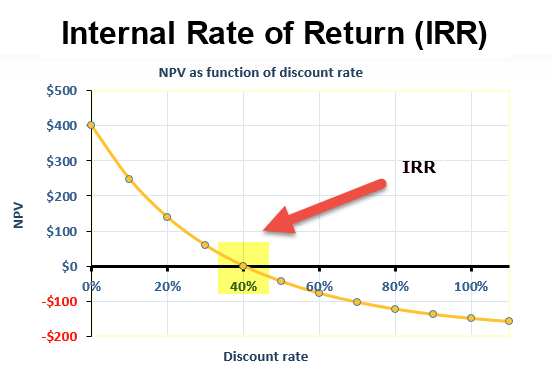

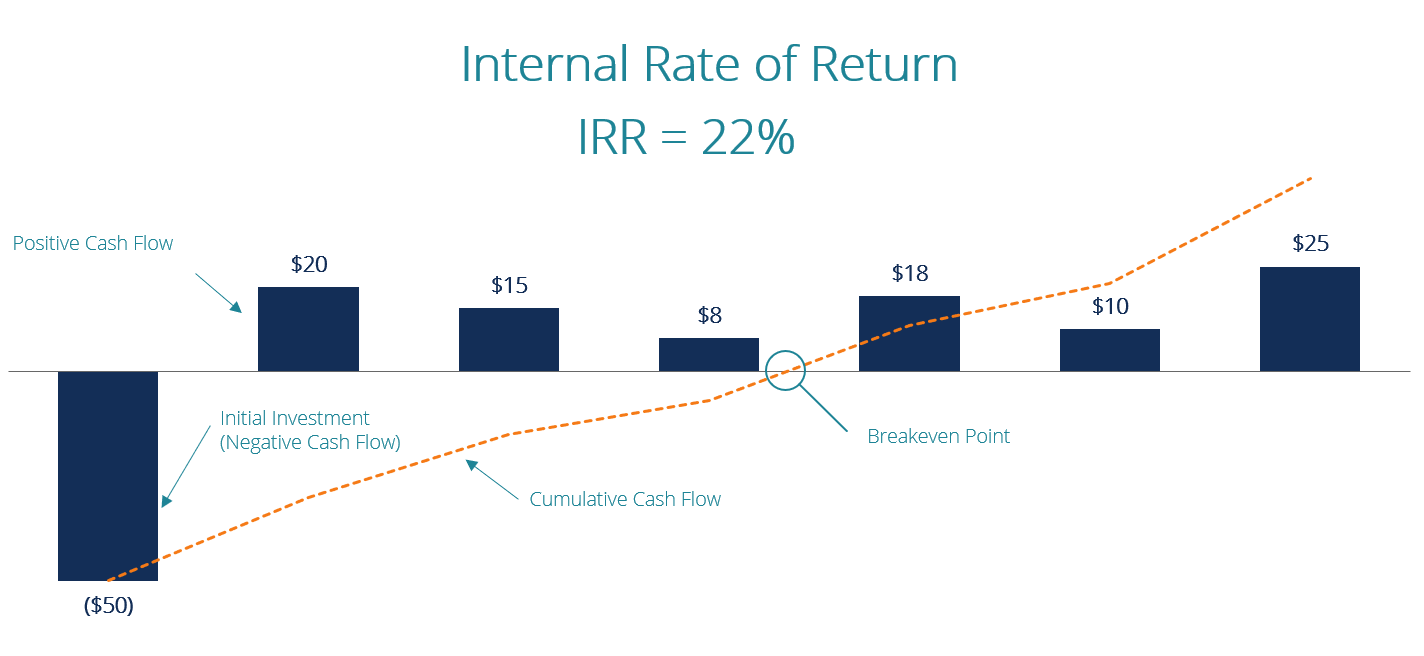

The irr is the discount rate r that makes net present value npvr0. The rate that makes the difference between current investment and the future npv zero is the correct rate of discount.

Internal Rate Of Return Formula Examples Calculate Irr In Excel

Internal Rate Of Return Formula Examples Calculate Irr In Excel

difference between irr and discount rate

difference between irr and discount rate is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in difference between irr and discount rate content depends on the source site. We hope you do not use it for commercial purposes.

Internal rate of return.

Difference between irr and discount rate. Can we use irr in the place of discount rate in the problem above or is that an incorrect use to the term. It can be taken as the annualized rate of return for an investment. You can choose a project with npv100 or you can choose based on irr10 and the idea is you get to the same set of projects.

