2019 rates included for use while preparing your income tax deduction. San diego county collects on average 061 of a propertys assessed fair market value as property tax.

Chart California State Sales Tax Rate And Proposition 30

Chart California State Sales Tax Rate And Proposition 30

current tax rate in san diego

current tax rate in san diego is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in current tax rate in san diego content depends on the source site. We hope you do not use it for commercial purposes.

The california sales tax rate is currently.

Current tax rate in san diego. Some cities and local governments in san diego county collect additional local sales taxes which can be as high as 25. When searching for a secured defaulted supplemental or escape bill please search either by the parcel number or the current mailing address. For a list of your current and historical rates go to the california city county sales use tax rates webpage.

The latest sales tax rate for san diego ca. Fixed charge assessments in addition to the tax calculated from your homes value your property tax bill may include fixed charge assessments. 735 the property tax rate shown here is the rate per 1000 of home value.

This page allows you to search for san diego county secured unsecured and defaulted properties. When searching for an unsecured bill for businesses boats airplanes etc. California city county sales use tax rates effective january 1 2020 these rates may be outdated.

The median property tax in san diego county california is 2955 per year for a home worth the median value of 486000. The san diego sales tax rate is. A county wide sales tax rate of 025 is applicable to localities in san diego county in addition to the 600 california sales tax.

Tax rates for san diego ca. The san diego county office of property tax services provides a tax rate by tax area search and also a list of typical tax rates for each city in the county. Center 1600 pacific hwy room 162 san diego ca 92101.

The minimum combined 2020 sales tax rate for san diego california is. Look up the current sales and use tax rate by address. Treasurer tax collector san diego county admin.

This is the total of state county and city sales tax rates. Californias statewide sales tax rate dropped one quarter of one percent. This rate includes any state county city and local sales taxes.

San diego county has one of the highest median property taxes in the united states and is ranked 168th of the 3143 counties in order of median property taxes. 930 the total of all income taxes for an area including state county and local taxesfederal income taxes are not included property tax rate. The san diego county sales tax rate is.

775 the total of all sales taxes for an area including state county and local taxesincome taxes. San diego will see a slight decrease in sales tax in 2017 according to the california state board of equalization. Please choose to search by either assessor parcel number supplemental bill number escape bill number mailing address or unsecured bill number to display a list of matching or related records.

Chart Current California Income Tax Brackets Rates And The

Chart Current California Income Tax Brackets Rates And The

San Diego Property Tax Rate San Diego Real Estate Taxes

County Of San Diego Treasurer Tax Collector

County Of San Diego Treasurer Tax Collector

California S Corporate Income Tax Rate Could Rival The Federal

California S Corporate Income Tax Rate Could Rival The Federal

State And Local Sales Tax Rates Midyear 2019 Tax Foundation

State And Local Sales Tax Rates Midyear 2019 Tax Foundation

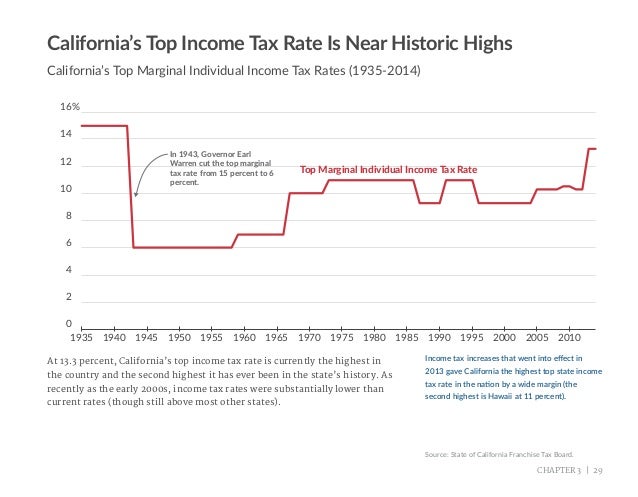

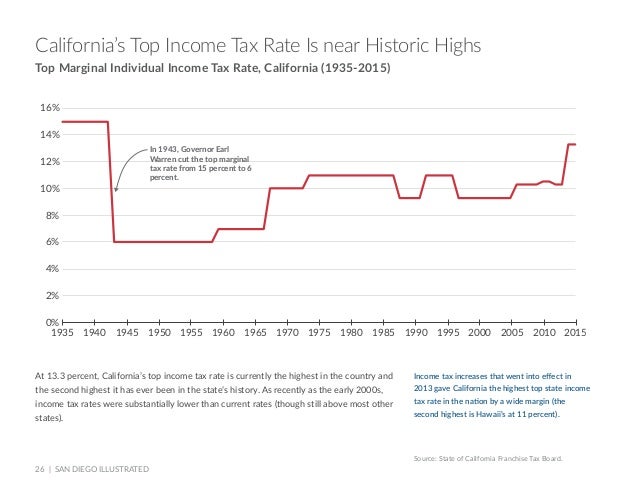

San Diego Illustrated 2015 Edition

San Diego Illustrated 2015 Edition

How High Are Cell Phone Taxes In Your State Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

California Income Tax Calculator Smartasset

California Income Tax Calculator Smartasset

Tax Equivalent Yields And The New Tax Law Breckinridge Capital

Tax Equivalent Yields And The New Tax Law Breckinridge Capital