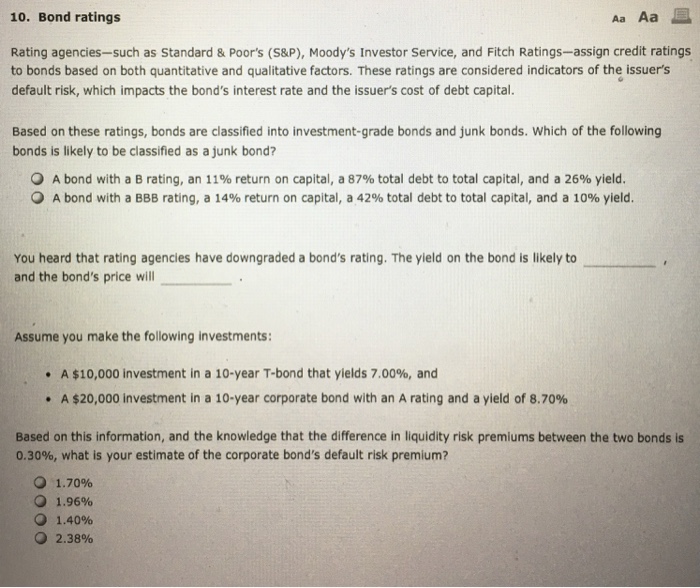

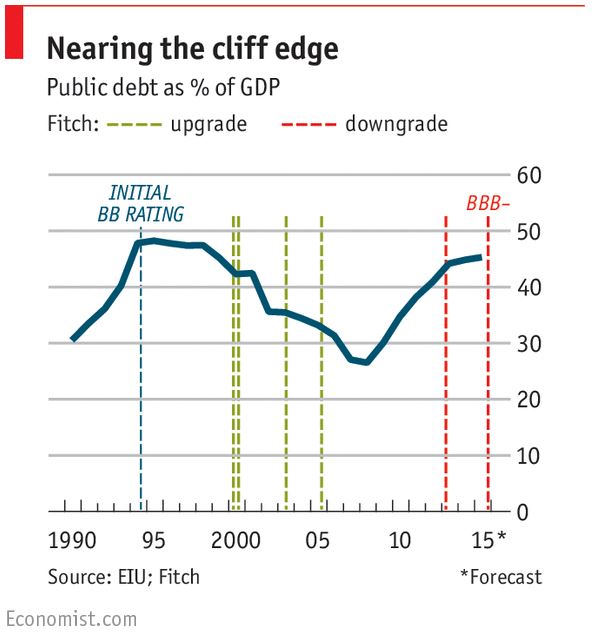

When a rating agency raises a bonds rating this action is called an upgrade similarly a lowered rating is called a downgrade. The rating levels descend to triple c as the possibility of default increases and finally to d or default.

Credit Rating How Credit Rating Downgrade Of Companies Impacts

Credit Rating How Credit Rating Downgrade Of Companies Impacts

credit rating downgrade effect on bonds

credit rating downgrade effect on bonds is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in credit rating downgrade effect on bonds content depends on the source site. We hope you do not use it for commercial purposes.

A downgrade is a negative change in the rating of a securitythis situation occurs when analysts feel that the future prospects for the security have weakened from the original recommendation.

