Who is responsible for this tax. Restoring the gross production tax back to its traditional 7 percent rate would be barely a blip in the industrys calculations on where and when to drill.

Gross Receipts Taxes Are Making A Dangerous Comeback Tax Foundation

Gross Receipts Taxes Are Making A Dangerous Comeback Tax Foundation

gross production tax rates by state

gross production tax rates by state is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in gross production tax rates by state content depends on the source site. We hope you do not use it for commercial purposes.

In general the severance tax is calculated based on either the value of the product or volume of production.

Gross production tax rates by state. 46 percent 046 of market value of oil. These severance taxes apply to materials severed from the ground and include the extraction or production of oil gas and other natural resources. In some cases the state will use both.

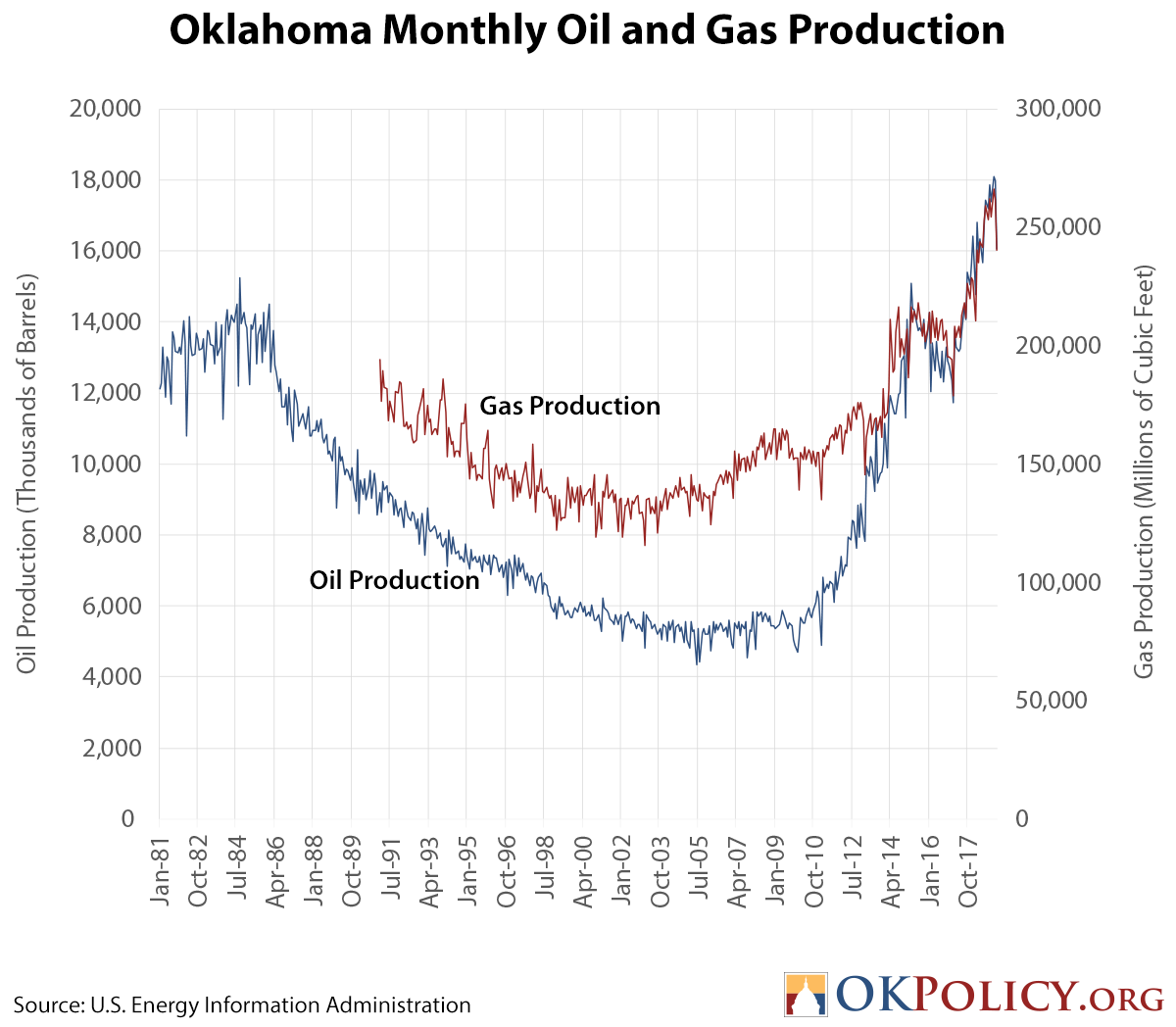

Two of oklahomas former finance and tax officials dissect a recent report about the oil and gas industrys gross production tax. Currently oklahoma charges just 2 percent in gross production taxes for the first three years of a wells production. Second given the multiplicity of tax code provisions the rates that an oil.

