With interest rates near record lows and rising rents real estate can be a good investment these days depending on where you buy and how you pay for it. Capitalization cap rates are the most commonly used metric by which real estate investments are measured.

Hvs Report Hotel Cap Rates Hold Steady Values Under Pressure

Hvs Report Hotel Cap Rates Hold Steady Values Under Pressure

best cap rates in usa 2016

best cap rates in usa 2016 is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in best cap rates in usa 2016 content depends on the source site. We hope you do not use it for commercial purposes.

Lets take an example of how a cap rate is commonly used.

/calculating-property-value-with-capitalization-rate-2866800-v3-5c13d7dbc9e77c000160837f.png)

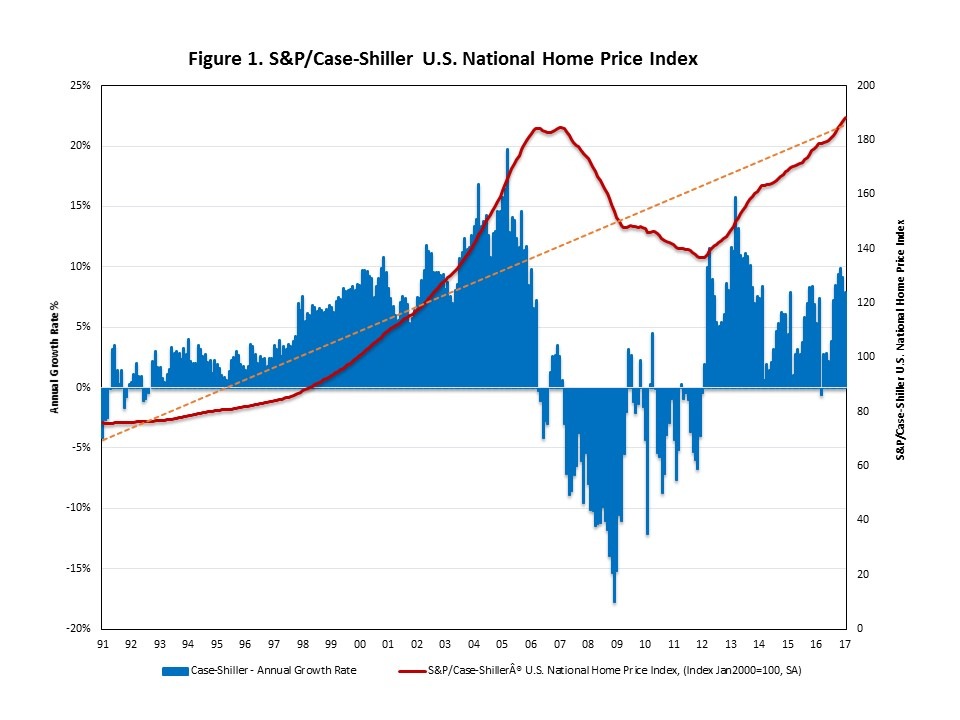

Best cap rates in usa 2016. As with any complex topic the answer is that it depends. In the commercial real estate industry it is common to say that this property sold at a 58 cap rate. Cap rates cycles and how to inflate a real estate bubble.

7 best small cap funds to buy and. Read more about how to find the market value of investment real estate. Says that small caps returned 284 annualized and large caps returned 144 when the fed is not raising interest rates.

While its impossible to know what the short term will bring come year end 2016 is still a buyers market for. The world economic forum is an independent international organization committed to improving the state of the world by engaging business. About the cap rate survey.

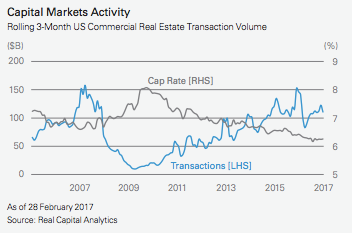

The most meaningful indicator of a potential bubble or overpricing of commercial real estate is the spread between cap rates and underlying treasury rates. With that in mind heres a look at some of the best index funds to buy in 2016. One way that real estate investors choose the best places to buy investment property is to look at cap rates by citytypically if the average cap rate for rental property in a city is high this location is considered to have a high potential for being profitable.

