The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. Tax rates 2016 2017 year residents the 2017 financial year starts on 1 july 2016 and ends on 30 june 2017.

Ato Tax Calculator Atotaxrates Info

Ato Tax Calculator Atotaxrates Info

ato income tax rates 2017 18

ato income tax rates 2017 18 is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in ato income tax rates 2017 18 content depends on the source site. We hope you do not use it for commercial purposes.

Your income if you are under 18 years old.

Ato income tax rates 2017 18. Working holiday makers who earned income between 1 july and 31 december 2016 and continue earning income up to 30 june 2017 will require two payment summaries. All income received by individuals is taxed at progressive tax rates in australia. Ato community is here to help make tax and super easier.

Personal tax rates 2016 17. The australian tax office ato collects income tax from working australians each financial year. Free tax calculator spreadsheet here.

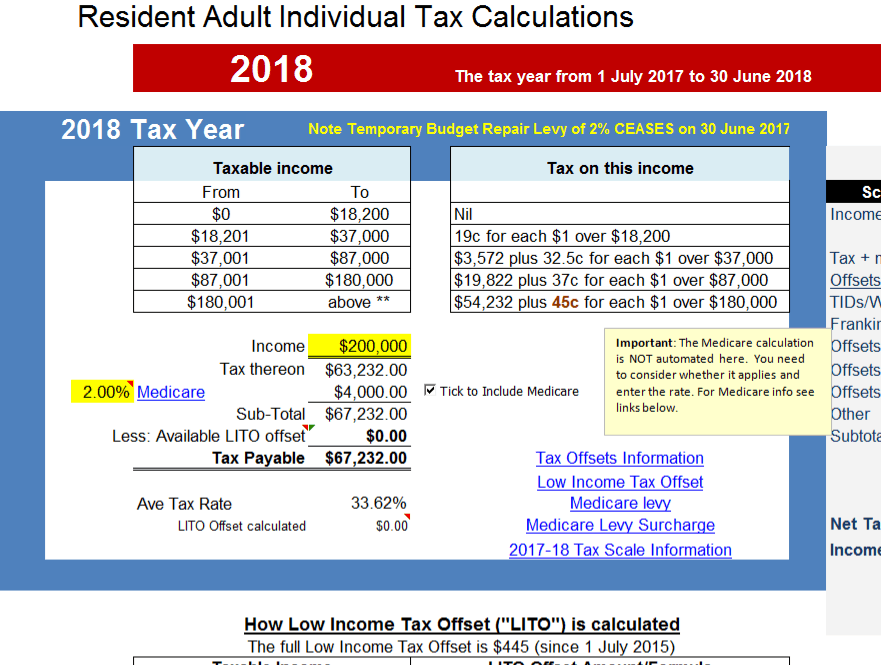

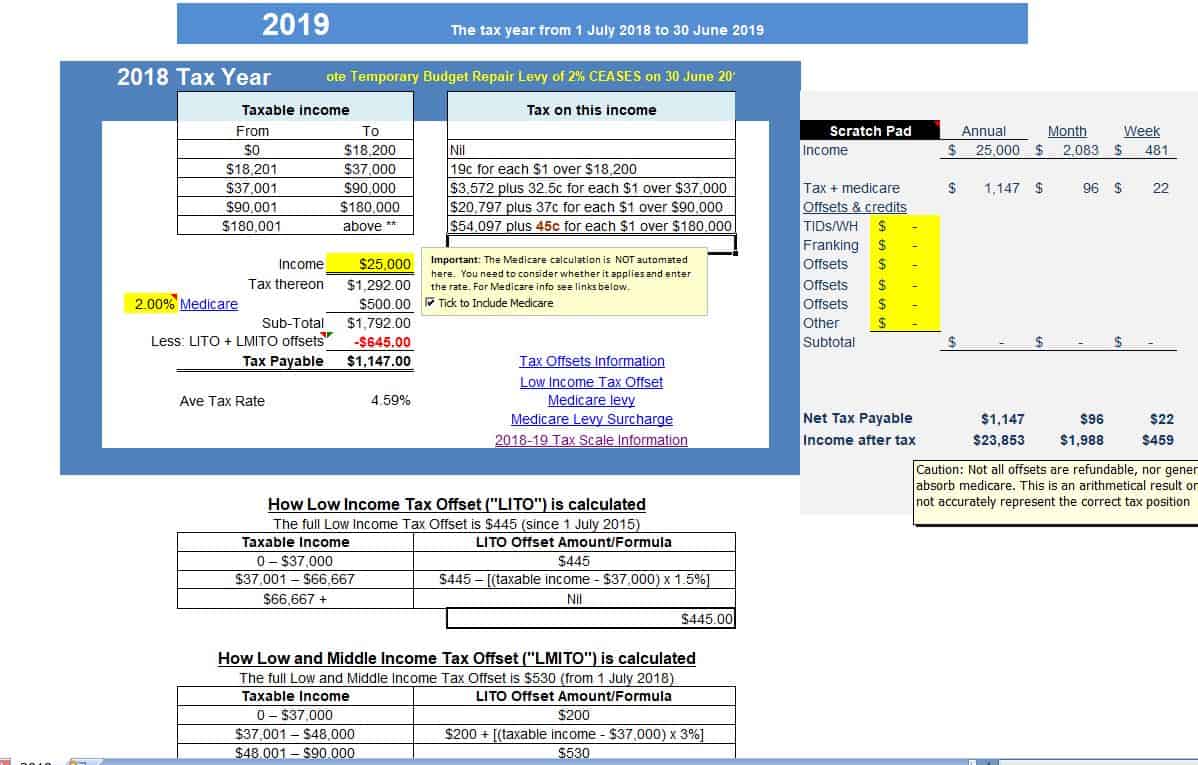

The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. Tax rates 2017 2018 year residents the 2018 financial year starts on 1 july 2017 and ends on 30 june 2018. Hi just looked at the exchange rates for the aud on the ato site.

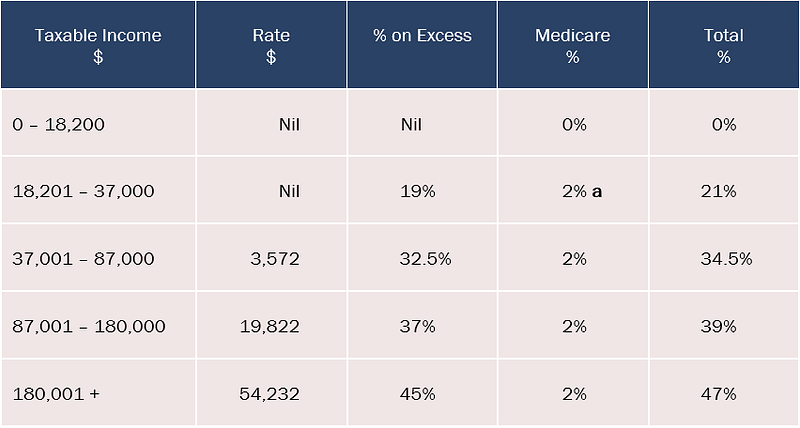

Threshold increases by 1500 for each additional dependent child after the first. That means your income is taxed in brackets and not at the marginal tax rate. Individual income tax rates for prior years.

