Sales tax rates general sales tax rates general. Prepaid sales tax on all motor fuel sold in the state of georgia must be remitted by all licensed motor fuel distributors suppliers and wholesalersthe tax is due at the same time as the state excise tax.

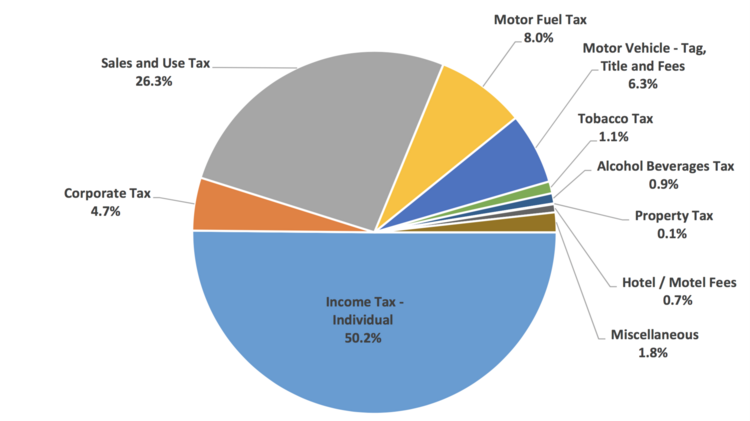

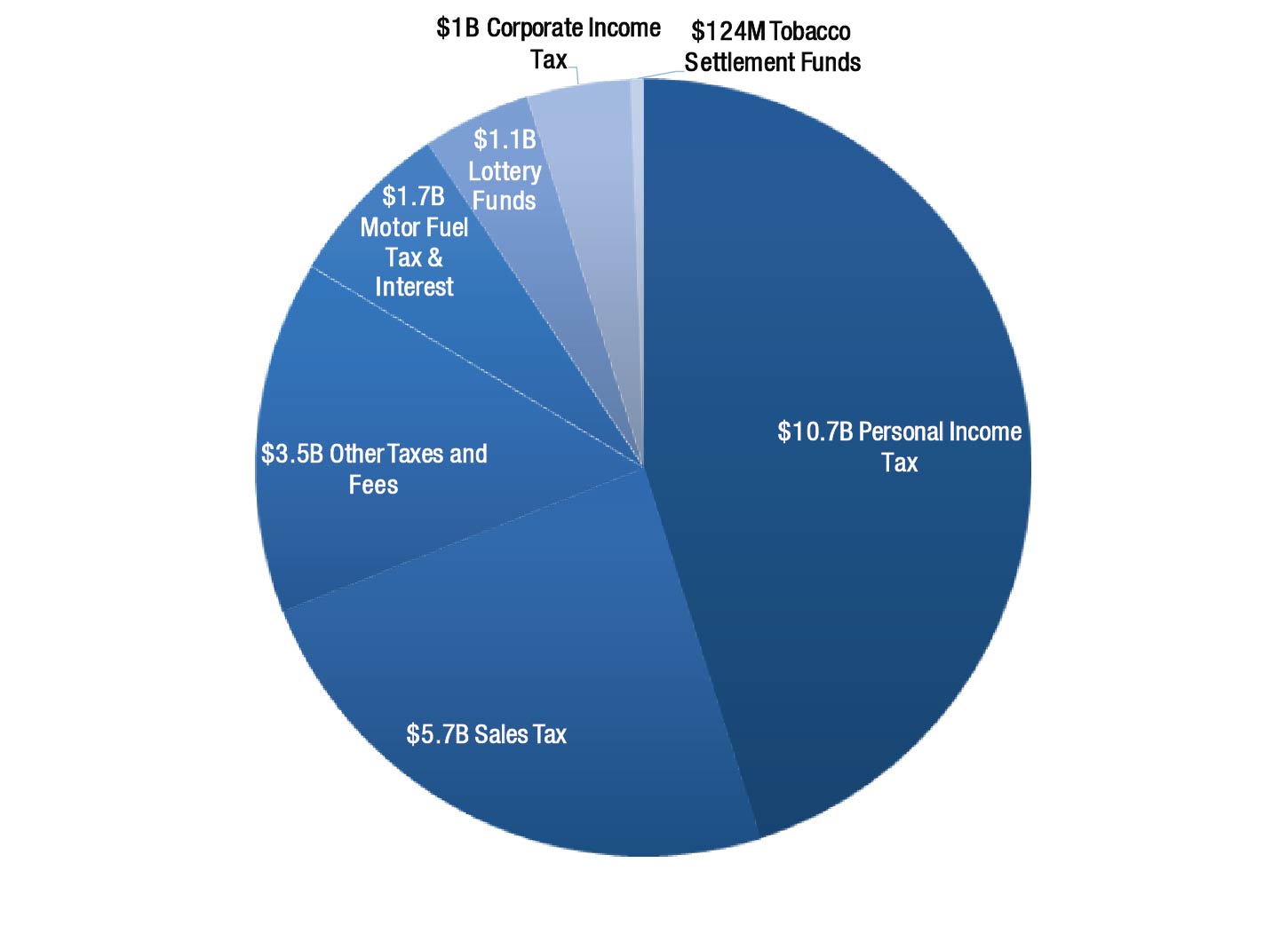

How The State Of Georgia Collected Almost 21 Billion In 2016

How The State Of Georgia Collected Almost 21 Billion In 2016

atlanta georgia sales tax rate 2016

atlanta georgia sales tax rate 2016 is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in atlanta georgia sales tax rate 2016 content depends on the source site. We hope you do not use it for commercial purposes.

2019 rates included for use while preparing your income tax deduction.

Atlanta georgia sales tax rate 2016. The atlanta sales tax rate is. The minimum combined 2020 sales tax rate for atlanta georgia is. The rate in randolph county decreases from 8 to 7.

The atlanta georgia sales tax is 400 the same as the georgia state sales taxwhile many other states allow counties and other localities to collect a local option sales tax georgia does not permit local sales taxes to be collected. The latest sales tax rates for cities in georgia ga state. How 2016 sales taxes are calculated in atlanta.

How 2019 sales taxes are calculated in atlanta. Rates include state county and city taxes. Code county rate type codecounty rate type codecounty rate type 001 appling 8 lse t 002 atkinson 7 lse.

This rate includes any state county city and local sales taxes. The latest sales tax rate for atlanta ga. There is no special rate for atlanta.

