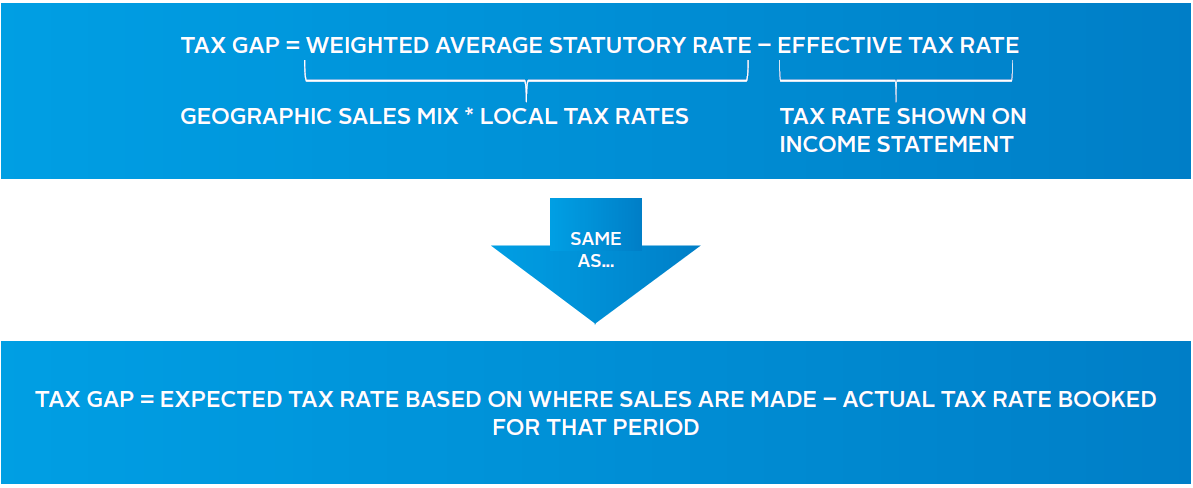

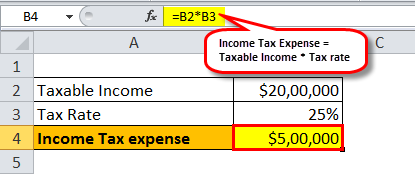

The effective tax rate is the average tax rate paid by the company on its earned income. Income tax is a type of expense which is to be paid by every person or organization on the income earned by them in each financial year as per the norms prescribed in the income tax laws and it results in the outflow of cash as the liability of income tax is paid out through bank transfers to the income tax department.

Financial Statement Preparation

Financial Statement Preparation

how to get tax rate from income statement

how to get tax rate from income statement is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to get tax rate from income statement content depends on the source site. We hope you do not use it for commercial purposes.

Income tax rates and bands the table shows the tax rates you pay in each band if you have a standard personal allowance of 12500.

How to get tax rate from income statement. We support singapores sustainable economic growth by fostering a competitive tax environment and administering government schemes. This guide has been updated to advise you of the introduction of the scottish rate of income tax from. View your annual tax summary and find out how the government.

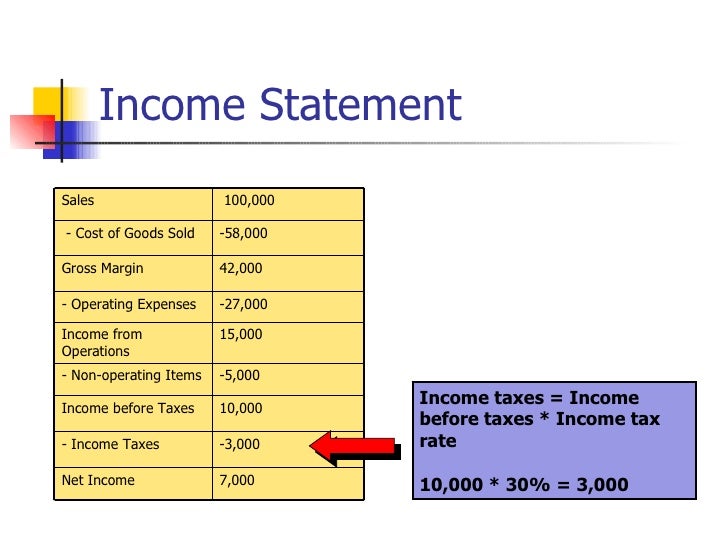

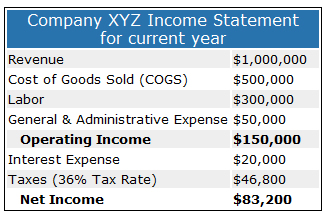

The income statement of your company may be a little more complex and contain more line items. An income statement helps managers evaluate sales keep track of various costs and evaluate the companys overall profitability during the year. An income statement is a documentation of a companys revenue expenses and profit during a specified time period.

