If you need access to a database of all florida local sales tax rates visit the sales tax data page. The florida fl state sales tax rate is currently 6.

florida sales tax rate 2017 by county

florida sales tax rate 2017 by county is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in florida sales tax rate 2017 by county content depends on the source site. We hope you do not use it for commercial purposes.

Combined with the state sales tax the highest sales tax rate in florida is 850 in the cities.

Florida sales tax rate 2017 by county. The florida state sales tax rate is currently. Rates include state county and city taxes. However the law also provides for a local option sales tax that lets each county set its own local tax that is collected on top of the general state rate.

The combined 2020 sales tax rate for orange county florida is. Click here for a larger sales tax map or here for a sales tax table. The orange county sales tax rate is.

2019 rates included for use while preparing your income tax deduction. This is the total of state and county sales tax rates. Florida law mandates a minimum sales tax rate of six percent collected by the state government to provide services to all floridians.

Florida has 993 cities counties and special districts that collect a local sales tax in addition to the florida state sales taxclick any locality for a full breakdown of local property taxes or visit our florida sales tax calculator to lookup local rates by zip code. A county wide sales tax rate of 100 is applicable to localities in brevard county in addition to the 600 florida sales tax. Depending on city county and local tax jurisdictions the total rate can be as high as 8.

Floridas general sales and use tax rate is 6 with the following exceptions. Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes to the florida department of. The rate varies from county to country between 0 and 2.

In addition to the state sales and use tax rate individual florida counties may impose a sales surtax called discretionary sales surtax or local option county sales tax. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. In the state of florida all sellers of tangible property or goods including leases licenses and rentals are required to register with the state and file and pay sales tax.

While florida has a 6 state sales tax rates many florida counties add on a discretionary sales surtax rate that must be charged on top of the state sales tax rate. The latest sales tax rates for cities in florida fl state. Some cities and local governments in brevard county collect additional local sales taxes which can be as high as 05.

Florida has state sales tax of 600 and allows local governments to collect a local option sales tax of up to 150there are a total of 297 local tax jurisdictions across the state collecting an average local tax of 1045. Follow the link to get the 2017 sales surtax rates by county. Discretionary sales surtax also called county tax is imposed by many florida counties and applies to most transactions subject to sales tax.

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Chart Of State Sales Tax Rates Yarta Innovations2019 Org

Chart Of State Sales Tax Rates Yarta Innovations2019 Org

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

States With The Highest And Lowest Sales Taxes

States With The Highest And Lowest Sales Taxes

State Sales Tax Chart 2016 Barta Innovations2019 Org

State Sales Tax Chart 2016 Barta Innovations2019 Org

Buy Stampin Up During Your Statsales Tax Holiday

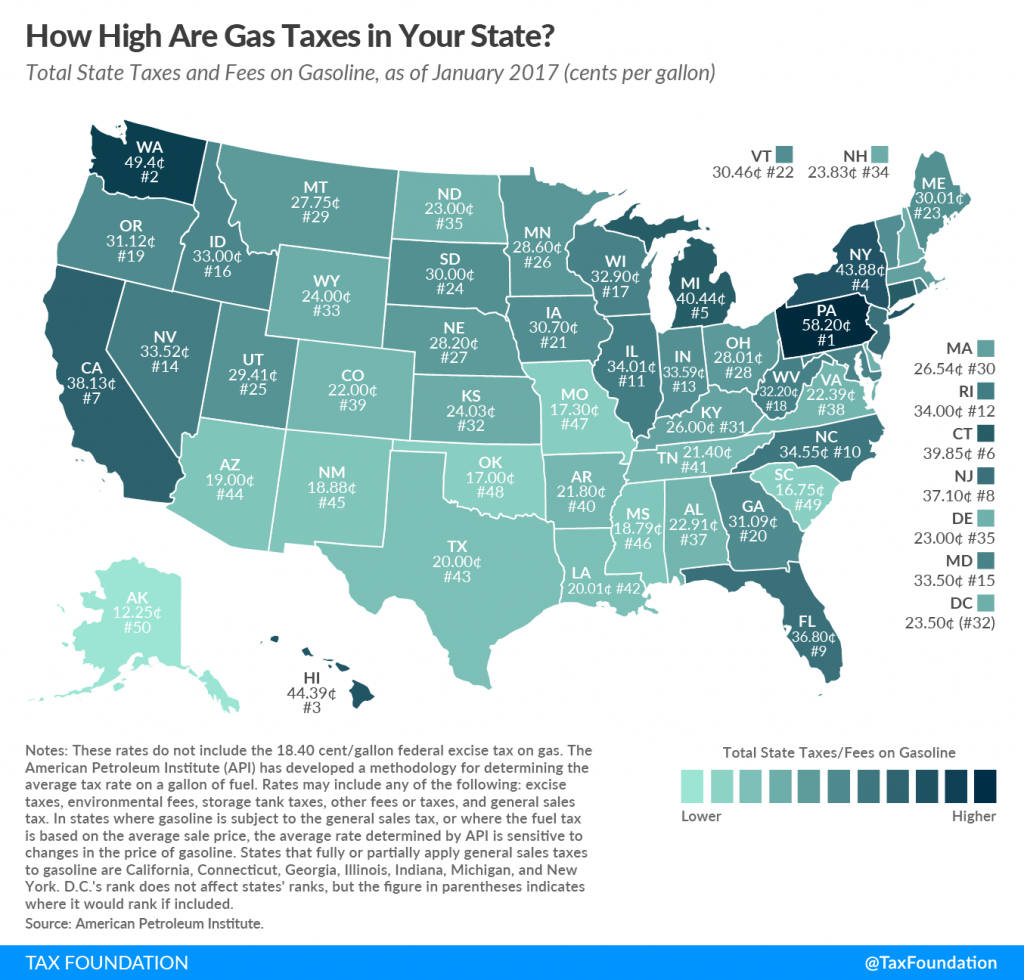

State Gasoline Tax Rates In 2017 Tax Foundation

State Gasoline Tax Rates In 2017 Tax Foundation

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

How High Are Cell Phone Taxes In Your State Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

Which States Tax The Sale Of Food For Home Consumption In 2017

Which States Tax The Sale Of Food For Home Consumption In 2017

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia