Also as of january 2013 individuals with earned income of more than 200000 250000 for married couples. The wage base increases to 118500 for social security and remains unlimited for medicare.

employer social security and medicare tax rates 2015

employer social security and medicare tax rates 2015 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in employer social security and medicare tax rates 2015 content depends on the source site. We hope you do not use it for commercial purposes.

Employers have numerous payroll tax withholding and payment obligations.

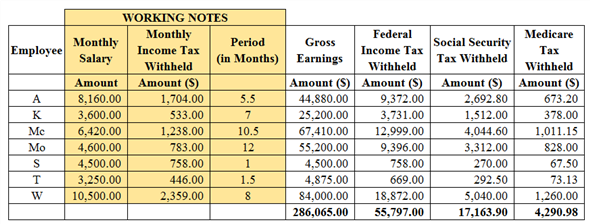

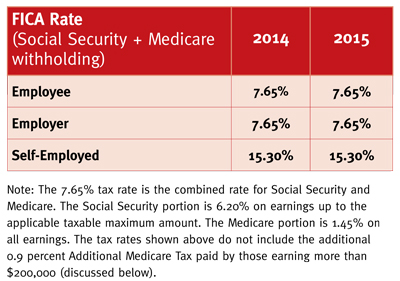

Employer social security and medicare tax rates 2015. What is the employers social security tax rate for 2019 and 2020. The 765 tax rate is the combined rate for social security and medicare. High earning employees will find more of their compensation subject to social security payroll fica taxes in 2015 when maximum taxable pay will increase to 118500 from 117000.

The social security portion oasdi is 620 on earnings up to the applicable taxable maximum amount see below. 2015 social security and medicare tax withholding rates and limits. 62 of each employees first 132900 of wages salaries etc.

Different rates apply for these taxes. The rates shown reflect the amounts received by the trust funds. The current rate for medicare is 145 for the employer and 145 for the employee or 29 total.

Print 2015 payroll tax alert. The social security administration ssa has announced that the maximum earnings subject to social security oasdi tax will increase from 117000 to 118500 in 2015 an increase of 1500 ssa news release social security announces 17 percent benefit increase for 2015 102214. Employers social security payroll tax for 2019.

The medicare portion hi is 145 on all earnings. An employers federal payroll tax responsibilities include withholding from an employees compensation and paying an employers contribution for social security and medicare taxes under the federal insurance contributions act fica. Social security and medicare withholding rates.

Ssa fact sheet 2015 social security changes. For social security the tax rate is 620 for both employers and employees maximum social security tax withheld from wages is 734700 in 2015. Social securitys old age survivors and disability insurance oasdi program and medicares hospital insurance hi program are financed primarily by employment taxes.

Tax rates are set by law see sections 1401 3101 and 3111 of the internal revenue code and apply to earnings up to a maximum amount for oasdi. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The employers social security payroll tax rate for 2019 january 1 through december 31 2019 is the same as the employees social security payroll tax.

Social security and medicare withholding rates the current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The current rate for medicare is 145 for the employer and 145 for the employee or 29 total. Social security medicare.

For 2015 the maximum limit on earnings for withholding of social security old age survivors and disability insurance tax is 11850000the maximum limit is changed from last year.