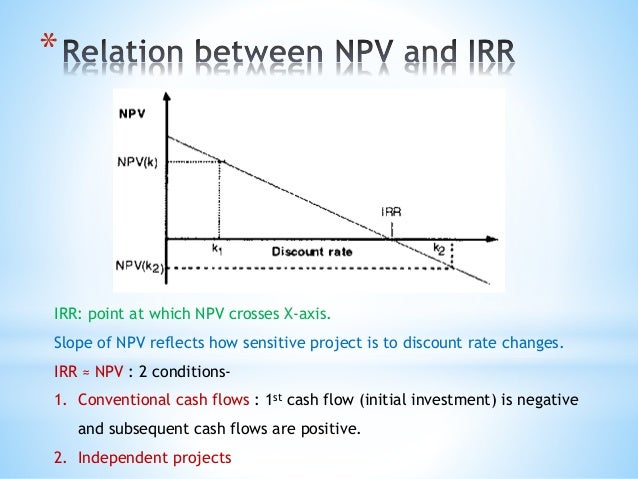

Irr or internal rate of return is the investors required rate of return. What is the difference between irr and the discount rate. With regards to the npv profiles of two projects the crossover rate can be best described as the discount rate at which the two projects have the same npv.

In other words npv is zero at irr. At this rate the initial cash outlay for the project proposal equals the present value of expected net cash flows. Another important difference between irr and roi is that roi indicates total growth start to finish of the investment.

What is the difference between wacc and irr. The above example makes it clear that irr calculates the discount rate keeping in mind what the future npv is going to be. Irr identifies the annual growth ratethe two numbers should normally be.

What this boils down to is two ways of making the same kind of profitability calculation. Say we were evaluating. When to use weighted average cost of capital vs.

Relationships Between Irr Cost Of Capital And Npv

Relationships Between Irr Cost Of Capital And Npv

Internal Rate Of Return Irr A Guide For Financial Analysts

Internal Rate Of Return Irr A Guide For Financial Analysts

:max_bytes(150000):strip_icc()/irrexcel-5c3f54c446e0fb0001d5a8af.png) Internal Rate Of Return Irr Definition