This web document highlights state oil and gas severance tax laws. Base ie corporate income tax fall on profits while the severance tax is imposed on production it is impossible to calculate a total tax bill by direct comparison of statutory provisions. A state or local jurisdiction is funded in a variety of ways whether by property tax income tax or in this case a severance tax on oil and natural gas production.

For report periods september 2015 and later the taxable barrels are subject to the oil field clean up fee of 000625 58 of a cent per barrel. Likewise severance taxes are legislated and collected by each individual state. The gross production tax or severance tax is a value based tax levied at a basic rate of 7 percent upon the production of oil and gas in oklahoma the tax rate is lower when oil and gas prices fall below a certain threshold.

The first purchaser of crude oil in texas must pay tax based on crude oils market value. Oil and gas gross production tax imposition and rates the oil and gas gross production tax is imposed in lieu of property taxes on oil and gas producing properties. States usually calculate the tax based on the value or volume of the oil produced though sometimes states use a combination of both.

Some states have imposed taxes and fees on the extraction production and sale of natural gas and oil. Most laws that affect oil production are created at the state level. A 5 rate is applied to the gross value at the well of all oil produced except royalty interest in oil produced from a state federal or municipal holding and from.

To include the effective rates in each state when including. The gross production tax is a tax on the production of oil and gas produced in oklahoma. The economic facts show this claim to be ludicrous.

Generally the tax is remitted to the tax commission on a monthly basis by the first purchaser.