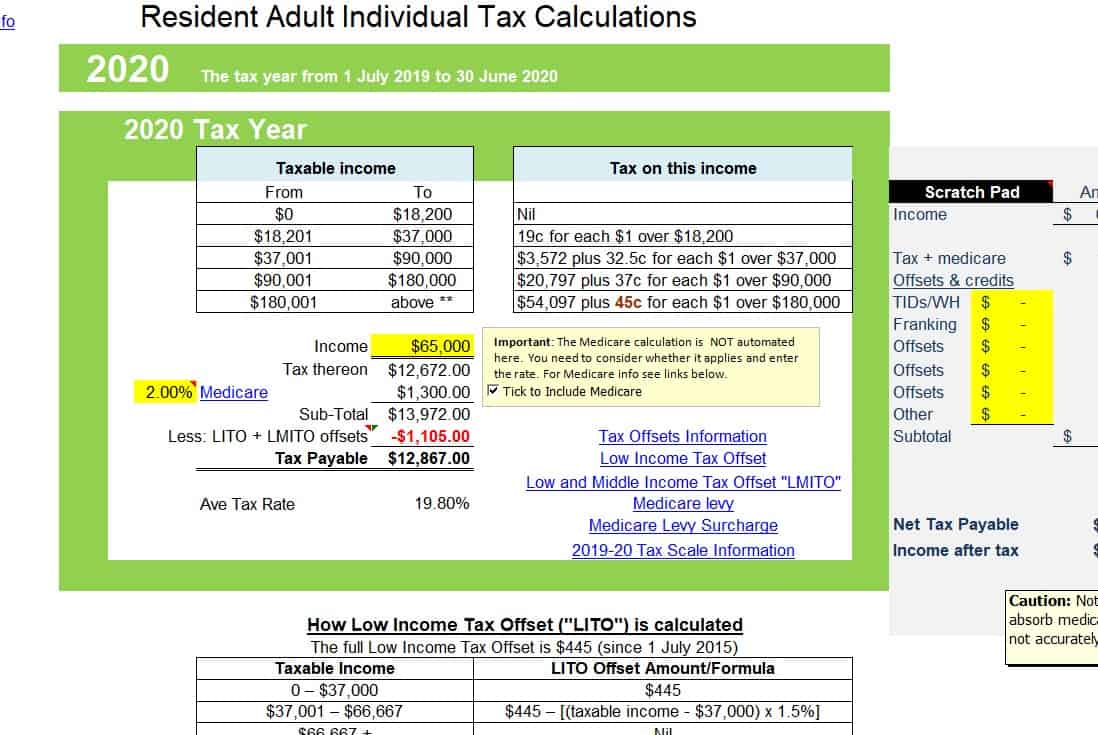

Financial years run from 1 july to 30 june of the following year so we are currently in the 20192020 financial year 1 july 2019 to 30 june 2020. These rates show the amount of tax payable in every dollar for each income bracket for individual taxpayers. The ato is the governments principal revenue collection agency.

Below are the ato tax rates that applies to individuals who are australian residents for tax purposes. If you need help applying this information to your personal situation phone us on 13 28 61. Video tax tips on atotv external link.

This is an ato requirement due to the tax change introducing two separate rates of taxation within the same financial year. The 2017 budget made no changes to the personal income tax scale for. Includes taxable income reportable fringe benefits reportable super contributions net investment losses exempt foreign income and any net amount subject to family trust distribution tax.

What are the changes to fringe benefit tax fbt. Ask questions share your knowledge and discuss your experiences with us and our community. Non savings and non dividend income of any taxpayer that is not subject to either the main rates or the scottish rates of income tax.

Daily exchange rates for 201718 income year. Our role is to manage and shape the tax excise and superannuation systems that fund services for australians. The income tax brackets and rates for australian residents for the current year are listed below.

Tax and tax credit rates and thresholds for 2017 18.

