It is focused on three types of taxes. Country both joined the european union and cut its income taxes during 2013.

lowest corporate tax rates in the world 2013

lowest corporate tax rates in the world 2013 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in lowest corporate tax rates in the world 2013 content depends on the source site. We hope you do not use it for commercial purposes.

Profit or corporate income tax.

Lowest corporate tax rates in the world 2013. The alternative minimum tax rates remained at 26 and 28. Corporate income tax rates around the world 2014 download. Kpmgs corporate tax table provides a view of corporate tax rates around the world.

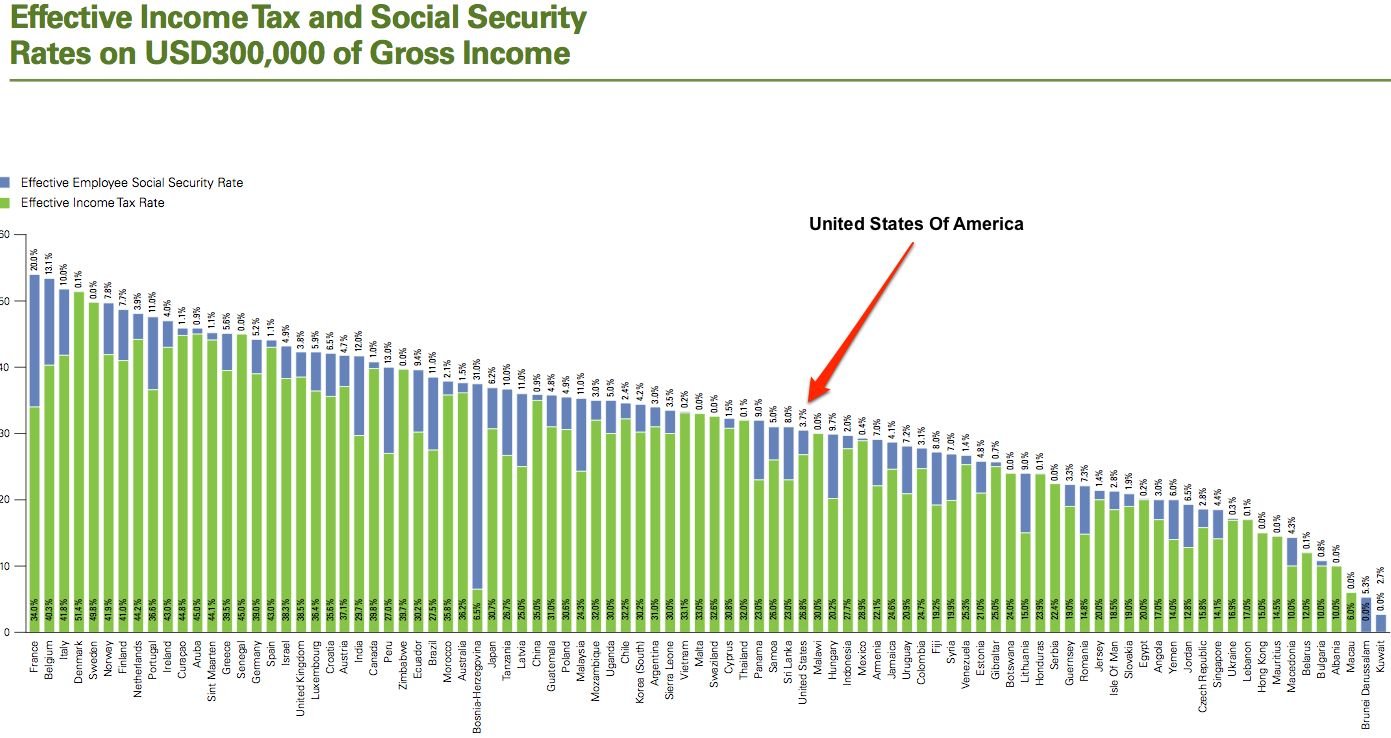

The united states has the third highest general top marginal corporate income tax rate in the world at 391 percent exceeded only by chad and the united arab emirates. The country both joined the european union and cut its income taxes during 2013. The 18 countries with the lowest tax rates in the world.

Use our interactive tax rates tool to compare tax rates by country jurisdiction or region. Regional variation in corporate tax rates. Tax rates are checked regularly by kpmg member firms.

The following tax rates apply to ordinary income which is most types of income. 2013 federal tax rates by filing status. Due to the recent reduction in chads.

The 18 countries with the lowest tax rates in the world. 2016 key findings the united states has the third highest general top marginal corporate income tax rate in the world at 3892 percent. It is not intended to represent the true tax burden to either the corporation or the individual in the listed country.

Corporate tax rates vary significantly among worldwide regions table 4. Corporation tax to be cut to 20 this article is more than 6 years old osborne says britain is open for business with new rate one of lowest in western world below luxembourgs 21. Countries with the lowest tax rates in the world.

Europe has the lowest average tax rate at 1888 percent 36 percentage points below the worldwide average of 2249 percent. Corporate individual and value added taxes vat. Corporate income tax rates around the world 2016 by kyle pomerleau and emily potosky director of federal projects no.

A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub national unit. However please confirm tax rates with the countrys tax authority before using them to make business decisions. This is a list of the maximum potential tax rates around europe for certain income brackets.

