We dont currently have indianas income tax brackets for tax year 2020. Rates do increase however based on geography.

indiana county income tax rates 2013

indiana county income tax rates 2013 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in indiana county income tax rates 2013 content depends on the source site. We hope you do not use it for commercial purposes.

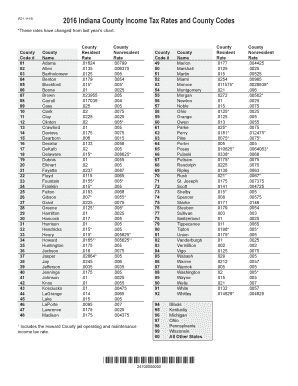

Check out the table below for indiana county tax rates.

Indiana county income tax rates 2013. Adopted county tax or out of state on january 1 2013 but works in another indiana county on new years day the employees county tax withholding should be based on the employer countys non resident tax rate which is generally a lower rate indiana county income tax withholdings are required even if indiana state tax is not withheld due. Indiana has a flat state income tax rate of 323 for the 2019 tax year which means that all indiana residents pay the same percentage of their income in state taxes. 2013 indiana county income tax rates and county code county name.

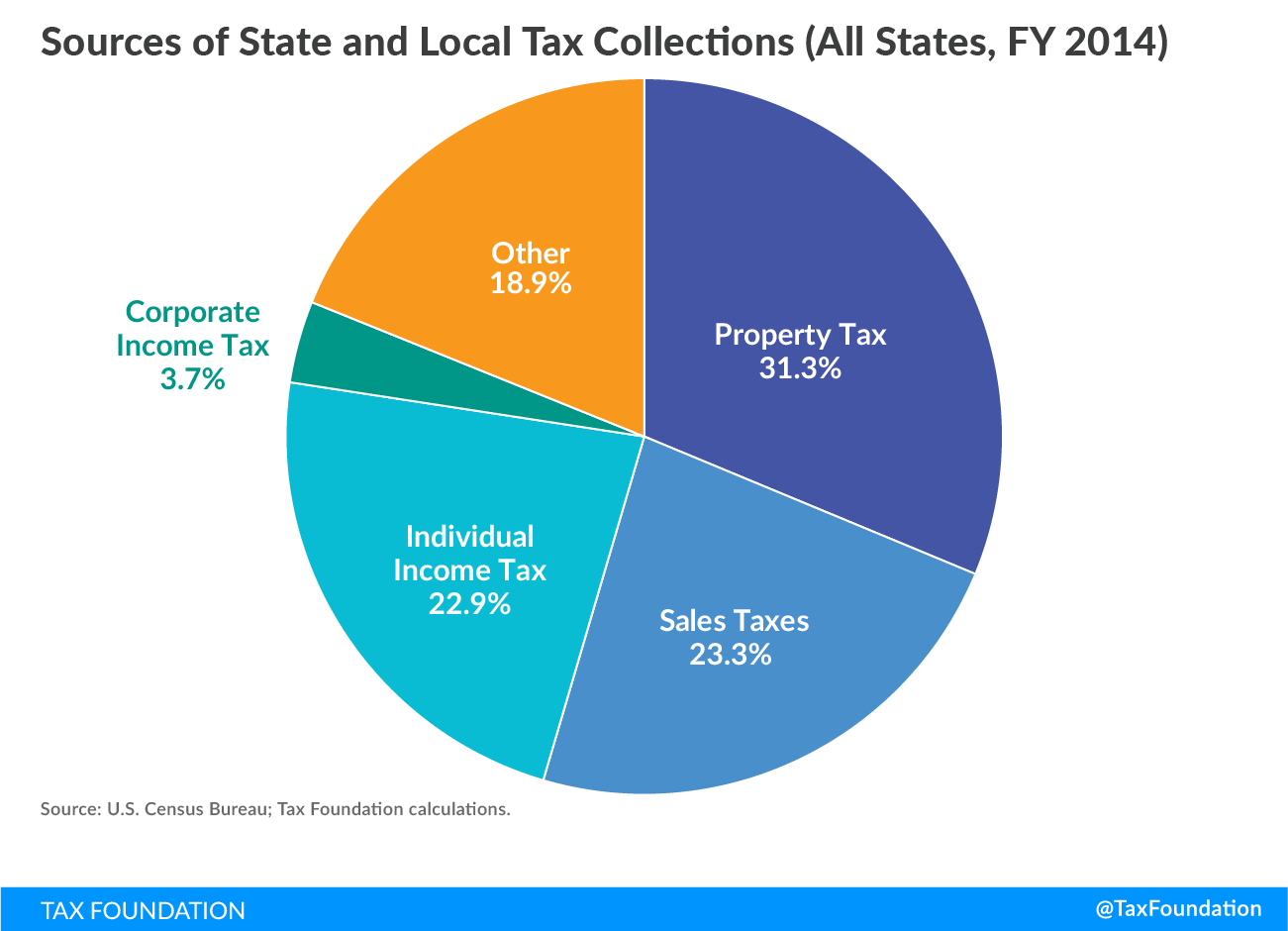

Find previous years individual income county tax rates by year from the in department of revenue. The state of indianas income comes from four primary tax areas. Indianas income tax has a single flat tax rate for all income.

