Important note on engagement of intermediaries. The floating rate is equal to the base rate plus a spread or margin.

/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png) Compute Loan Interest With Calculators Or Templates

Compute Loan Interest With Calculators Or Templates

how to calculate floating rate loans

how to calculate floating rate loans is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to calculate floating rate loans content depends on the source site. We hope you do not use it for commercial purposes.

Free loan calculator to determine repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds.

How to calculate floating rate loans. Once again you need to fill in the number of variations and the expected interest rates. The total rate paid by the customer varies or floats in relation to some base rate to which a spread or margin is added or more rarely subtracted. Federal reserve fed funds rate or the libor london interbank offered rate.

In business and finance a floating rate loan or a variable or adjustable rate loan refers to a loan with a floating interest rate. Hang seng bank limited the bank does not accept any sme loan and hire purchase for taxi and public light bus applications referred by third parties not being appointed by the bank. Floating rate funds can include preferred stock corporate bonds and loans.

Two of the most common reference rates used with floating interest loans are the prime rate in the us and in europe the london interbank offered rate libor. A floating interest rate is an interest rate that moves up and down with the rest of the market or along with an index. The interest rate for fixed rate loan ranges between 985 and 101 per annum.

Floating rate loans or savings are normally based on some reference rate such as the us. It can also be referred to as a variable interest rate because it can vary. This is great when rates are falling but when rates are rising hang on or try to refinance into a fixed rate mortgage.

The interest rate of a loan or savings can be fixed or floating. For instance currently icici bank is offering rs 50 lacs floating rate loan at 945. Although there is no formula to calculate a floating rate fund there can be various investments that comprise a fund.

Once you have done this enter the floating rate the lender has given you. For example interest on a. Changes in the floating interest rate are based on a reference rate.

The calculator gives you a straightforward answer whether to go with the floating rate or the fixed one. In another example if your mortgage interest rate is a floating rate that is it is adjustable your rate rises and falls with the market and you and your payments get to go along for the ride. The rate of interest in a fixed rate loan is certainly higher than interest in floating rate loan.

Also learn more about different types of loans experiment with other loan calculators or explore other calculators addressing finance math fitness health and many more. Normally the loan rate is a little higher and the savings rate is a little lower than the reference rate.