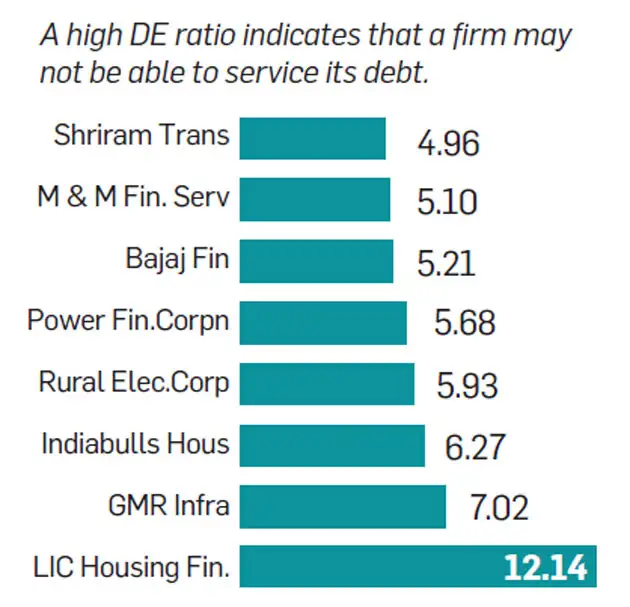

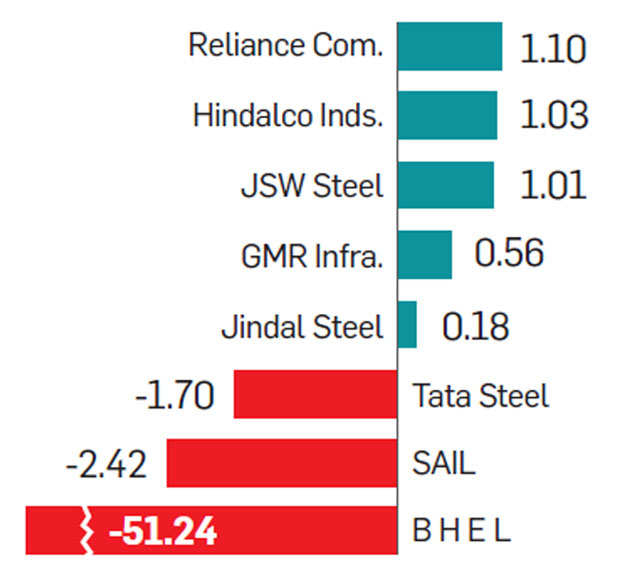

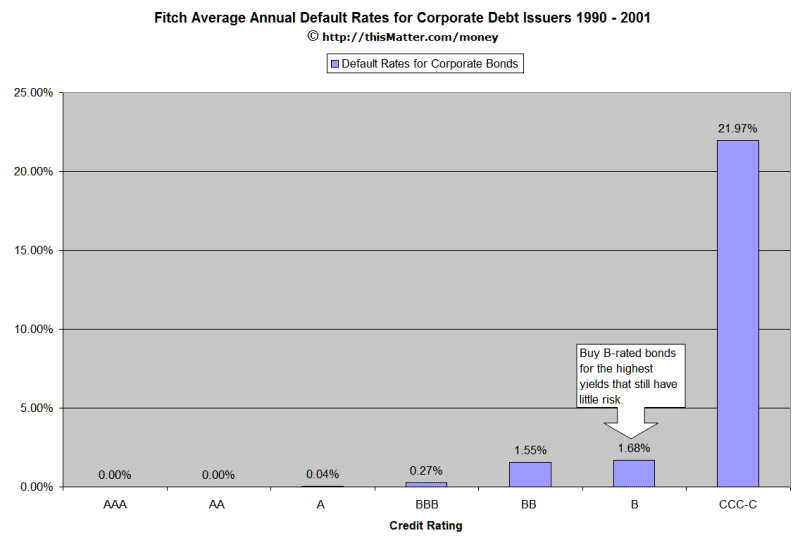

Credit rating downgrade effect on bonds. Usually only bonds issued by the largest and strongest companies qualify for the prized investment grade ratings which indicate outstanding relative credit. What leads to a downgrade. To help make informed equity investments here is what you need to know about a ratings downgrade.

Sp had announced a negative outlook on the aaa rating in april 2011. The downgrade to aa occurred four days after the 112th united states congress voted to raise the debt ceiling of the federal government by means of the budget control act of 2011 on august 2 2011. Most individual bonds including the majority of those typically held in bond funds are assigned credit ratings by major rating agencies such as standard poors.

If a country is a really good creditor and there isnt any meaningful risk that the country will default on its debt then the country will get an investment grade credit rating. The highest quality rating is triple a. The credit rating process is no different to a credit assessment that a bank might perform on you when you apply for a loan.

Credit migration risk is a vital part of the credit risk assessment specifically with regard to corporate bonds which underlie numerous rating changes. The counters fell 22 and 40 respectively over the past one month. The 2011 sp downgrade was the first time the us federal government was given a rating below aaa.

Credit ratings agencies recently downgraded bonds issued by idbi bank and reliance communications seriously impacting their stock prices.

Does Change In Investment Rating Impact Bond Value

Does Change In Investment Rating Impact Bond Value

Credit Rating How Credit Rating Downgrade Of Companies Impacts

Credit Rating How Credit Rating Downgrade Of Companies Impacts

Cracks Emerge In Bond Market Wsj

Cracks Emerge In Bond Market Wsj

What Is A Credit Rating Downgrade World Economic Forum

What Is A Credit Rating Downgrade World Economic Forum

Credit Rating How Credit Rating Downgrade Of Companies Impacts

Credit Rating How Credit Rating Downgrade Of Companies Impacts

:max_bytes(150000):strip_icc()/CorporateBonds_CreditRisk22-8c12f1dbc1494f28b3629d456fb4fa63.png) Corporate Bonds An Introduction To Credit Risk

Corporate Bonds An Introduction To Credit Risk

Credit Rating How Credit Rating Downgrade Of Companies Impacts

Credit Rating How Credit Rating Downgrade Of Companies Impacts

Bond Ratings And Credit Risk Nationally Recognized Statistical

Bond Ratings And Credit Risk Nationally Recognized Statistical

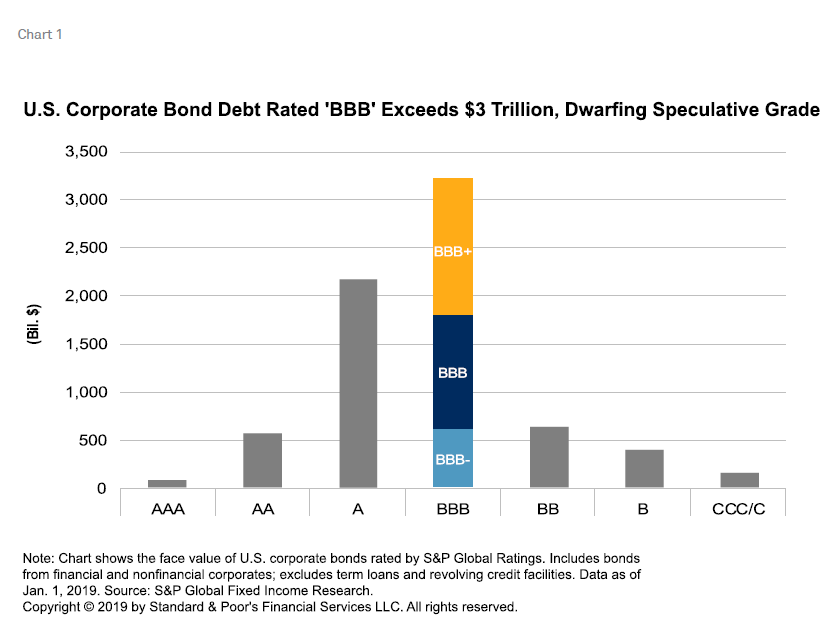

The Bbb U S Bond Market Exceeds 3 Trillion S P Global

The Bbb U S Bond Market Exceeds 3 Trillion S P Global

Increasing Share Of Bbb Rated Bonds And Changing Credit

Increasing Share Of Bbb Rated Bonds And Changing Credit