Corporate tax rate in sri lanka averaged 3195 percent from 1997 until 2018 reaching an all time high of 42 percent in 2002 and a record low of 15 percent in 2016. 500000 not available for gains from the realization of investment asset.

State Vehicles Are Not Exempted From The Carbon Tax Finance

carbon tax rates in sri lanka

carbon tax rates in sri lanka is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in carbon tax rates in sri lanka content depends on the source site. We hope you do not use it for commercial purposes.

The eu environmental target for 2015 is 130g of carbon dioxidekm as the vehicle fleet average for all manufacturers.

Carbon tax rates in sri lanka. By the year 2040 all vehicles in sri lanka will be powered by renewable energy. While exempting electric cars a carbon tax will be imposed on directly fossil fueled vehicles including petrol cars from january 1 department of motor traffic dmt commissioner general ahk. Budget 2018 vehicle tax change.

The colombo gazette is a news website operating from sri lanka and accessed by sri lankans and others both in sri lanka and around the world. According to the 2018 budget proposal sri lanka for the convenience of our customers. This page provides sri lanka corporate tax rate actual values historical data forecast chart statistics economic calendar and news.

Carbon pricing is a cost effective means of reducing co2 emissions but countries are still not using this tool to its full potential to curb climate changeexperts from the oecd centre for tax policy and administration presented the key findings from their report on effective carbon rates which measures pricing of co2 emissions from energy. Sri lanka should set this target for new car imports in 2019. Importers of japanese toyota nissan mitsubishi honda used and brand new vehicles and auction agents.

Tax revenue is a primary constituent of the governments fiscal policy. There is also a need to consider an annual road congestion levy based on the square area of each vehicle to fund the road development. Tax rates for resident and non resident individuals personal relief for residentsnon resident citizens of sri lanka is rs.

The corporate tax rate in sri lanka stands at 28 percent. Best wishes for more unique ideas professor in management department of human resource management university of kelaniya sri lanka. User id password remember me forgot.

The government of sri lanka imposes taxes mainly of two types in the forms of direct taxes and indirect. Sri lanka government new vehicle import tax calculation and custom duties due budget 2010. Actulay this is the first time we are experiencing such a valuable updated speed accurate user friendly and professional service in sri lanka.

Taxation in sri lanka mainly includes excise duties value added tax income tax and tariffs. We quote the summary of vehicle taxes imposed by the govt. A carbon tax has been imposed on motor vehicles with effect from january 1st 2019.

Buy and sell of used and unregistered new cars vans bikes cabs jeeps and many models in sri lanka.

Https Economynext Com Sri Lanka Slams Carbon Tax On Cars More On Older Vehicles 8769

Carbon Tax A Mechanism To Control Carbon Dioxide Emissions

Carbon Tax A Mechanism To Control Carbon Dioxide Emissions

Carbon Tax From January 1 Mirrorcitizen Lk

Carbon Tax 2019 Sri Lanka How To Calculate Your Carbon Tax Youtube

Carbon Tax 2019 Sri Lanka How To Calculate Your Carbon Tax Youtube

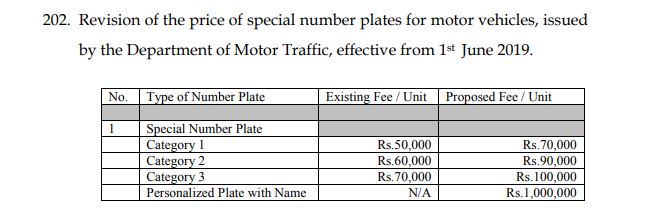

Taxes And Fees On Vehicles Revised

Taxes And Fees On Vehicles Revised

Budget 2018 Vehicle Tax Change

An Environmentally Friendly Vehicle Tax System For Sri Lanka

An Environmentally Friendly Vehicle Tax System For Sri Lanka

Budget 2018 Vehicle Tax Change

Daily Mirror Carbon Tax From Jan 1 Dmt