Each tax rate applies to a specific range of taxable income called a tax bracket. Special rates apply to long term capital gains and qualified dividends. World corporate tax rates and gdp 1993 2014 download fiscal fact no.

Africas average top marginal corporate income tax rate of 2853 percent is the highest among all regions.

Corporate Tax In The United States Wikipedia

Corporate Tax In The United States Wikipedia

The Incredible Shrinking Corporate Tax Rate Continues To Hit New

The Incredible Shrinking Corporate Tax Rate Continues To Hit New

The Incredible Shrinking Corporate Tax Rate Continues To Hit New

The Incredible Shrinking Corporate Tax Rate Continues To Hit New

Japan Corporate Tax Rate 1993 2020 Data 2021 2022 Forecast

Japan Corporate Tax Rate 1993 2020 Data 2021 2022 Forecast

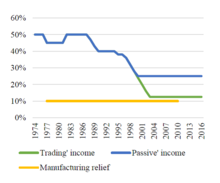

Corporation Tax In The Republic Of Ireland Wikipedia

Corporation Tax In The Republic Of Ireland Wikipedia

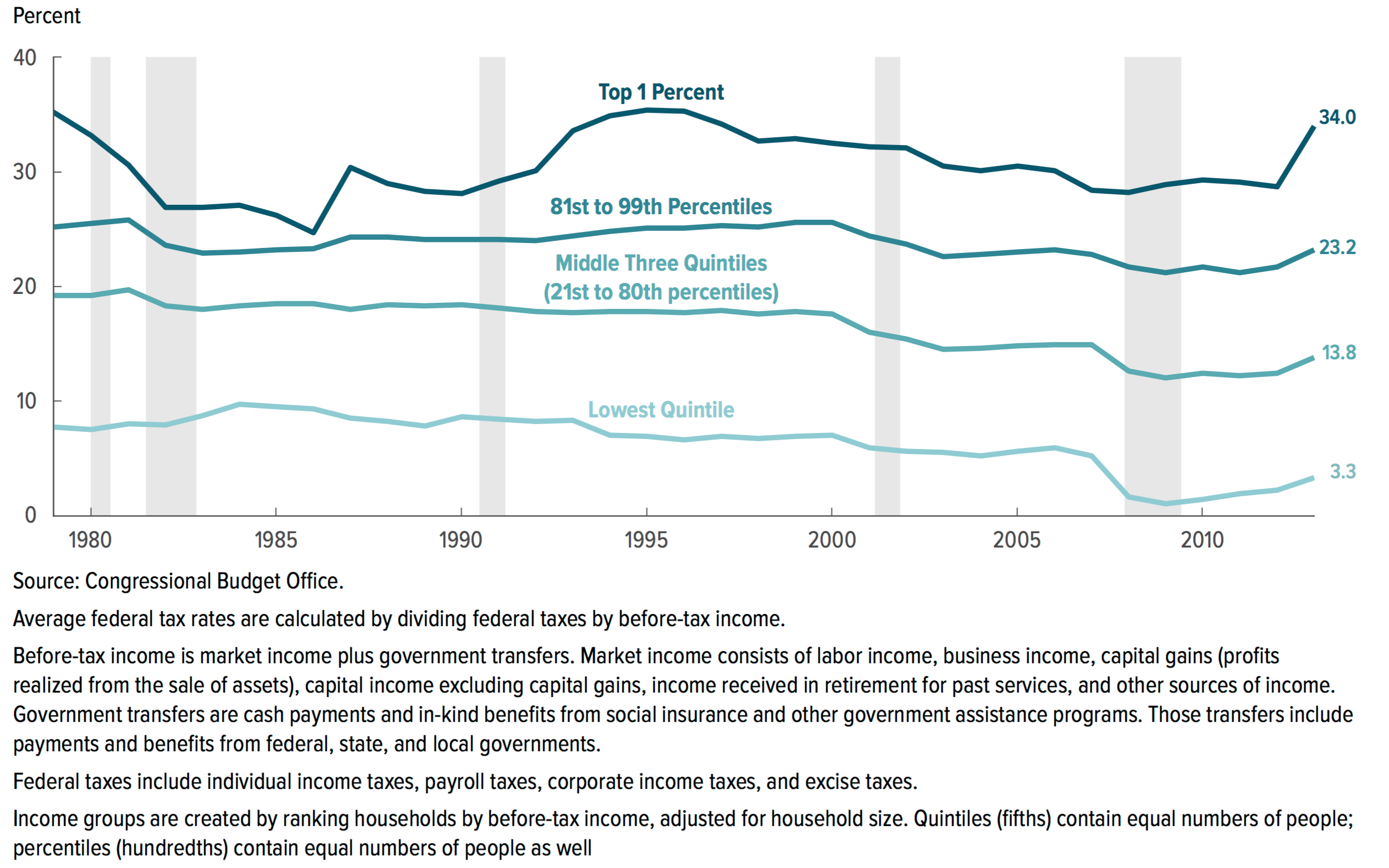

How Low Are U S Taxes Compared To Other Countries The Atlantic

How Low Are U S Taxes Compared To Other Countries The Atlantic

List Of Countries By Tax Rates Wikipedia

List Of Countries By Tax Rates Wikipedia

Estate And Inheritance Taxes Around The World Tax Foundation

Estate And Inheritance Taxes Around The World Tax Foundation