Failure to file penalty. Dishonored check or other form of payment.

Irs Interest Rates 2019 How Irs Interest Rates Work

Irs Interest Rates 2019 How Irs Interest Rates Work

irs interest and penalty rates 2019

irs interest and penalty rates 2019 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in irs interest and penalty rates 2019 content depends on the source site. We hope you do not use it for commercial purposes.

If you owe the irs taxes and dont file your return on time you may owe a failure to file penalty in addition to any current irs interest rates.

/GettyImages-57173091-66f9b5d085fc4aa780d30dc7d2261489.jpg)

Irs interest and penalty rates 2019. The rates will be. Three and one half 35 percent for the portion of a corporate overpayment exceeding 10000. The irs has announced in revenue ruling 2018 18 that interest rates will remain the same for the.

Interest rates are staying put at least when it comes to the internal revenue service irs. Washington the internal revenue service today announced that interest rates will increase for the calendar quarter beginning january 1 2019. The rates will be.

See irs news release ir 2019 55 or irs news release ir 2019 24 farmers and fishermen to determine if you meet the criteria for a waiver of this penalty for your 2018 taxes. The internal revenue service announced that interest rates on underpayments will remain the same at 5 for the calendar quarter beginning january 1 2020. While the penalty starts accruing the day after the tax.

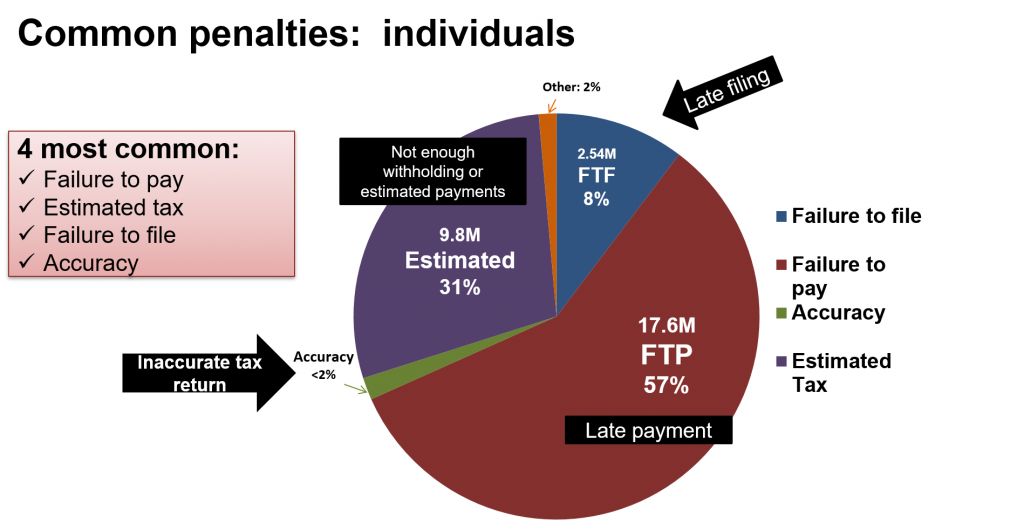

Irs penalty interest rates. 5 for overpayments 4 in the case of a corporation. The penalty for filing late is typically larger than the penalty for not paying and amounts to 5 of the taxes that are late for each month the tax return is late.

Period overpayments underpayments 2019 october 1 2019 december 31 2019 5 5 july 1 2019 september 30 2019 5 5. 25 for the portion of a corporate overpayment exceeding 10000. 1991 to present.

For payments of 1250 or more the penalty is 2 of the amount of the payment. Six 6 percent for overpayments five 5 percent in the case of a corporation. Internal revenue code 6657.

Irs interest rates.

Irs Penalty Rates Common Penalties And What It Will Cost You For

Irs Penalty Rates Common Penalties And What It Will Cost You For

What Is Failure To Deposit Penalty Interest Internal Revenue

What Is Failure To Deposit Penalty Interest Internal Revenue

Calculate Irs Tax Late Filing Or Payment Penalties On Efile Com

Calculate Irs Tax Late Filing Or Payment Penalties On Efile Com

This Is Why Filing Your Income Tax Return Will Never Be The Same

This Is Why Filing Your Income Tax Return Will Never Be The Same

2019 Standard Mileage Rates Announced Internal Revenue Code

2019 Standard Mileage Rates Announced Internal Revenue Code

Check Out The New W 4 Tax Withholding Form Really The New York

Check Out The New W 4 Tax Withholding Form Really The New York

One In 5 Taxpayers Risk A Penalty From The Irs For Withholding Too

One In 5 Taxpayers Risk A Penalty From The Irs For Withholding Too

Irs Waives Penalty For Some Who Underpaid Their Taxes In 2018

Irs Waives Penalty For Some Who Underpaid Their Taxes In 2018

Irs Is Warning Thousands Of Cryptocurrency Holders To Pay Their Taxes

Irs Is Warning Thousands Of Cryptocurrency Holders To Pay Their Taxes

Penalty Chart Of Income Tax Barta Innovations2019 Org

Penalty Chart Of Income Tax Barta Innovations2019 Org

Is Irs Manger Approval Required For Computer Generated Penalties

Is Irs Manger Approval Required For Computer Generated Penalties