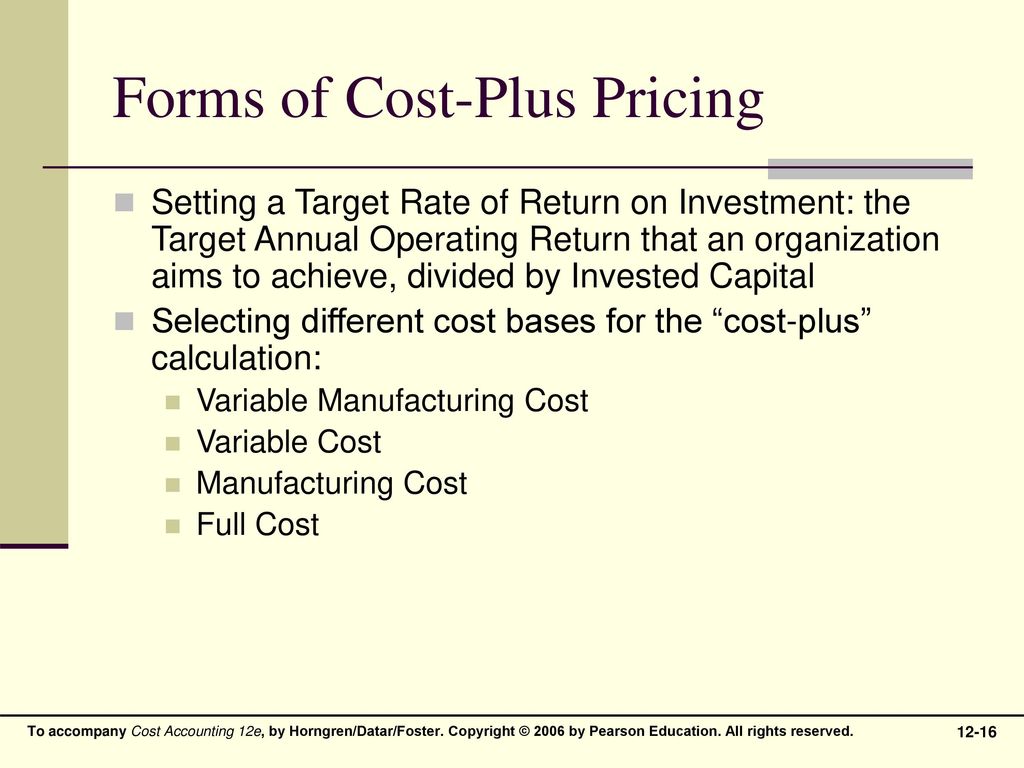

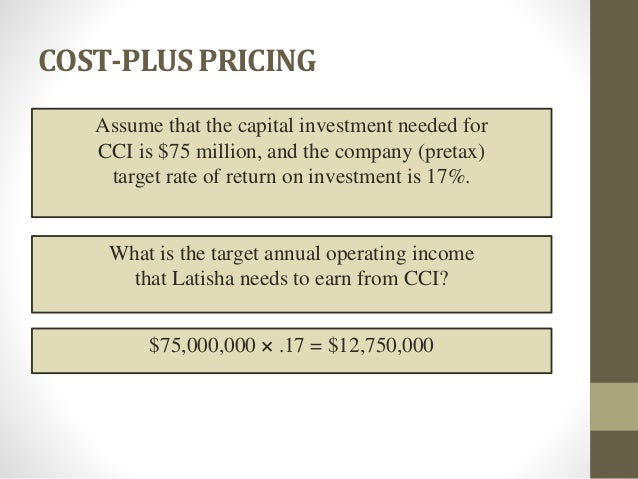

Then you arrange your price structure so as to achieve these target rates of return. Target rate of return on investment is a method you can use to compute a markup.

cost plus target rate of return on investment

cost plus target rate of return on investment is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in cost plus target rate of return on investment content depends on the source site. We hope you do not use it for commercial purposes.

Cost plus target return on investment pricing.

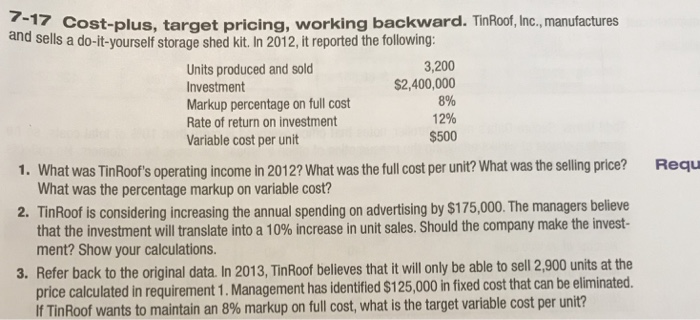

Cost plus target rate of return on investment. Blodgett anticipates that he will rent these rooms for 15000 nights next year or 15000 room nights all rooms are similar and will rent for the same price. The target return model differs somewhat from a cost plus pricing strategy wherein the price markup is based on other criteria. There are several methods to decide on your markup.

