Like an interest rate the apr is expressed as a percentage. For that reason your apr is usually higher than your interest rate.

Apr Vs Interest Rate Surprising Differences Between The Two Numbers

Apr Vs Interest Rate Surprising Differences Between The Two Numbers

apr vs interest rate mortgage refinance

apr vs interest rate mortgage refinance is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in apr vs interest rate mortgage refinance content depends on the source site. We hope you do not use it for commercial purposes.

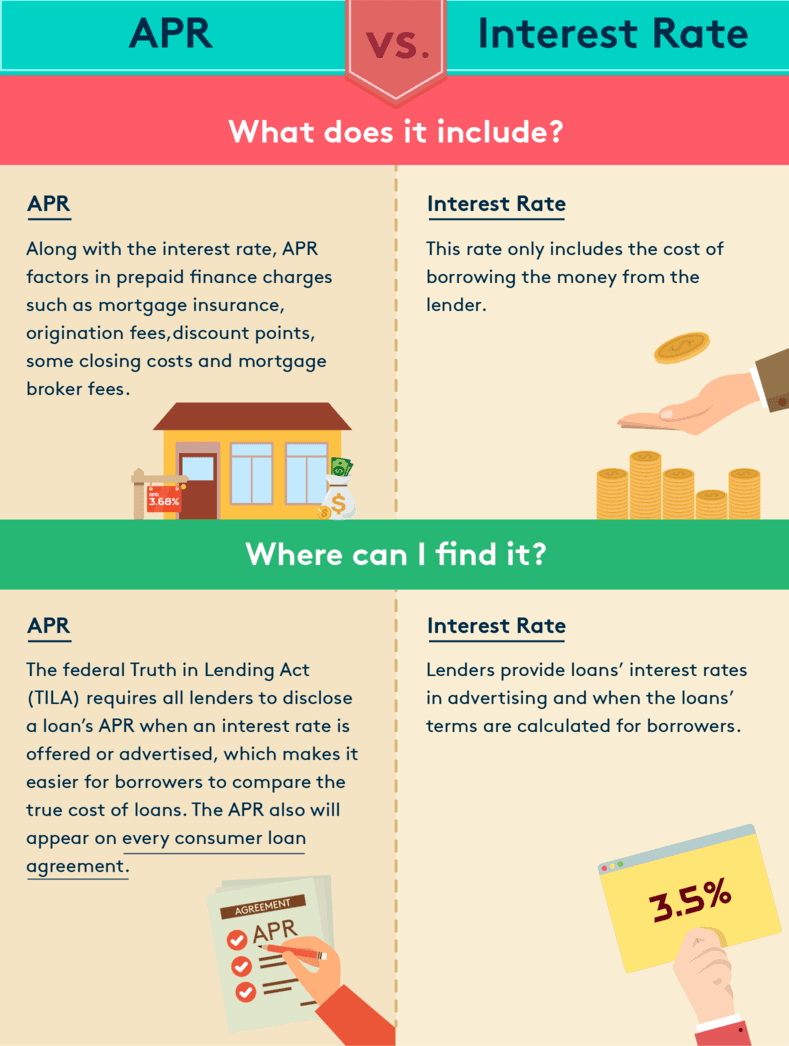

An annual percentage rate apr is a broader measure of the cost of borrowing money than the interest rate.

Apr vs interest rate mortgage refinance. The average 51 adjustable rate mortgage has a 377 interest rate according to freddie macs primary mortgage market survey. Apr the interest rate is the cost of borrowing the principal loan amount. Apr if youre shopping for real estate or looking to refinance and youve seen a certain mortgage rate advertised you may have noticed a second similar percentage adjacent to or below that interest rate possibly in smaller fine print.

Its time for another mortgage match up. Interest rate at its simplest the interest rate reflects the current cost of borrowing expressed as a percentage rate. By contrast the typical 30 year fixed rate mortgage has an interest rate of 420.

The apr reflects the interest rate any points mortgage broker fees and other charges that you pay to get the loan. For example if you were considering a mortgage loan for 200000 with a 6 percent interest rate your annual interest expense would amount to 12000 or a monthly payment of 1000. When looking at apr vs.

Basically apr is meant to help consumers understand the total cost of a loan product including all upfront expenses. The mortgage rate and payment calculator is a good place to start. What is the difference between the mortgage interest rate and apr.

Keep in mind that interest rates can be unpredictable even though you can control some of the factors that determine your rate. Think wealthy with mike adams 210028 views. The rate can be variable or fixed but its always expressed as a percentage.

Unlike an interest rate however it includes other charges or fees such as mortgage insurance most closing costs discount points and loan origination fees. How to pay off your mortgage fast using velocity banking the fastest way to pay off your mortgage. Apr is the annual cost of a loan to a borrower including fees.

All mortgage lenders charge different amounts in closing fees but the law requires all of them to express those costs in the annual percentage rate.

What S The Difference Between Apr And Interest Rate

What S The Difference Between Apr And Interest Rate

Car Loans Apr Vs Interest Rate For A Car Loan Ifs

Car Loans Apr Vs Interest Rate For A Car Loan Ifs

Apr Finance Charge Chart Barta Innovations2019 Org

Differences Between Mortgage Rate And Apr Difference Between

What Is The Difference Between The Interest Rate And The A P R

What Is The Difference Between The Interest Rate And The A P R

How To Calculate Annual Percentage Rate Apr

How To Calculate Annual Percentage Rate Apr

Pros And Cons Of Apr Versus Interest Rate Fortunebuilders

Pros And Cons Of Apr Versus Interest Rate Fortunebuilders

Annual Percentage Rate Wikipedia

Annual Percentage Rate Wikipedia

Don T Fall Victim To Low Mortgage Rates Ads Mortgagehippo

Don T Fall Victim To Low Mortgage Rates Ads Mortgagehippo

Apr Vs Interest Rate Home Loan

Apr Vs Interest Rate Home Loan

How To Calculate Interest Rates On Bank Loans

How To Calculate Interest Rates On Bank Loans