Rather its a tool used to determine.

Expected Return How To Calculate A Portfolio S Expected Return

Expected Return How To Calculate A Portfolio S Expected Return

expected rate of return on investment

expected rate of return on investment is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in expected rate of return on investment content depends on the source site. We hope you do not use it for commercial purposes.

What is a good rate of return on your investment.

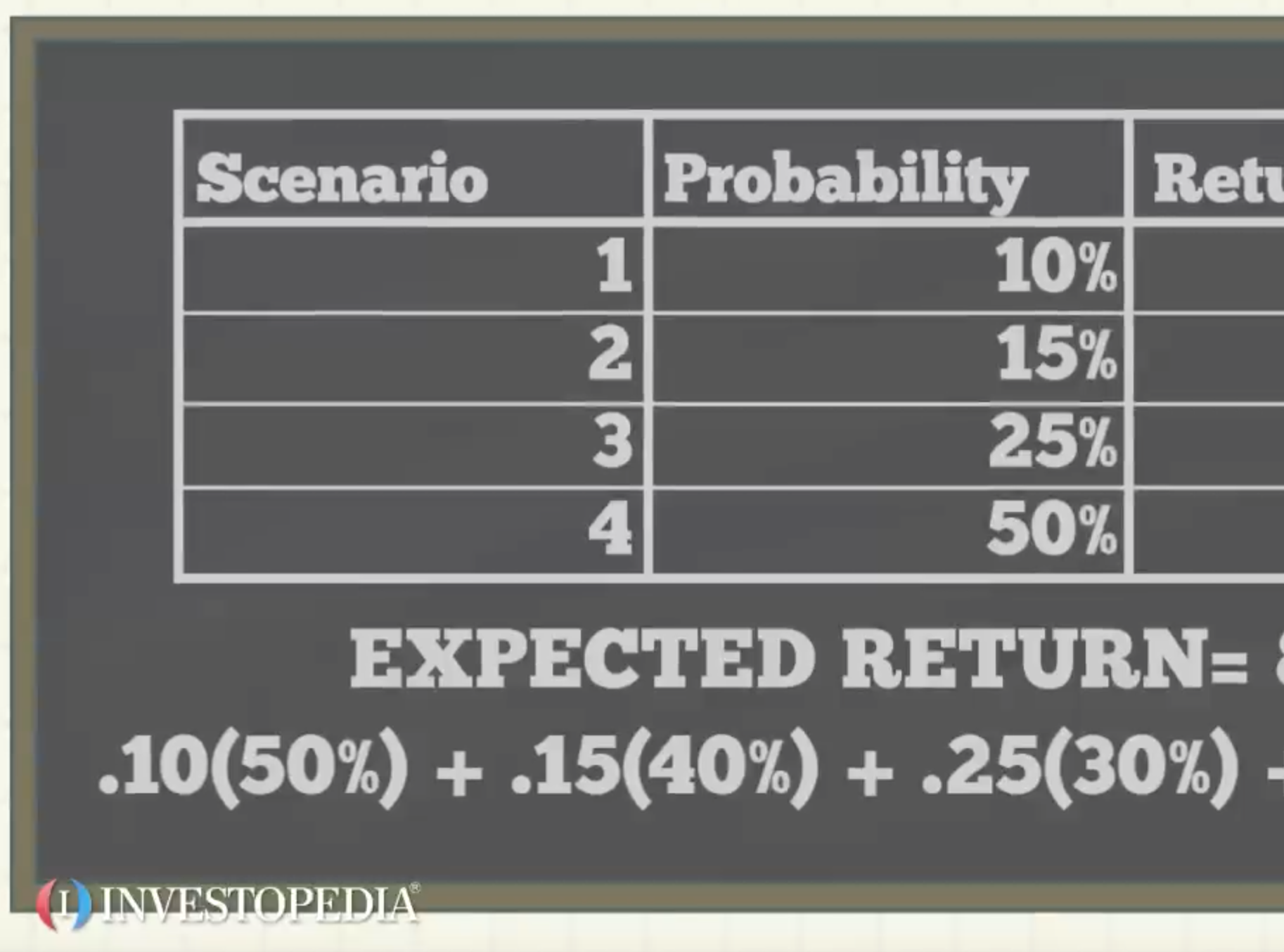

Expected rate of return on investment. The rate of return ror is the gain or loss of an investment over a period of time copmared to the initial cost of the investment expressed as a percentage. It is calculated by estimating the probability of a full range of returns on an investment with the probabilities summing to 100. Calculation examples example 1.

