It also includes property tax sales tax and other local taxes. The sales tax rate in seattle is 101.

How To Find Out What Tax Bracket You Re In Under The New Tax Law

How To Find Out What Tax Bracket You Re In Under The New Tax Law

highest tax rate in us 2019

highest tax rate in us 2019 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in highest tax rate in us 2019 content depends on the source site. We hope you do not use it for commercial purposes.

California has the highest state level sales tax rate.

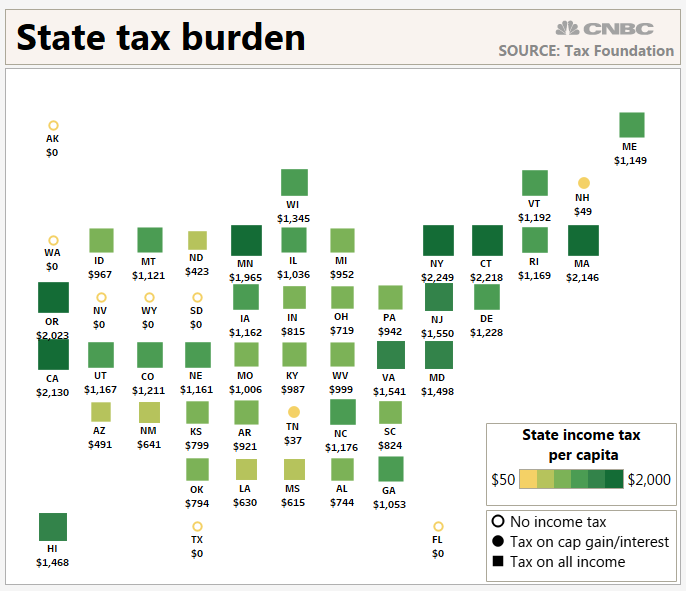

Highest tax rate in us 2019. To determine which states carry the highest tax burdens wallethub compared property taxes. For example texas levies no state income tax but the statewide average property tax rate is 186 percent. Individual income tax rates for prior years.

Check out our new state tax map to see how high 2019 sales tax rates are in your state. There are seven federal tax brackets for the 2019 tax year. From ya 2017 onwards.

Income tax brackets and rates. Capital gains are taxed at different rates from ordinary income. Inland revenue authority of singapore.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher for single filers and 612350 and higher for married couples filing jointly. This means higher income earners pay a proportionately higher tax with the current highest personal income tax rate at 22. Please email us if you would like us to respond to your enquiries.

Lets use the tax bracket for 2019 and say your filing status. This is the sixth highest property tax rate of any state. Compare this with louisiana which has a state income tax rate of anywhere from 2 to 6 percent.

The state rate is one of the highest in the country at 650 and local taxes combine to push the average rate north of 9. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. For ya 2019 a.

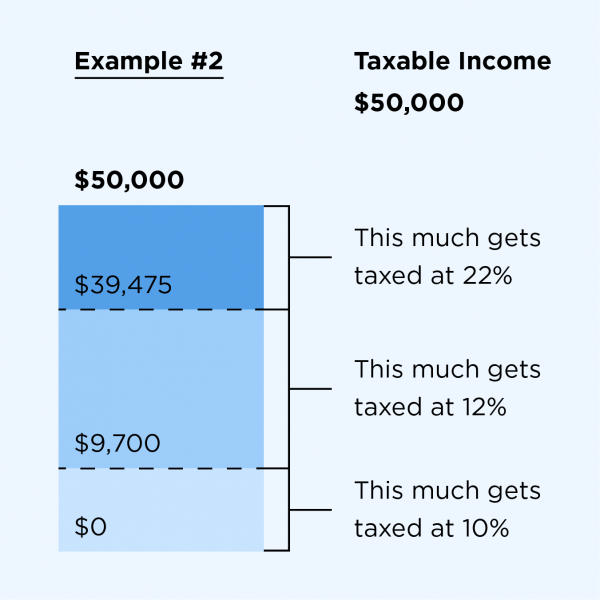

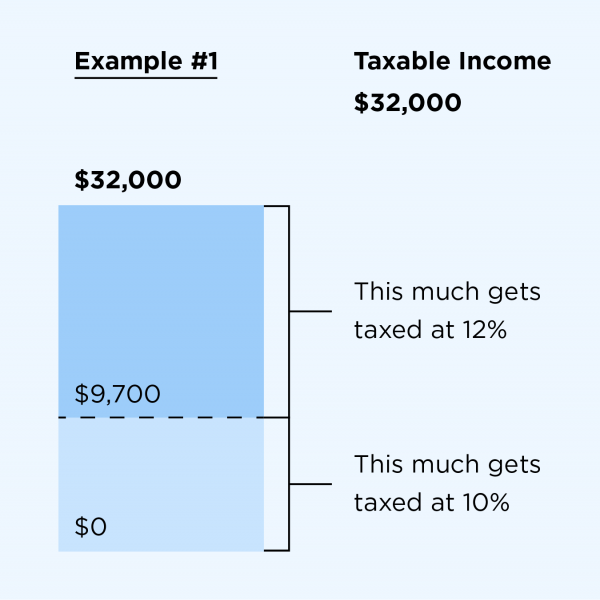

Tax brackets are not as intuitive as they seem because most taxpayers have to look at more than one bracket to know their tax rate. Your bracket depends on your taxable income and filing status. 3 arkansas 943 the razorback state has the third highest combined sales tax rate in the us just 04 behind the leader.

State and local sales tax rates as of january 1 2019. Chargeable income income tax rate. The new 2019 federal income tax brackets and rates for capital gains.

Hawaii has the broadest sales tax in the united states. For example while there are seven tax brackets for ordinary. 10 12 22 24 32 35 and 37.

You need to earn 418000 to buy a home in nycheres what you need in other major us cities. 27 jun 2019 qc 16218. These rates show the amount of tax payable in every dollar for each income bracket for individual taxpayers.

Video tax tips on atotv external link. If you need help applying this information to your personal situation phone us on 13 28 61.

For The First Time In History U S Billionaires Paid A Lower Tax

For The First Time In History U S Billionaires Paid A Lower Tax

Opinion The Rich Really Do Pay Lower Taxes Than You The New

Opinion The Rich Really Do Pay Lower Taxes Than You The New

2019 State Individual Income Tax Rates And Brackets Tax Foundation

2019 State Individual Income Tax Rates And Brackets Tax Foundation

The Incredible Shrinking Corporate Tax Rate Continues To Hit New

The Incredible Shrinking Corporate Tax Rate Continues To Hit New

These Three States Have The Highest Income Taxes

These Three States Have The Highest Income Taxes

Opinion The Rich Really Do Pay Lower Taxes Than You The New

Opinion The Rich Really Do Pay Lower Taxes Than You The New

Corporate Income Tax Rates By State 2019 U S Statista

Corporate Income Tax Rates By State 2019 U S Statista

2019 2020 Federal Income Tax Brackets And Tax Rates Nerdwallet

2019 2020 Federal Income Tax Brackets And Tax Rates Nerdwallet

2019 2020 Federal Income Tax Brackets And Tax Rates Nerdwallet

2019 2020 Federal Income Tax Brackets And Tax Rates Nerdwallet

Ian Bremmer On Twitter A Little History On Top Marginal Tax

Ian Bremmer On Twitter A Little History On Top Marginal Tax