How To Use The Excel Rate Function Exceljet

How To Use The Excel Rate Function Exceljet

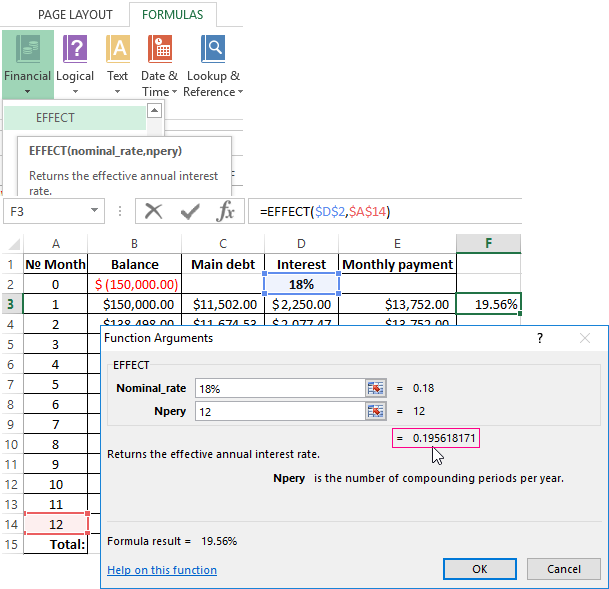

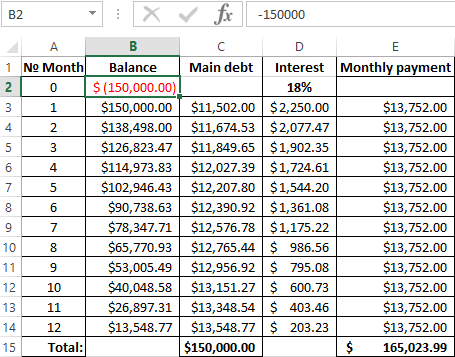

Calculation Of The Effective Interest Rate On Loan In Excel

Calculation Of The Effective Interest Rate On Loan In Excel

How Should One Calculate Equated Monthly Installments For A Loan

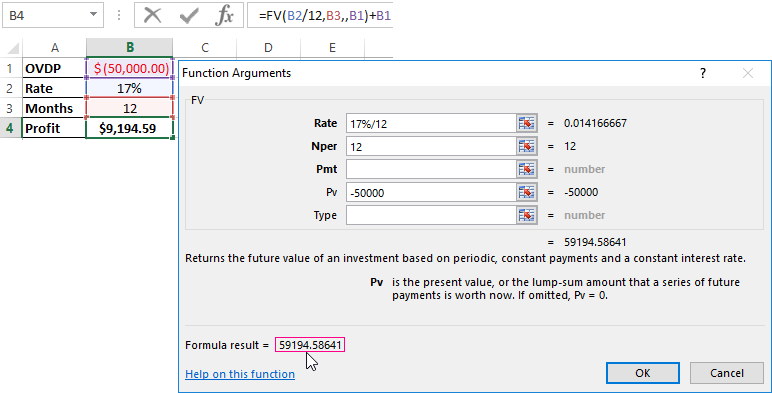

Excel Formula Calculate Interest Rate For Loan

Excel Formula Calculate Interest Rate For Loan

How To Calculate Interest Rates On Bank Loans

How To Calculate Interest Rates On Bank Loans

How Can I Calculate Compounding Interest On A Loan In Excel

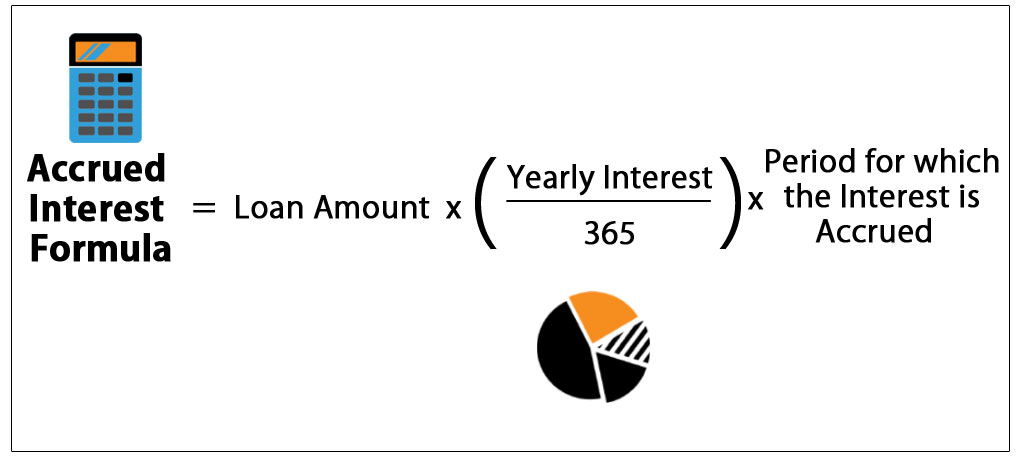

Accrued Interest Formula Calculate Monthly Yearly Accrued Interest

Accrued Interest Formula Calculate Monthly Yearly Accrued Interest

Calculation Of The Effective Interest Rate On Loan In Excel

Calculation Of The Effective Interest Rate On Loan In Excel

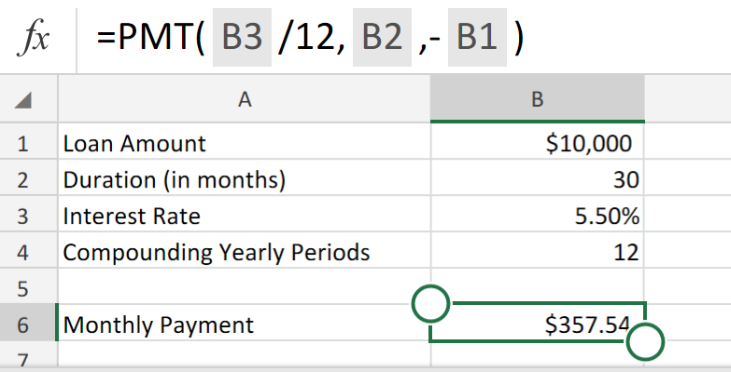

How To Calculate A Monthly Loan Payment In Excel

How To Calculate A Monthly Loan Payment In Excel

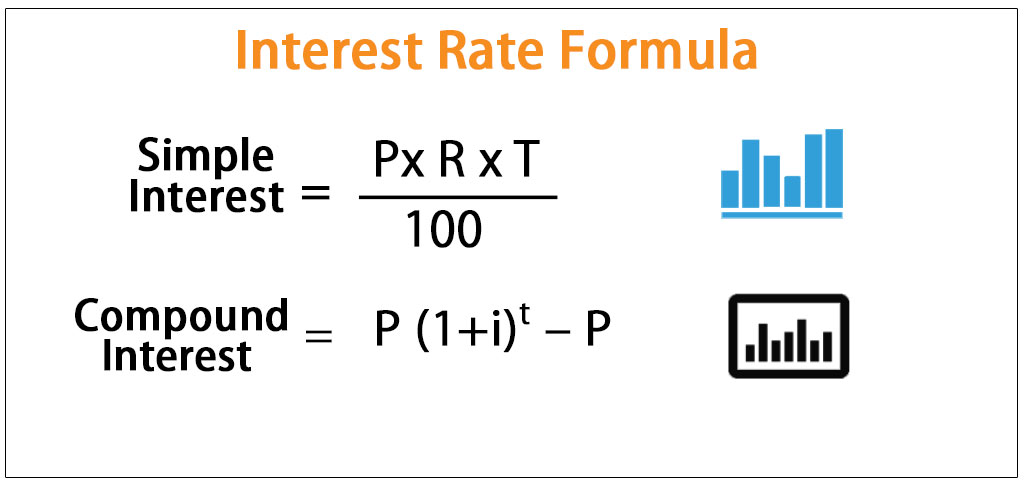

Interest Rate Formula Calculate Simple Compound Interest

Interest Rate Formula Calculate Simple Compound Interest

How To Calculate Effective Interest Rate 8 Steps With Pictures

How To Calculate Effective Interest Rate 8 Steps With Pictures