Which begs the question what is a good cap rate for an investment property. So is the cap rate the best early warning indicator of market overheating. Cbre is pleased to present its semiannual north america cap rate survey for h1 2018 which reveals cap rates and pricing trends for all major property types in major markets across the us.

According to rca cap rates averaged 65 nationwide during 2015 while the 10 year treasury rate averaged in the low 2 range for most of 2015 and early 2016. Keep in mind that cap rates for specific properties may be higher or lower than the median in their area. Suppose we are researching the recent sale of a class a office building with a stabilized net operating income noi of 1000000 and a sale price of 17000000.

Below is a list showing the median cap rate by county for select property types.

Hvs Report Hotel Cap Rates Hold Steady Values Under Pressure

Hvs Report Hotel Cap Rates Hold Steady Values Under Pressure

Hvs Report Hotel Cap Rates Hold Steady Values Under Pressure

Hvs Report Hotel Cap Rates Hold Steady Values Under Pressure

Hvs Report Hotel Cap Rates Hold Steady Values Under Pressure

Hvs Report Hotel Cap Rates Hold Steady Values Under Pressure

Hvs Report Hotel Cap Rates Hold Steady Values Under Pressure

Hvs Report Hotel Cap Rates Hold Steady Values Under Pressure

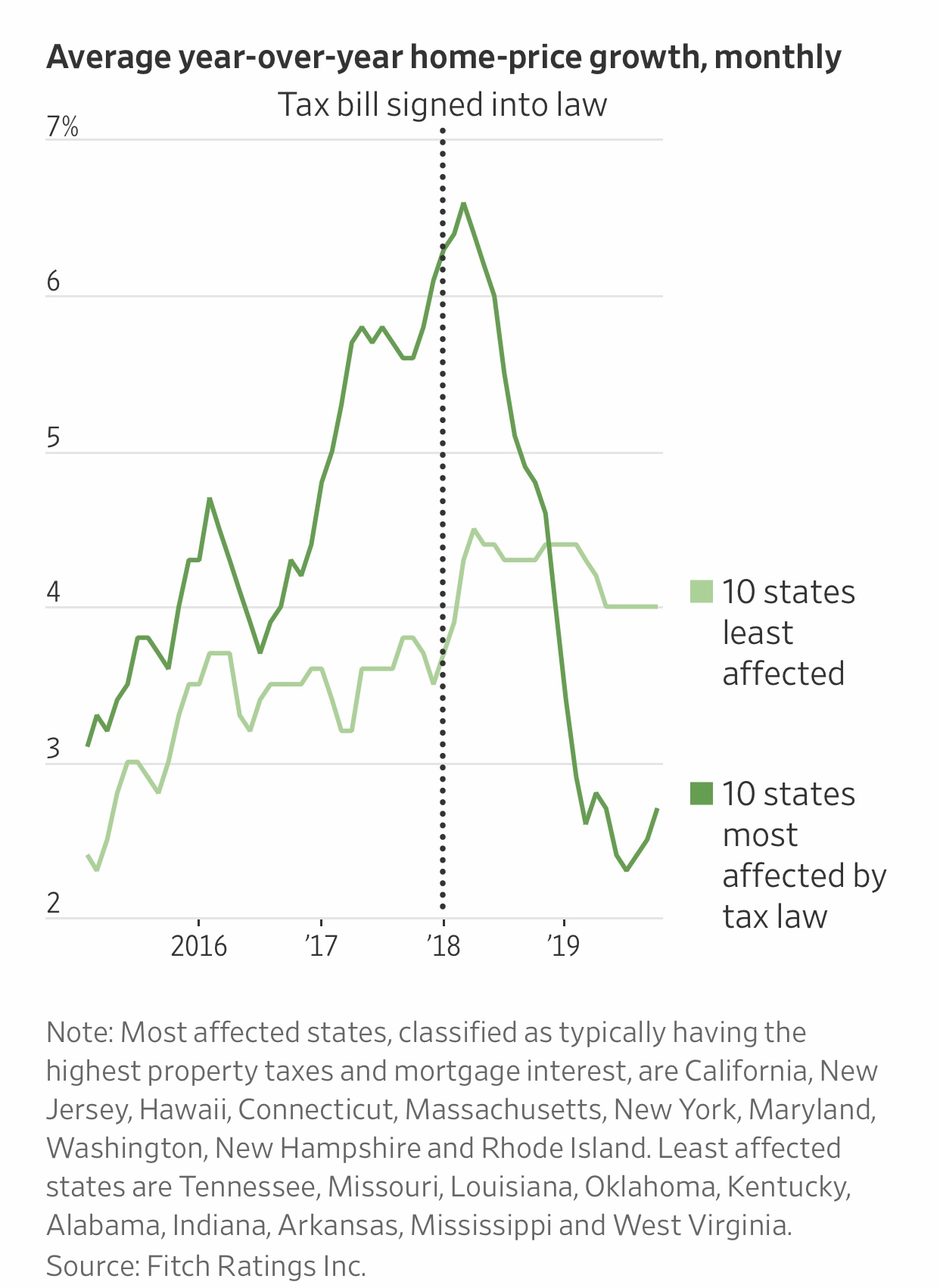

Top States To Buy Real Estate In The New Decade Financial Samurai

Top States To Buy Real Estate In The New Decade Financial Samurai

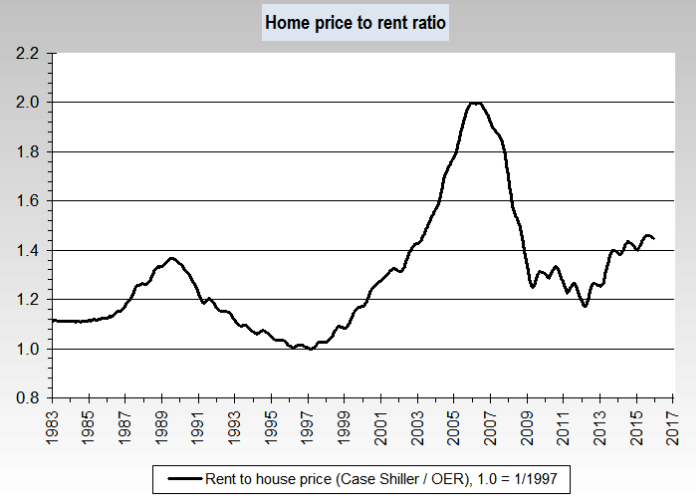

The U S Real Estate Market Trends Characteristics And Outlook

The U S Real Estate Market Trends Characteristics And Outlook

The U S Real Estate Market Trends Characteristics And Outlook

The U S Real Estate Market Trends Characteristics And Outlook

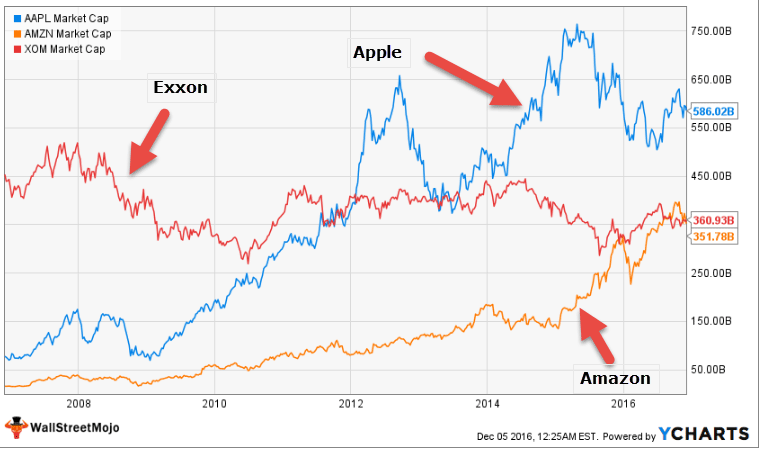

Market Capitalization Definition Examples How To Intepret

Market Capitalization Definition Examples How To Intepret

2020 Commercial Real Estate Industry Outlook Deloitte Insights

2020 Commercial Real Estate Industry Outlook Deloitte Insights

Are Stock Buybacks A Good Thing Or Not

The U S Real Estate Market Trends Characteristics And Outlook

The U S Real Estate Market Trends Characteristics And Outlook