Ato Tax Calculator Atotaxrates Info

Ato Tax Calculator Atotaxrates Info

Oxygen Private Clients 2018 Federal Budget Tax Analysis

Oxygen Private Clients 2018 Federal Budget Tax Analysis

The Rubiix 2018 9 Budget Report Personal Taxation Rubiix

The Rubiix 2018 9 Budget Report Personal Taxation Rubiix

Ato Tax Calculator Atotaxrates Info

Ato Tax Calculator Atotaxrates Info

Instalment Ato Payg Instalment Calculation

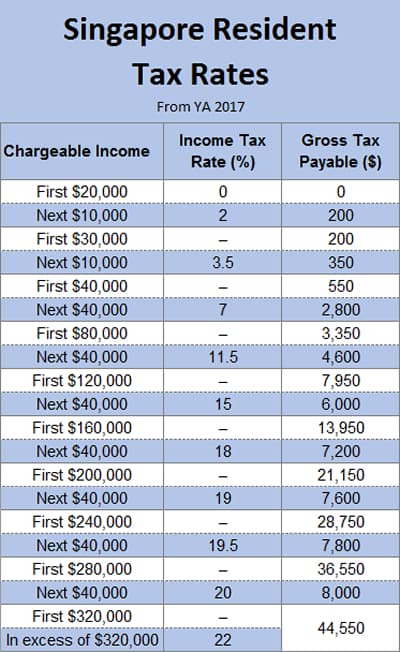

Singapore Personal Individual Income Tax Rate Singapore 2017 And 2018

Singapore Personal Individual Income Tax Rate Singapore 2017 And 2018

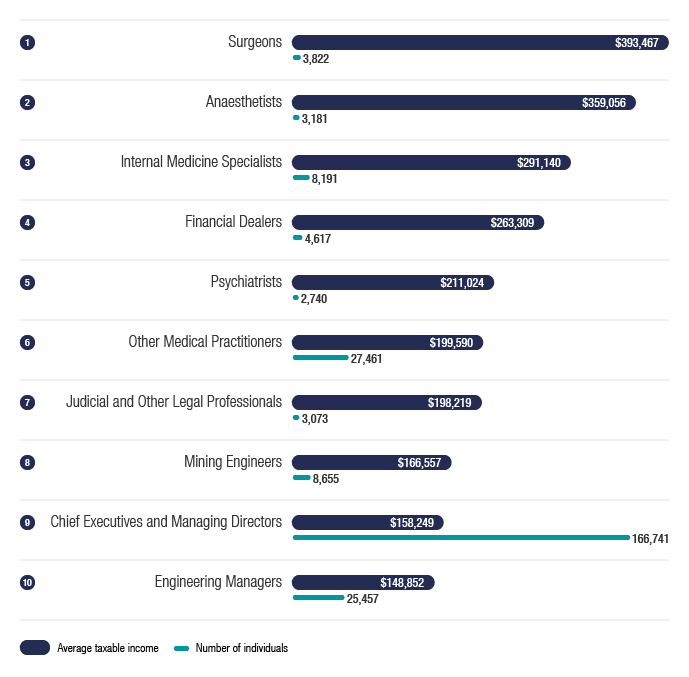

Individuals Australian Taxation Office

Individuals Australian Taxation Office

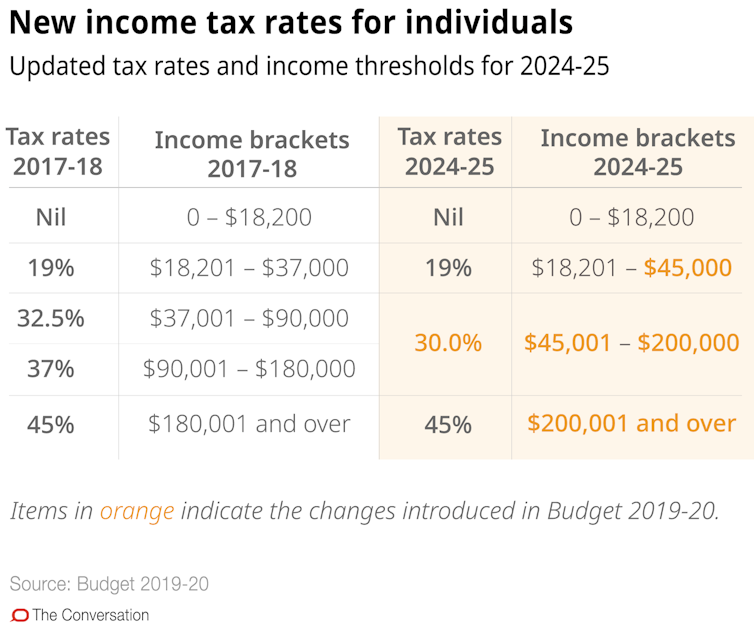

Infographic Budget 2019 At A Glance

Infographic Budget 2019 At A Glance

My Taxes And My Super Campervan Motorhome Rv Travel Deals

My Taxes And My Super Campervan Motorhome Rv Travel Deals

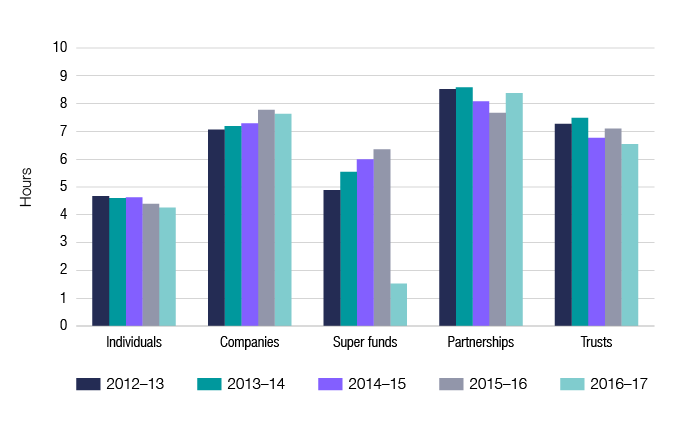

Cost Of Tax Compliance Australian Taxation Office

Cost Of Tax Compliance Australian Taxation Office