Target rate of return pricing. Cost plus target return on investment pricing. John blodgett is the managing partner of a business that has just finished building a 60 room motel.

Here the desired return is the desired return on investment also known as roi. Rate of return pricing is a method by which a company fixes the price of the product in such a way that it ultimately helps organisations in achieving the ultimate goal or return on the capital employed. Target rate of return pricing is a pricing method used almost exclusively by market leaders or monopolistsyou start with a rate of return objective like 5 of invested capital or 10 of sales revenue.

Target return pricing is a pricing strategy used by e commerce experts that helps them set the price of a product based on the expected rate of return of their business. Compute a target rate of return on investment in cost accounting. John branch is the managing partner of a business that has just finished building a 60 room motel.

The target return pricing is a method wherein the firm determines the price on the basis of a target rate of return on the investment ie. The concept of. Although customer judgments about price and competitor pricing can limit the markup theres another view.

Target return price unit cost desired return invested capital unit sales. This is a common practice but can only be effective in cases or products which have very little competition. A cap rate is the rate of return youd expect to receive from a property during the first year of ownership excluding the cost to improve the property and financing costs.

Think of a cap rate as the dividend one would receive in the first year if the property were acquired with all cash. The product of desired rate of return and the capital invested gives the required. What the firm expects from the investments made in the venture.

The roi can be calculated as gain from investment cost of investment cost of investment. What is it and how to use it. The cost of producing the product is the main factor with an.

Branch anticipates that he will rent these rooms for 16000 nights next year or 16000 room nights.

Copyright C 2003 Pearson Education Canada Inc Slide Chapter 12

Copyright C 2003 Pearson Education Canada Inc Slide Chapter 12

Pricing Decisions And Cost Management Ppt Download

Pricing Decisions And Cost Management Ppt Download

Pricing Decisions And Cost Management Ppt Download

Pricing Decisions And Cost Management Ppt Download

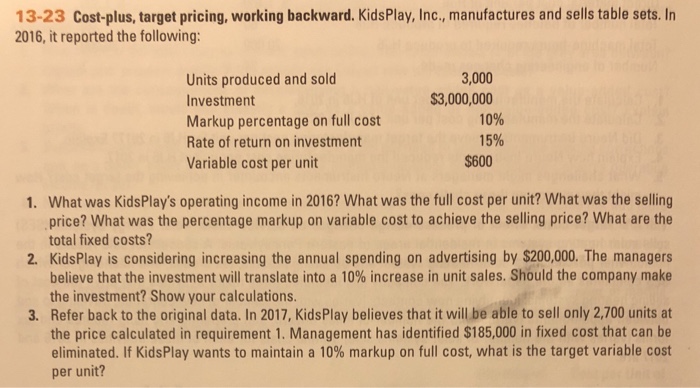

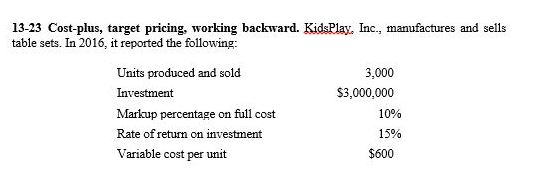

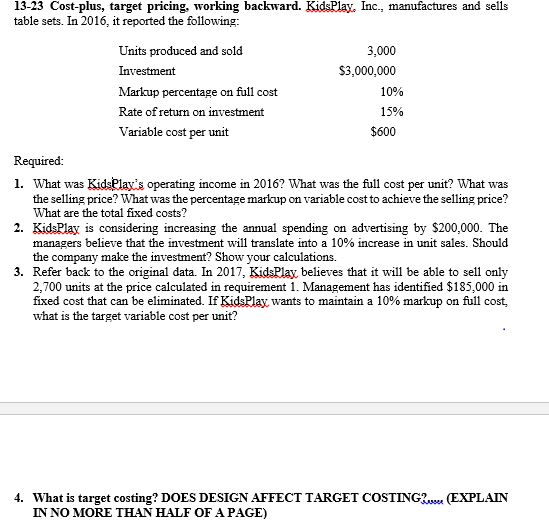

Solved Cost Plus Target Pricing Working Backward Kidsplay

Solved Cost Plus Target Pricing Working Backward Kidsplay

Pricing Decisions Emba 5412 Fall Ppt Download

Pricing Decisions Emba 5412 Fall Ppt Download

Solved 1 What Is Target Costing Does Design Affect Targ

Solved 1 What Is Target Costing Does Design Affect Targ

Pricing Decisions And Cost Management Ppt Download

Pricing Decisions And Cost Management Ppt Download

Mgmt Acc Chap 6 Pricing Decisions

Mgmt Acc Chap 6 Pricing Decisions

Solved 13 23 Cost Plus Target Pricing Working Backward

Solved 13 23 Cost Plus Target Pricing Working Backward

Cost Plus Pricing Definition Method Formula Examples Video

Cost Plus Pricing Definition Method Formula Examples Video