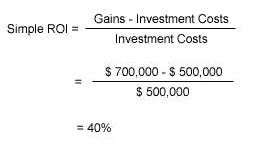

Expected return the return on an investment as estimated by an asset pricing model. What is a good rate of return on your investment. In its simplest form john does rate of return in one year is simply the profits as a percentage of the investment or 3000500 600.

Components are weighted by the percentage of the portfolios total value that each accounts for. The expected rate of return is the return on investment that an investor anticipates receiving. The percentage of return of security a has five possible outcomes.

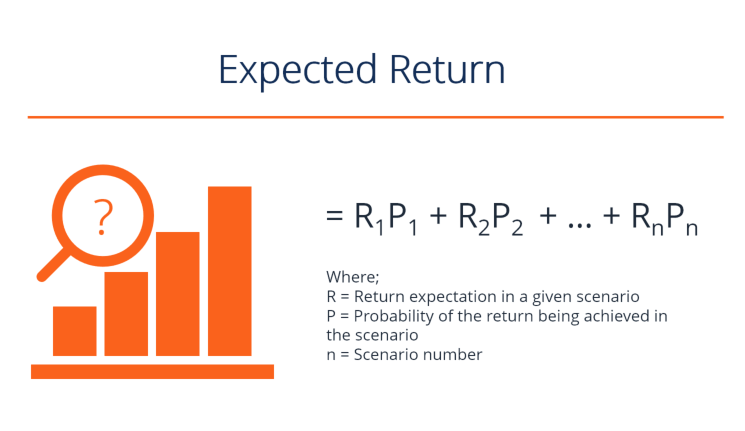

Where w i is a proportion of ith investment in a portfolio err is an expected rate of return of ith investment and n is the number of a portfolios components. Calculating expected return is not limited to calculations for a single investment. The expected return is calculated as.

Also the expected return of a portfolio is a simple extension from a single investment to a portfolio which can be calculated as the weighted average of returns of each investment in the portfolio and it is represented as below. R i rate of return with different probability. However by calculating the different possible outcomes of a given investment you can derive an expected rate of return the math is fairly straightforward and it will give you a window into the financial future of the investment in question.

The expected return for an investment portfolio is the weighted average of the expected return of each of its components. Roi varies from one asset to the next so you need to understand each component of your portfolio. Expected return is the amount of profit or loss an investor can anticipate receiving on an investment.

Based on historical data its not a guaranteed result. The riskier the venture the higher the expected rate of return. For example a model might state that an investment has a 10 chance of a 100 return and a 90 chance of a 50 return.

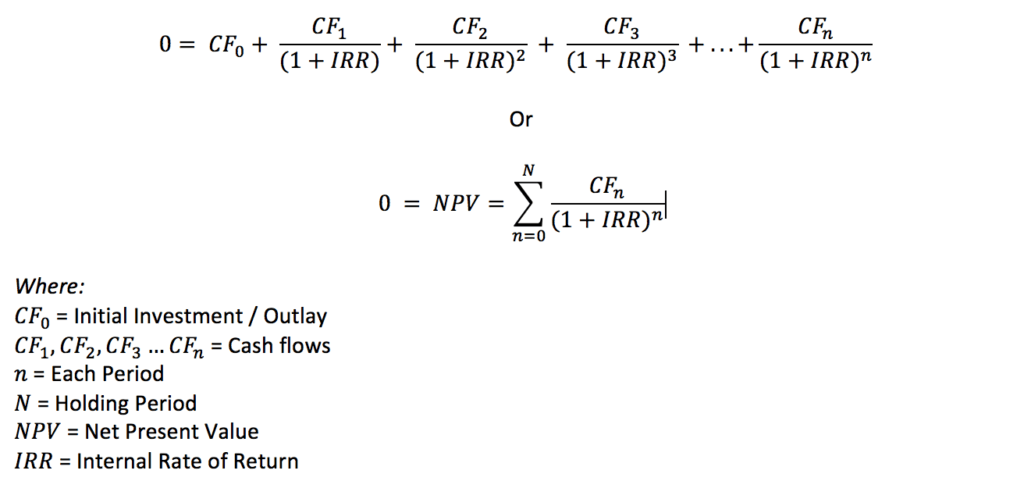

This guide teaches the most common formulas for calculating different types of rates of returns including total return annualized return roi roa roe irr. There is one fundamental relationship you should be aware of when thinking about rates of return. P i probability of each return.