From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22. A companys tax rate isnt specifically. Foreign individuals who are ineligible for singpass require the iras unique account to access iras digital services for personal tax matters.

Taxes on directors fee consultation fees and all other income. The inland revenue authority of singapore iras is the largest revenue agency in singapore responsible for the administration of taxes. Statement of earnings.

Iras unique account for foreign individuals who are ineligible for singpass the iras unique account has replaced the iras pin. Income tax bands are different if you live in scotland. Our role is to manage and shape the tax excise and superannuation systems that fund services for australians.

Tax season 2019 find out all you need to know about individual income tax filing and your tax filing obligations. Locate net income on the companys income statement this line may sometimes read earnings. This statement should serve to give you the basic layout and an idea of how a profitloss statement or income statement works.

The ato is the governments principal revenue collection agency. This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. The table below shows an example of a very simplified income statement.

We are a partner of the community in nation building and inclusive growth.

Income Tax Expense On Income Statement Formula Calculation

Income Tax Expense On Income Statement Formula Calculation

Nopat Net Operating Profit After Tax Definition Example

Nopat Net Operating Profit After Tax Definition Example

Solved Compute Nopat Using Tax Rates From Tax Footnote Th

Solved Compute Nopat Using Tax Rates From Tax Footnote Th

Ebiat Earnings Before Interest After Taxes Definition Example

Ebiat Earnings Before Interest After Taxes Definition Example

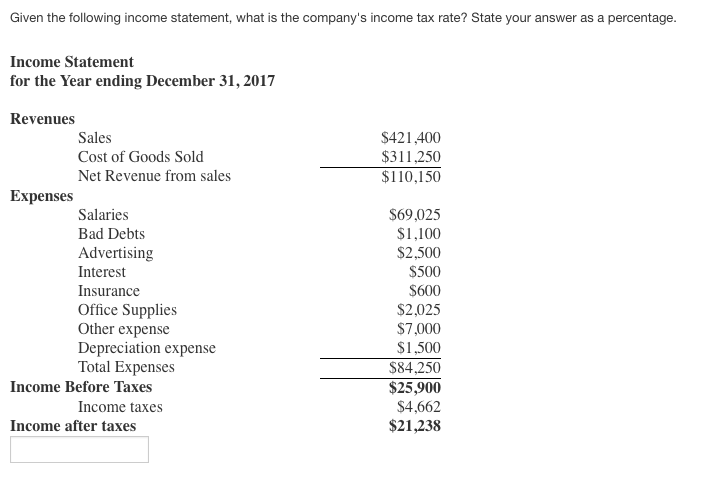

Solved Given The Following Income Statement What Is The

Solved Given The Following Income Statement What Is The

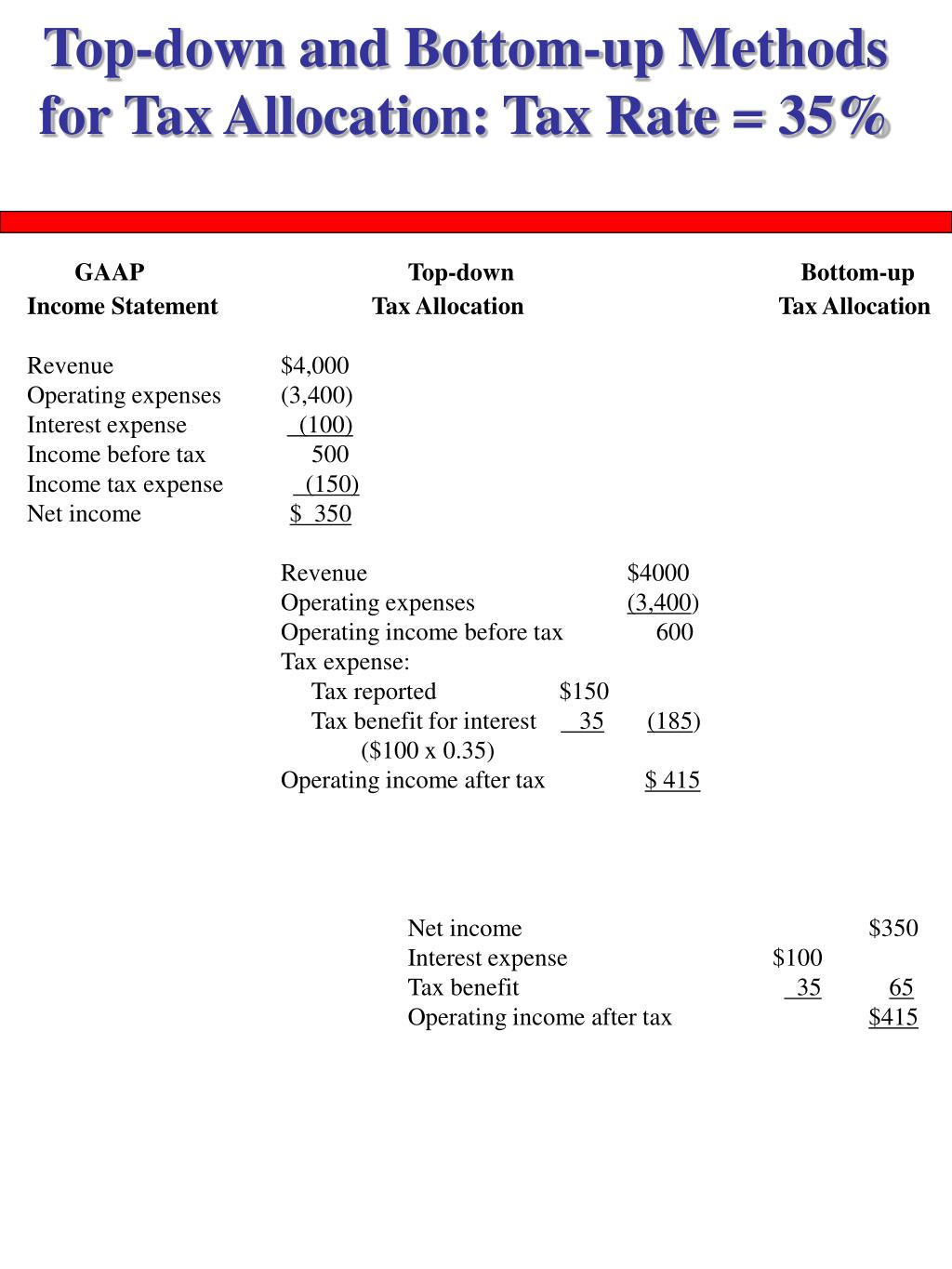

Ppt Chapter 9 Powerpoint Presentation Free Download Id 7032402

Ppt Chapter 9 Powerpoint Presentation Free Download Id 7032402

Interest Expense How To Calculate Interest With An Example

Interest Expense How To Calculate Interest With An Example

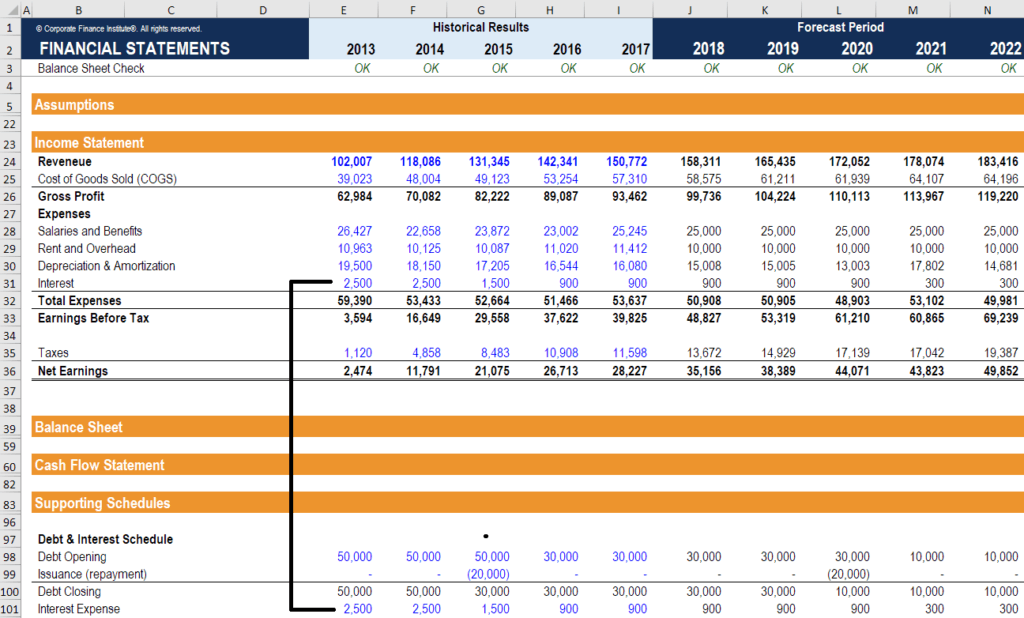

How To Find The Tax Rate Plan Projections

How To Find The Tax Rate Plan Projections