Georgia tax center help individual income taxes. 060 city of atlanta 1 o. Several tax rate changes tax effect in georgia on july 1 2016.

January 2020 rate chart 1878 kb october 2019 rate chart 1877 kb july 2019 rate chart 2167 kb april 2019 rate chart 28941 kb january 2019 rate chart 28935 kb october 2018 rate chart 28959 kb department of revenue. Georgia sales and use tax rate chart effective january 1 2016 code 000 state sales tax 4 included in county sales tax rates below. The georgia sales tax rate is currently.

The atlanta georgia general sales tax rate is 4depending on the zipcode the sales tax rate of atlanta may vary from 4 to 89 every 2019 combined rates mentioned above are the results of georgia state rate 4 the county rate 2 to 4 the atlanta tax rate 0 to 15 and in some case special rate 0 to 1. The cobb county sales tax rate is. 2019 rates included for use while preparing your income tax deduction.

This is the total of state county and city sales tax rates. The 890 sales tax rate in atlanta consists of 400 georgia state sales tax 300 fulton county sales tax 150 atlanta tax and 040 special taxthe sales tax jurisdiction name is atlanta fulton co which may refer to a local government divisionyou can print a 890 sales tax table herefor tax rates in other cities see georgia sales taxes by city and county. The atlanta georgia general sales tax rate is 4depending on the zipcode the sales tax rate of atlanta may vary from 4 to 8 every 2016 combined rates mentioned above are the results of georgia state rate 4 the county rate 2 to 3 the atlanta tax rate 0 to 1.