Roi varies from one asset to the next so you need to understand each component of your portfolio. An investor is considering two securities of equal risk to include one of them in a portfolio. It can also be calculated for a portfolio.

Learn how to calculate the expected rate of return on some of your investments.

Solved Computing The Expected Rate Of Return And Risk A

Solved Computing The Expected Rate Of Return And Risk A

M07 Titman 2544318 11 Fin Mgt C07

M07 Titman 2544318 11 Fin Mgt C07

Roi Metrics Are Direct Easy To Interpret Profitability Measures

Roi Metrics Are Direct Easy To Interpret Profitability Measures

Risk And Rates Of Return Ppt Download

Risk And Rates Of Return Ppt Download

Internal Rate Of Return Irr A Guide For Financial Analysts

Internal Rate Of Return Irr A Guide For Financial Analysts

Rule Of 72 Divide The Number 72 By Your Investment S Expected

Rule Of 72 Divide The Number 72 By Your Investment S Expected

1 Expected Rate Of Return And Variance Assume The Following

1 Expected Rate Of Return And Variance Assume The Following

A Guide To Calculating Return On Investment Roi

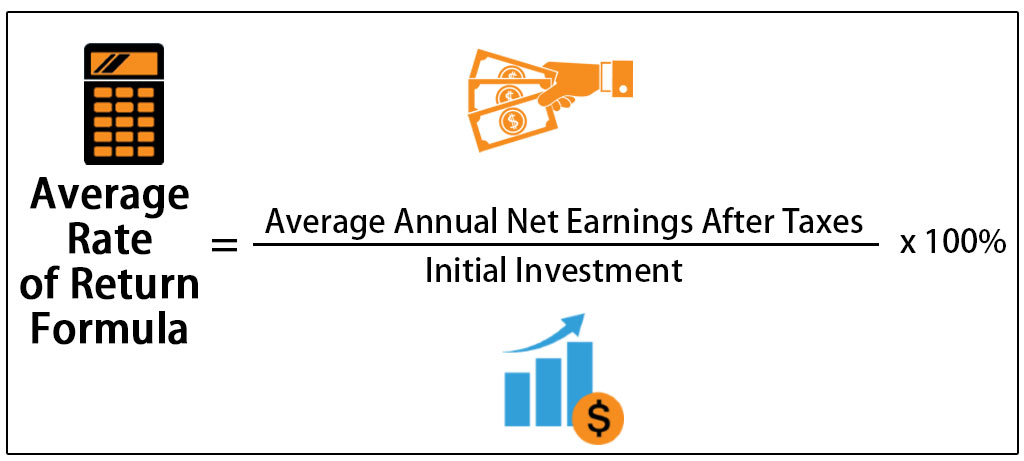

Average Rate Of Return Formula Definition Examples

Average Rate Of Return Formula Definition Examples

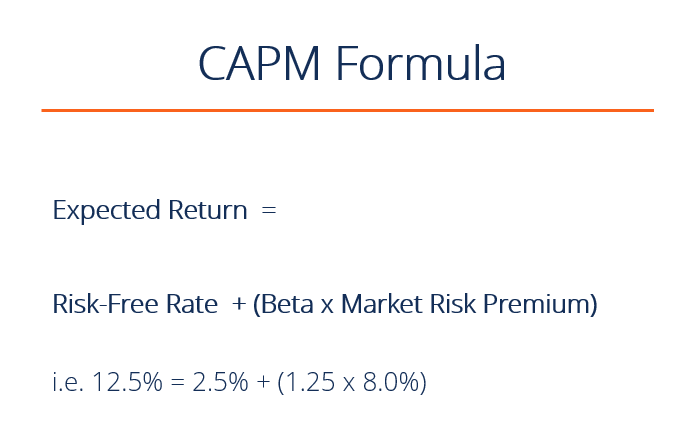

What Is Capm Capital Asset Pricing Model Formula Example

What Is Capm Capital Asset Pricing Model Formula Example