The information presented here is not intended to be a comprehensive analysis. Chernoff diamond is a benefits advisory firm and does not provide tax or legal advice.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

2018 federal long term capital gains rate

2018 federal long term capital gains rate is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 2018 federal long term capital gains rate content depends on the source site. We hope you do not use it for commercial purposes.

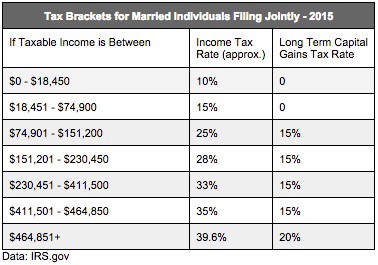

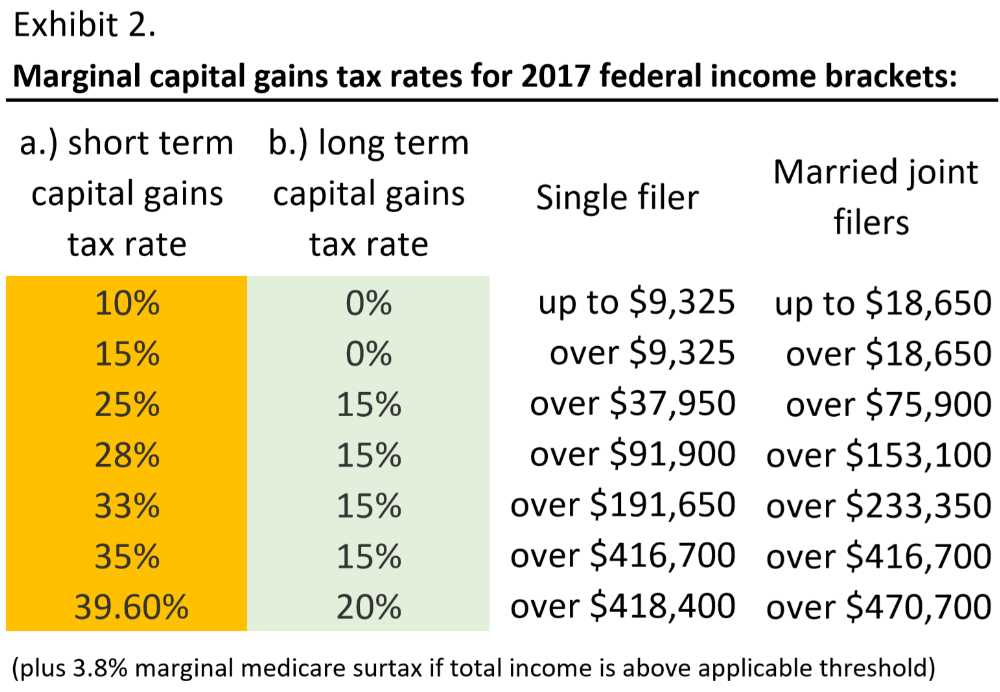

They are generally lower than short term capital gains tax rates.

2018 federal long term capital gains rate. Finally a 20 long term capital gains tax rate applies to taxpayers in the highest 396 tax bracket. The tax cuts and jobs act tcja included many changes that will affect individual taxpayers for 2018 2025. Long term capital gains tax rates in 2018 if you sell an investment that youve held for over a year heres how much tax you may have to pay.

The long term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. However it maintains the status quo for taxes on long term capital gains ltcgs and. In a hot stock market the difference can be significant to your after tax profits.

1 surtax applies to lesser of net investment income or modified adjusted gross income over threshold 2 surtax applies to the lesser of 1 undistributed net investment income or 2 the excess of adjusted gross income over 12750. Capital gains and deductible capital losses are reported on form 1040. To correctly arrive at your net capital gain or loss capital gains and losses are classified as long term or short term.

Unlike other tax rates long term capital gains tax rates were not much affected by the the tax cuts and jobs actheres a three years tax year 2019 year 2018 and year 2017 long term capital gains tax brackets. If you hold it one year or less your capital gain or loss is short term. Its also important to remember that certain high income taxpayers pay an additional 38.

Capital gains tax rules. If you hold it one year or less your capital gain or loss is short term. Get all the numbers you need at your fingertips with our free 2018 desktop reference.

Generally if you hold the asset for more than one year before you dispose of it your capital gain or loss is long term. Long term capital gains are taxed at a lower rate than short term gains. Capital gains rates individual and corporate tax rates deductionsexemptions and more.

Long term capital gains tax rates in 2019 if you sell investments at a profit and youve held them for over a year heres what you need to know about taxes.

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term And Long Term Capital Gains Tax Rates By Income

Prometrics Finance Income Tax In The United States

Prometrics Finance Income Tax In The United States

Taxes From A To Z 2019 L Is For Long Term Capital Gains Or Losses

Taxes From A To Z 2019 L Is For Long Term Capital Gains Or Losses

A Programmer Tries To Figure Out How Capital Gains Tax Actually

A Programmer Tries To Figure Out How Capital Gains Tax Actually

Capital Gains Tax Brackets For Home Sellers What S Your Rate

Capital Gains Tax Brackets For Home Sellers What S Your Rate

How Capital Gains Tax Rates Are Assessed

The Tax Impact Of The Long Term Capital Gains Bump Zone

The Tax Impact Of The Long Term Capital Gains Bump Zone

Real Estate Tax Benefits The Ultimate Guide

Real Estate Tax Benefits The Ultimate Guide

2019 Tax Brackets Shape Your New Year Money Steps Investor S

2019 Tax Brackets Shape Your New Year Money Steps Investor S

How To Take Advantage Of Long Term Capital Gains Rates

How To Take Advantage Of Long Term Capital Gains Rates