Income tax rates for fy financial year 2012 13 ay assessment year 2013 14for individualsmen women senior citizens hufs and other categories surcharge and education cess. Ay 2012 13 fy 2011 12 personal.

Income Tax Slab For Fy 2013 14 Income Tax Personal Finance Public

Income Tax Slab For Fy 2013 14 Income Tax Personal Finance Public

income tax slab rate for fy 2012 13 india

income tax slab rate for fy 2012 13 india is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in income tax slab rate for fy 2012 13 india content depends on the source site. We hope you do not use it for commercial purposes.

Assessment year 2019 20 and financial year 19 20 ie.

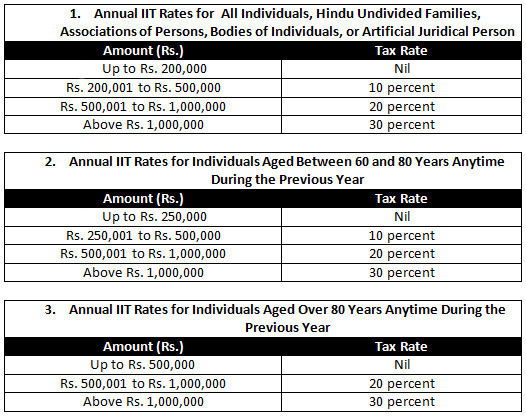

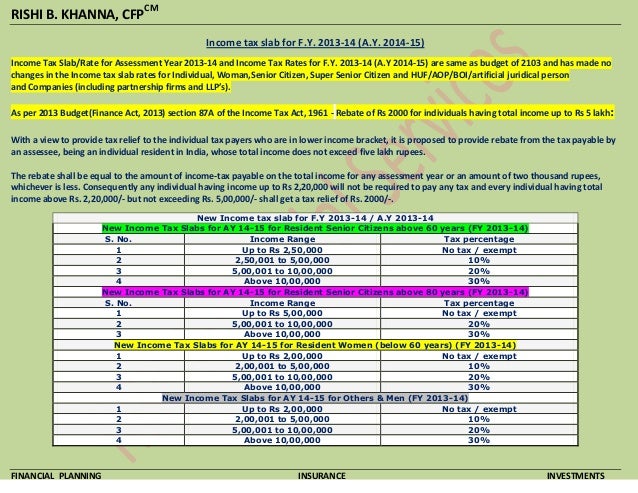

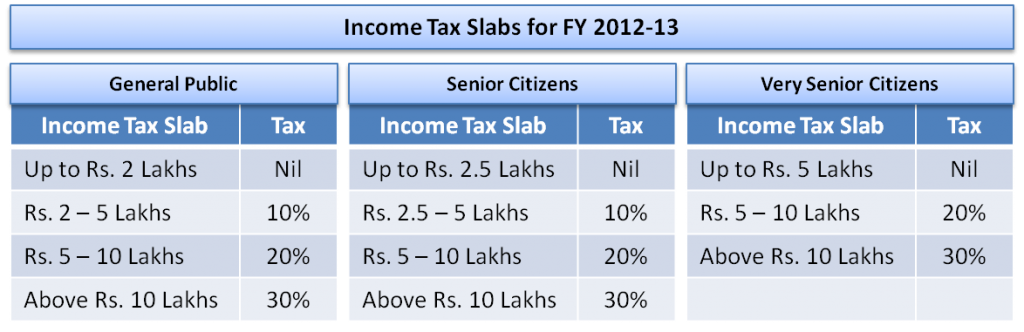

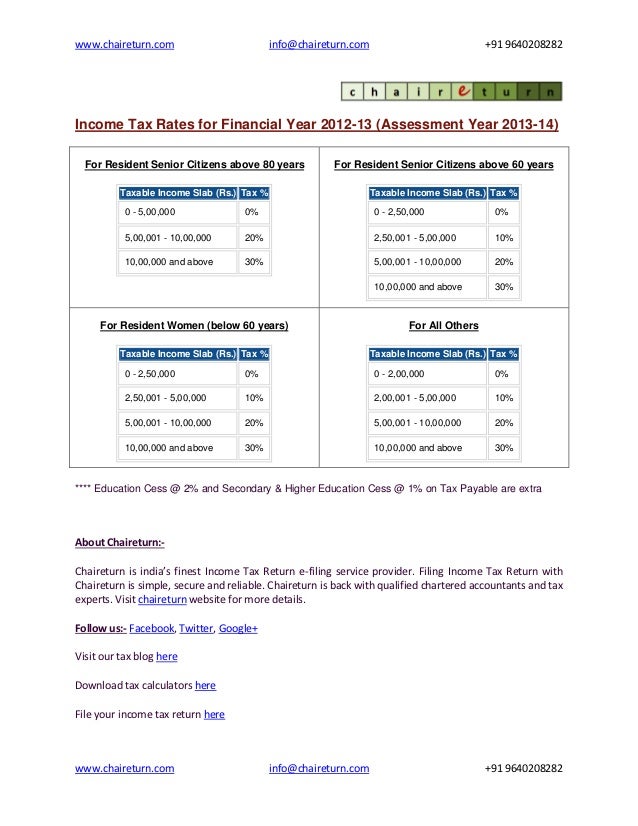

Income tax slab rate for fy 2012 13 india. Education cess at 4 shall be levied on the tax computed using the income tax rates given below while filing the income tax return. The new and revised income tax slabs and rates applicable for the financial year fy 2011 12 and assessment year ay 2012 13 are mentioned below. There will be no surcharge on income tax payments by individual taxpayers during fy 2012 13 ay 2013 14.

The following it rates were applicable for the financial year ending march 31 2013 financial year 2012 13 assessment year 2013 14. The rates are for the previous year 2012 13. And after being reduced by the amount of tax rebate shall be increased by a surcharge at the rate of 5 of such income tax provided that the total.

10 of the amount exceeding. What is income tax slab rates in india. The following income tax slabs are applicable for the financial year 2018 19 ie.

Assessment year 2012 13 relevant to financial year 2011 12. In case of individual being a woman resident in india and below the age of 60 years at any. Income tax rates income tax slabs for ay 2012 13 individuals and hufs.