Research Income Taxes On Social Security Benefits

Research Income Taxes On Social Security Benefits

What Is The 2016 Maximum Social Security Tax The Motley Fool

What Is The 2016 Maximum Social Security Tax The Motley Fool

Fica Withholding Chart Yarta Innovations2019 Org

Fica Withholding Chart Yarta Innovations2019 Org

Research Income Taxes On Social Security Benefits

Research Income Taxes On Social Security Benefits

Increasing Payroll Taxes Would Strengthen Social Security Center

Increasing Payroll Taxes Would Strengthen Social Security Center

Research Income Taxes On Social Security Benefits

Research Income Taxes On Social Security Benefits

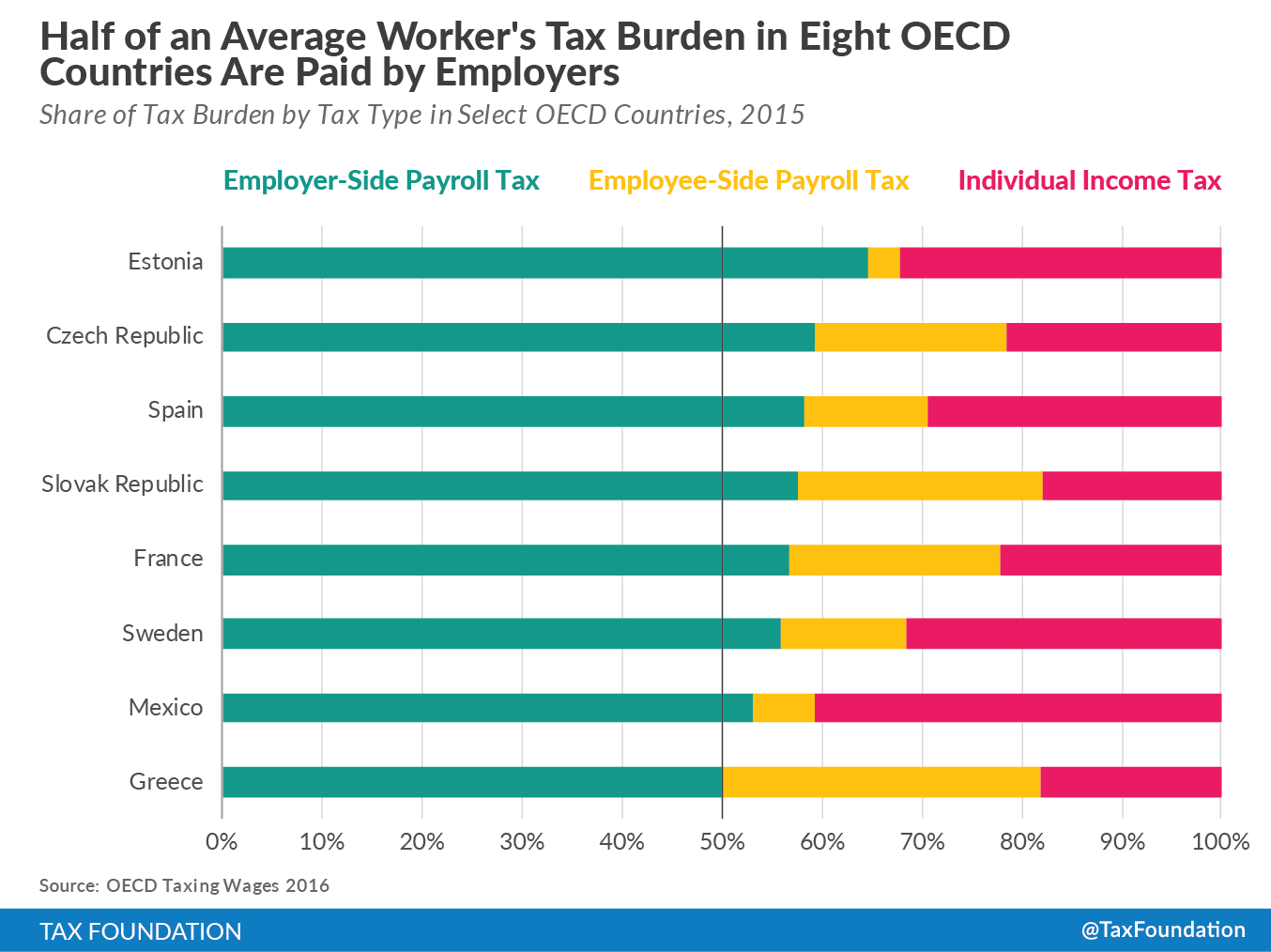

A Comparison Of The Tax Burden On Labor In The Oecd 2016 Tax

A Comparison Of The Tax Burden On Labor In The Oecd 2016 Tax