Georgia Sales Tax Rate Vat 2014 2019 Data 2020 2022 Forecast

Georgia Sales Tax Rate Vat 2014 2019 Data 2020 2022 Forecast

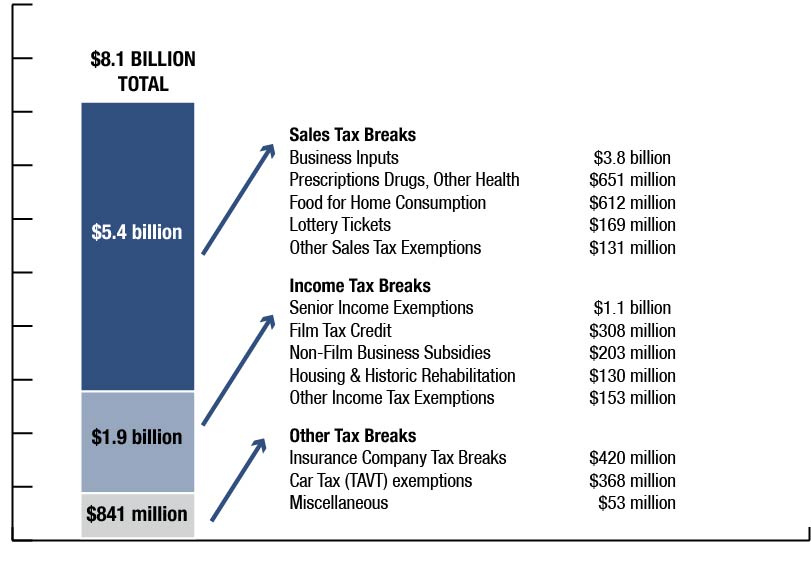

Georgia State Budget Overview For Fiscal Year 2017 Georgia

Georgia State Budget Overview For Fiscal Year 2017 Georgia

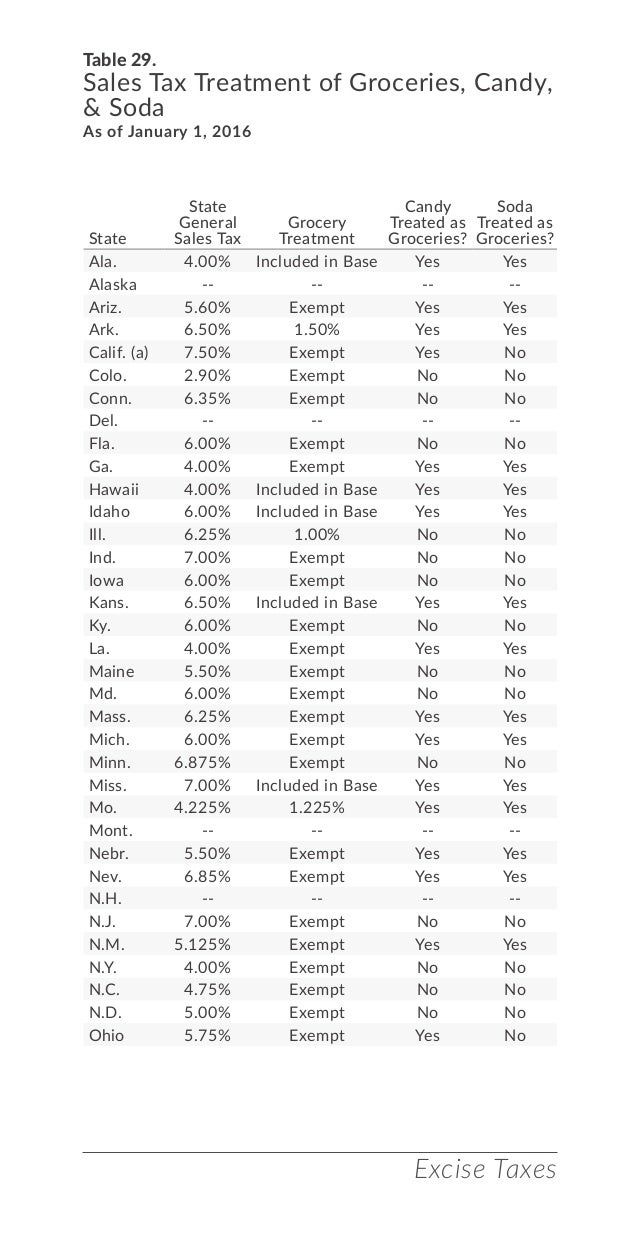

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Georgia State Budget Overview For Fiscal Year 2017 Georgia