Association of persons aop and body of individuals boi in india is as under. This article might help you find out the same. Indian income tax system follows income tax slabs for levying the tax on the income of an individual or non individual.

Latest income tax slabs in india fy 2016 17 or as 2017 18. For individuals huf. The amount of income tax shall be increased by education cess on income tax at the rate of two per cent of the income tax.

For individuals below 60 years age other than woman assessees. 231 education cess on income tax. Various slabs are accounted for.

Looking for the income tax slabs and rates for the financial year 2012 13 or assessment year 2013 14. These rates are subject to enactment of the finance bill 2012. New income tax slab for ay 12 13 new income tax slabs for ay 12 13 for resident senior citizens above 60 years fy 2011 12.

In case of individual. 22 surcharge on income tax. 11 for individuals hindu undivided families association of persons and body of individuals.

Click here to save tax with hdfc lifes various online insurance products. Income tax slab rates. Hdfc life provides the latest income tax slab rates and deductions in india for tax payers in different age groups and tax benefits offered by its online insurance products for the financial year 2013 14.

India S New Tax Structure For The Year 2012 13 India Briefing News

India S New Tax Structure For The Year 2012 13 India Briefing News

Income Tax Calculation Ay 2013 14 Skatax

Income Tax Calculation Ay 2013 14 Skatax

Income Tax Slab For Fy 2013 14

Income Tax Slab For Fy 2013 14

Budget Snapshot 2012 13 Points To Be Noted Succinct Fp

Income Tax Slab Rate Archives Lic Help Line

Income Tax Slabs History In India

Income Tax Slabs History In India

Income Tax Slab For Ay 12 13 H20ho Papers

Income Tax Slab For Ay 12 13 H20ho Papers

Income Tax Slab F Y 2012 13 Amazing Maharashtra

Income Tax Slab F Y 2012 13 Amazing Maharashtra

Income Tax Rates For Financial Year 2012 Assessement Year 2013 14

Income Tax Rates For Financial Year 2012 Assessement Year 2013 14