Reality Check Restoring Oklahoma S Gross Production Tax Won T

Reality Check Restoring Oklahoma S Gross Production Tax Won T

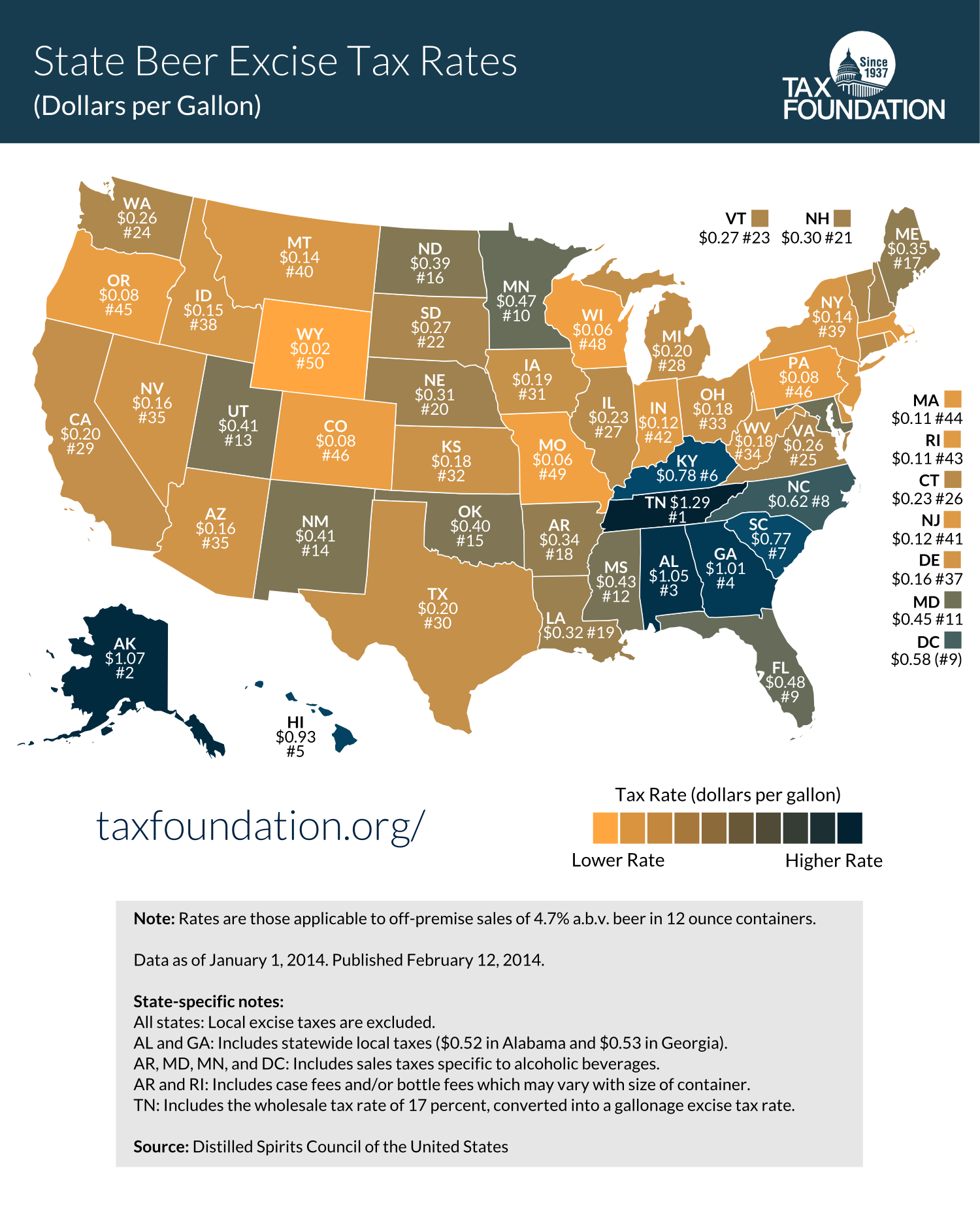

Map Beer Excise Tax Rates By State 2014 Tax Foundation

Map Beer Excise Tax Rates By State 2014 Tax Foundation

Beer Taxes In Your State 2019 State Beer Tax Rankings

Beer Taxes In Your State 2019 State Beer Tax Rankings

State Revenues And The Natural Gas Boom An Assessment Of State

State Revenues And The Natural Gas Boom An Assessment Of State

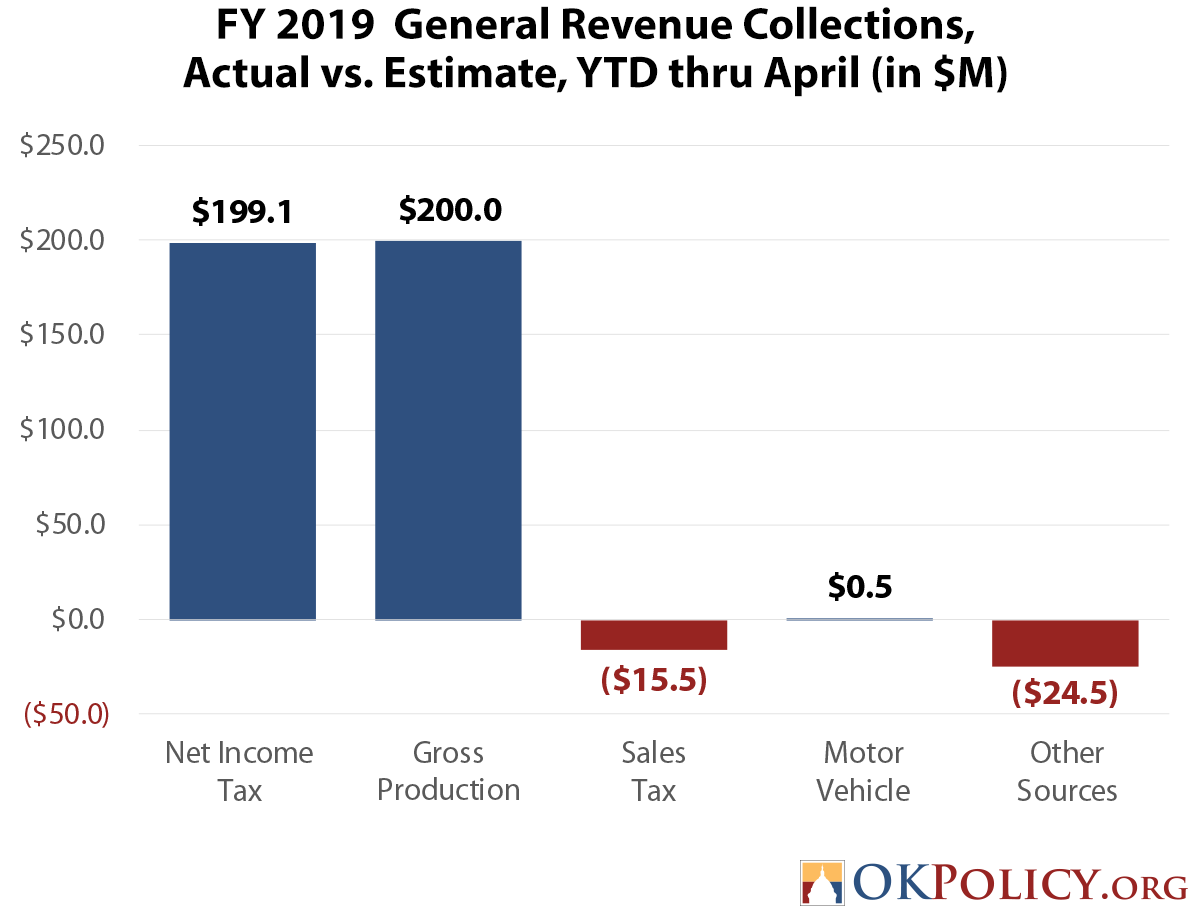

Increased Gross Production Taxes Are Fueling State S Revenue Boom

Increased Gross Production Taxes Are Fueling State S Revenue Boom

Together Oklahoma On Twitter It Is Time For The Okleg To

Together Oklahoma On Twitter It Is Time For The Okleg To

Increased Gross Production Taxes Are Fueling State S Revenue Boom

Increased Gross Production Taxes Are Fueling State S Revenue Boom

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

The Okie Okoga Legislature S Oil Gas Tax Grab Slows State S

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Hb1358 Oil Gas Production Tax Distribution Kelly Schmidt State

Hb1358 Oil Gas Production Tax Distribution Kelly Schmidt State