Internal Rate Of Return Irr Definition

How Do I Calculate A Discount Rate Over Time Using Excel

The Internal Rate Of Return Ffm Foundations In Financial

The Internal Rate Of Return Ffm Foundations In Financial

Npv Vs Irr Pbp Pi Why Npv Is The Best Method To Evaluate

Npv Vs Irr Pbp Pi Why Npv Is The Best Method To Evaluate

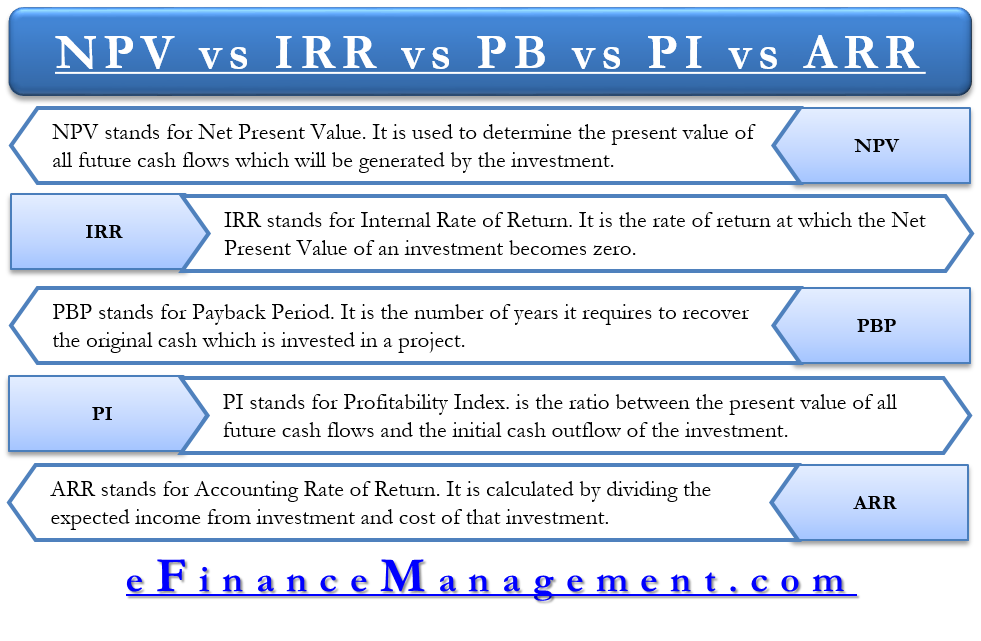

Npv Vs Irr Vs Pb Vs Pi Vs Arr Comparision Of All Evaluation Methods

Npv Vs Irr Vs Pb Vs Pi Vs Arr Comparision Of All Evaluation Methods

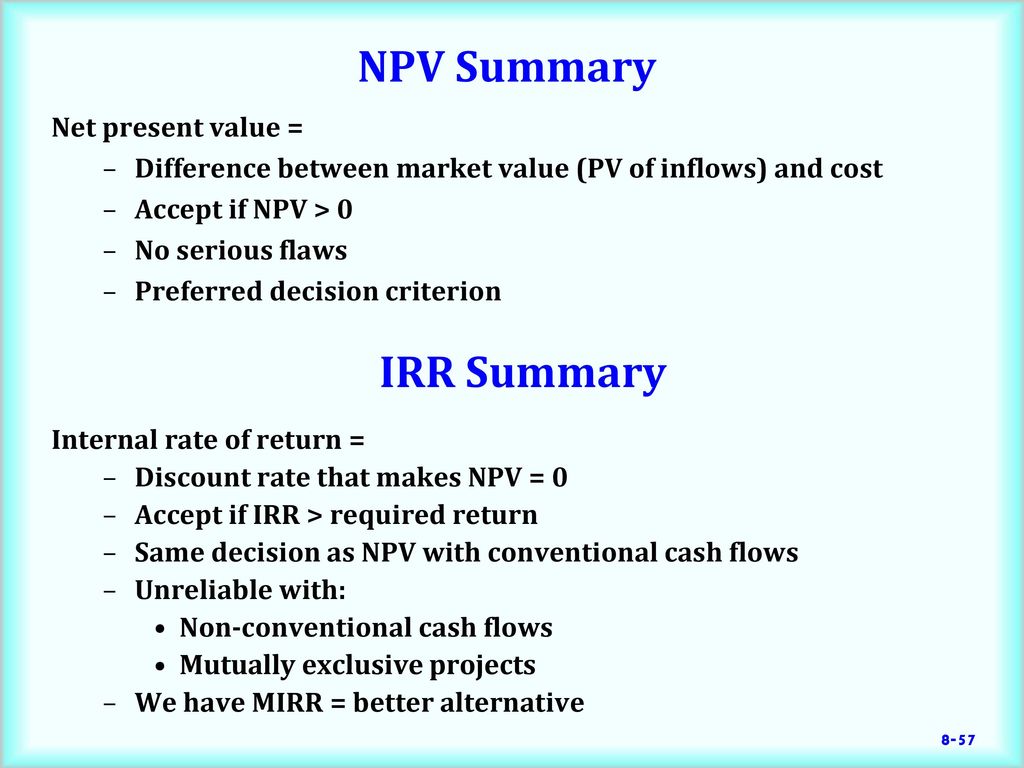

Chapter 8 Lecture Net Present Value And Other Investment

Chapter 8 Lecture Net Present Value And Other Investment

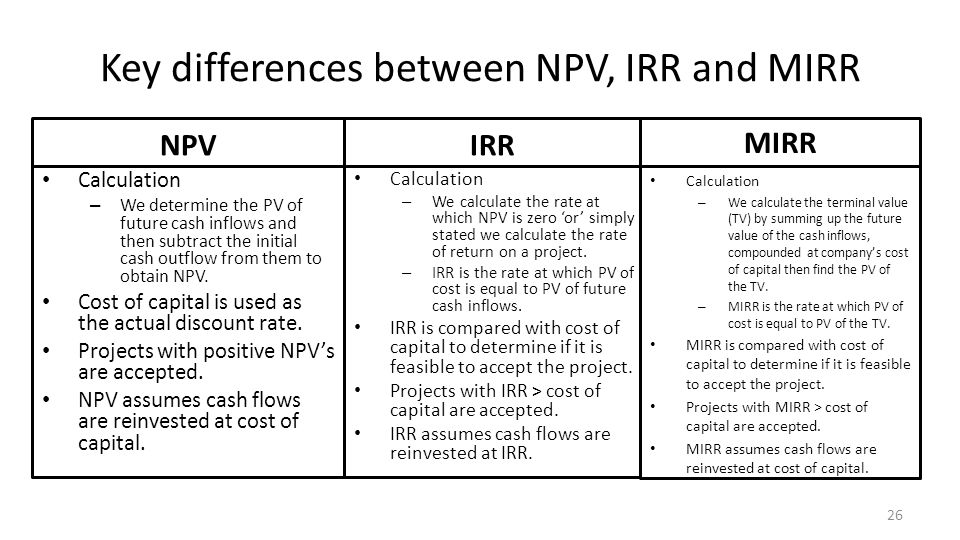

Capital Budgeting Chapter Ppt Video Online Download

Capital Budgeting Chapter Ppt Video Online Download

Net Present Value Npv And Internal Rate Of Return Irr