We are not a commercial bank and do not offer banking services to the public. For the first time in almost three years the bank of canada has lowered its five year benchmark rate.

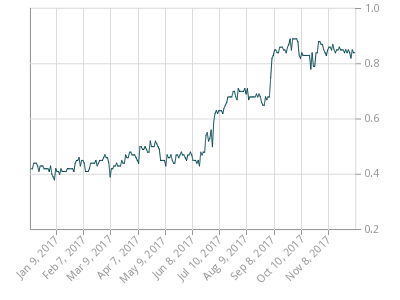

Interest Rate Spread At Brian Ripley S Canadian Housing Price

bank of canada 5 year benchmark mortgage rate

bank of canada 5 year benchmark mortgage rate is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in bank of canada 5 year benchmark mortgage rate content depends on the source site. We hope you do not use it for commercial purposes.

This rate as calculated by thomson reuters is published by the bank at the end of the day.

Bank of canada 5 year benchmark mortgage rate. Earlier this week the bank announced it was cutting its. Td banks decision on tuesday to lower 5 year fixed mortgage rates may have been partly due to pressure from regulators experts say. The feds felt this benchmark rate should be based on the consistently higher bank of canada conventional five year rate.

Three of canadas biggest banks have hiked the rate on their benchmark five year mortgage and more are expected to follow suit. 12 month per cent change. Our principal role as defined in the bank of canada act is to promote the economic and financial welfare of canadaquot.

The benchmark qualifying rate is the posted 5 year fixed rate as published by the bank of canada every thursday. Rather we have responsibilities for canadas monetary policy bank notes financial system and funds management. Cmhc defines the benchmark rate as the chartered bank conventional mortgage 5 year rate that is the most recent interest rate published by the bank of canada in the series v121764 as of 1201 am eastern time each monday.

Since 30 march 2015 thomson reuters benchmark services limited has been responsible for the calculation of the corra rate. The bank of canadas five year benchmark is the rate at which canadian borrowers are stress tested against when applying for a mortgage says james laird co founder of ratehub inc. Todays bank of canada qualifying rate.

The bank of canada surveys the six major banks posted 5 year fixed rates every wednesdays and uses a mode average of those rates to set the official benchmark. The bank of canada raised the conventional five year mortgage rate from 514 per cent to 534 per cent after all big six banks raised their posted five year fixed mortgage rates in recent weeks. A rate meant to represent a cross section of posted bank rates.

The conventional five year rate and posted bank rates are much higher than rates that can be available through a mortgage broker in canada. The bank of canada is the nations central bank. The bank of canada raised the conventional five year mortgage rate from 514 per cent to 534 per cent after all big six banks raised their posted five year fixed mortgage rates in recent weeks.

And president of canwise financial. The royal bank of canada raised its posted rate for a five year.

Pretty Cheap Money Canadian Mortgage Rates Falling To Their

Pretty Cheap Money Canadian Mortgage Rates Falling To Their

Qualifying Mortgage Rate Falls For First Time Since B 20 Intro

Qualifying Mortgage Rate Falls For First Time Since B 20 Intro

Best 5 Year Variable Mortgage Rates In Canada 2020

Best 5 Year Variable Mortgage Rates In Canada 2020

Bank Of Canada Raises Benchmark Interest Rate To 1 5 Noting

Bank Of Canada Raises Benchmark Interest Rate To 1 5 Noting

Why Canadian Mortgages Are About To Get More Expensive

Why Canadian Mortgages Are About To Get More Expensive

Interest Rate Spread At Brian Ripley S Canadian Housing Price

Why Do Banks Raise Rates When Bank Of Canada Doesn T Andrew C

Why Do Banks Raise Rates When Bank Of Canada Doesn T Andrew C

Canada S Best 5 Year Variable Rates Ratespy Com

Canada S Best 5 Year Variable Rates Ratespy Com

Bank Of Canada Rate Cut Unlikely To Lower Mortgage Loan Rates

Td Bank Drops 5 Year Variable Mortgage Rate As Competition Among

Td Bank Drops 5 Year Variable Mortgage Rate As Competition Among