Airplane january 1 2020. Notice 2019 02 posted today on irsgov contains the standard mileage rates the amount a taxpayer must use in calculating reductions to basis for depreciation taken under the business standard mileage rate and the maximum standard automobile cost that a taxpayer may use in computing the allowance under a fixed and variable rate plan.

Irs Announces 2019 Mileage Rates

Irs Announces 2019 Mileage Rates

federal reimbursement rate for mileage 2019

federal reimbursement rate for mileage 2019 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in federal reimbursement rate for mileage 2019 content depends on the source site. We hope you do not use it for commercial purposes.

Pov mileage reimbursement rates.

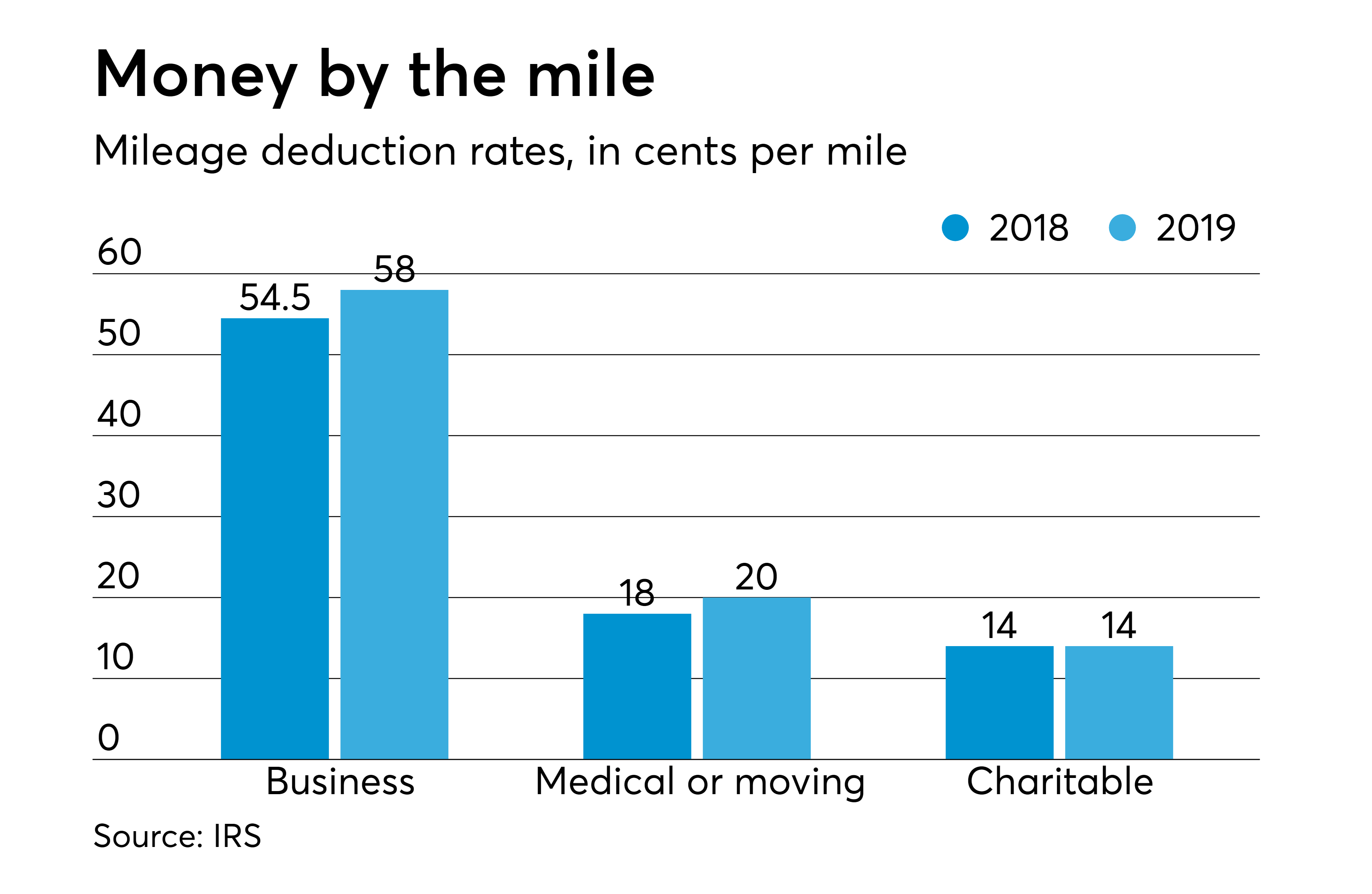

Federal reimbursement rate for mileage 2019. While the standard mileage rates for business medical and moving purposes are based on annual changes in the costs of operating an automobile the charitable rate is set by statute. For 2019 the rates are increasing to 58 cents a mile to reflect increased gas prices and other costs. There are almost 400 destinations across the united states for which a special per diem rate has been specified.

As of january 1st 2019 the standard mileage reimbursement rates are. Every year the irs decides on a standard mileage reimbursement rate calculated using an annual study of the fixed and variable costs of operating an automobile like depreciation insurance repairs maintenance gas and oil. Federal government websites often end in gov or mil.

With the new year comes new standard mileage reimbursement rates for businesses in the us. For travel to any other areas within the united states the fy 2019 general per diem rates are used. The irs knows theres a cost to using a personal car for business reasons and it offers a tax break for.

Effectiveapplicability date rate per mile. How does the irs calculate the 2019 standard mileage rate. The standard mileage rate determines how much your mileage deduction is worth.

Rates are set by fiscal year effective october 1 each year. Mileage reimbursement rates for 2019. Also irs mileage reimbursements rates for employees are tax free.

The following table summarizes the optional standard mileage rates for employees self employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes. Find current rates in the continental united states conus rates by searching below with city and state or zip code or by clicking on the map or use the new per diem tool to calculate trip allowances. If use of privately owned automobile is authorized or if no government furnished automobile is available.

Notice 2019 02 contains the standard mileage rates the amount taxpayers must use in calculating reductions to basis for depreciation taken under the business standard mileage rate and the maximum standard automobile cost that may be used in computing the allowance under a fixed and variable rate favr plan. The irs mileage reimbursement rates for 2019. Gsa has adjusted all pov mileage reimbursement rates effective.

The per diem amount you will be issued for meals and lodging depends on the location to which you are traveling. You tally up your business drives for the year and then multiply that by the standard mileage rate.

The 2020 Standard Mileage Rate Straight From Irs Cfo Daily News

The 2020 Standard Mileage Rate Straight From Irs Cfo Daily News

Irs Mileage Rate For 2020 Small Business Trends

Irs Mileage Rate For 2020 Small Business Trends

Mileage Rates Increasing For 2019 Irs Uberdrivers

Mileage Rates Increasing For 2019 Irs Uberdrivers

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

2019 Standard Mileage Rates Announced Internal Revenue Code

2019 Standard Mileage Rates Announced Internal Revenue Code

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement For Employees Info Free Download

What Is The Mileage Rate For 2019 Tax Deduction

What Is The Mileage Rate For 2019 Tax Deduction

2020 Mileage Reimbursement Rates Paycor

2020 Mileage Reimbursement Rates Paycor

Mileage Reimbursement Rate What S Best For Your Company And Drivers

Mileage Reimbursement Rate What S Best For Your Company And Drivers

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

Irs Raises Mileage Rates For 2019 Accounting Today

Irs Raises Mileage Rates For 2019 Accounting Today