To be completed by those taxpayers who were residents of a county that had adopted a county income tax. The same rates apply to residents and nonresidents. You can click on any city or county for more details including the nonresident income tax rate and tax forms.

Most state level income is from a sales tax of 7 and a flat state income tax of 33 with another cut coming in 2017 that will bring the rate down to 323. All counties in indiana impose their own local income tax rates in addition to the state rate that everyone must pay. The state also collects an additional income tax for some counties.

Indiana county as of january 1 then the withholding agent should withhold for the indiana county of principal place of work or business. County tax schedule for part year and full year indiana nonresidents names shown on form it 40pnr your social security number section 1. We have information on the local income tax rates in 91 localities in indiana.

Unlike the federal income tax system rates do not vary based on income level. Indiana counties local tax rates range from 035 to 338. Amber alert but when youre done reading it click the close button in the corner to dismiss this alert.

Divide the annual indiana tax withholding by 26 to obtain the biweekly indiana tax withholding. Until updated 2020 tax rates become available for indiana the tax brackets shown above and used in the income tax calculator will be from tax year 2018. Income tax information bulletin 88 and commissioners directive 51 for further.

1 2018 certain professional team members and race team members are subject to county tax.

Fillable Online 2016 Indiana County Income Tax Rates And County

Fillable Online 2016 Indiana County Income Tax Rates And County

.png) State And Local Sales Tax Rates In 2014 Tax Foundation

State And Local Sales Tax Rates In 2014 Tax Foundation

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Income Tax Rates In Indiana Counties How Does Monroe County

Income Tax Rates In Indiana Counties How Does Monroe County

State Local Tax Toolkit Sources Of Tax Collections Tax Foundation

State Local Tax Toolkit Sources Of Tax Collections Tax Foundation

Wireless Taxation In The United States 2014 Tax Foundation

Wireless Taxation In The United States 2014 Tax Foundation

Ohio S Tax Policy Is Based On 191 People In Oberlin Plunderbund

Featured Bond Indianapolis Local Public Improvement Bond Bank

Featured Bond Indianapolis Local Public Improvement Bond Bank

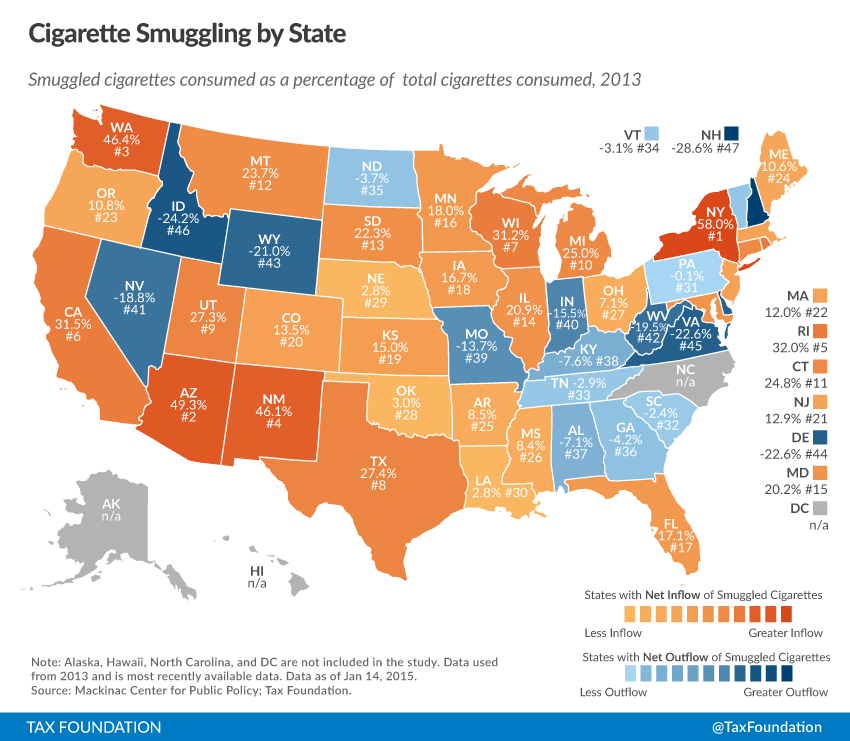

Cigarette Taxes And Cigarette Smuggling By State 2013 Tax

Cigarette Taxes And Cigarette Smuggling By State 2013 Tax