Georgia State Budget Overview For Fiscal Year 2017 Georgia

Barrow County Georgia Tax Rates

Https Dor Georgia Gov Document Report 2016 Statistical Report Download

Https Dor Georgia Gov Document Report 2016 Statistical Report Download

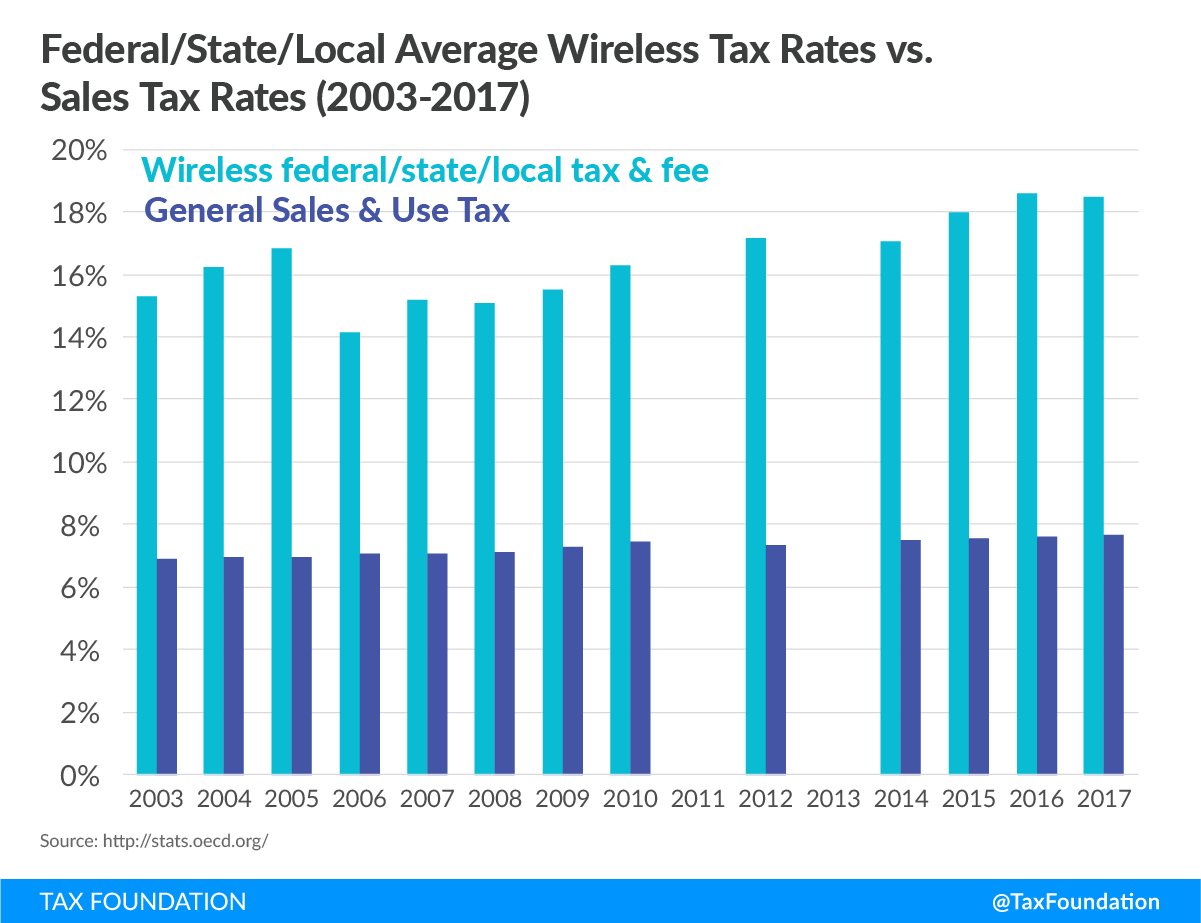

Cell Phone Taxes And Fees In 2017 Tax Foundation

Cell Phone Taxes And Fees In 2017 Tax Foundation

How High Are Capital Gains Taxes In Georgia Atlanta Business