If money is cheaper now due to low interest rates there is more of it chasing supply. Its hard to find any bad news in this situation.

do cap rates rise with interest rates

do cap rates rise with interest rates is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in do cap rates rise with interest rates content depends on the source site. We hope you do not use it for commercial purposes.

As interest rates rise where do valuations and.

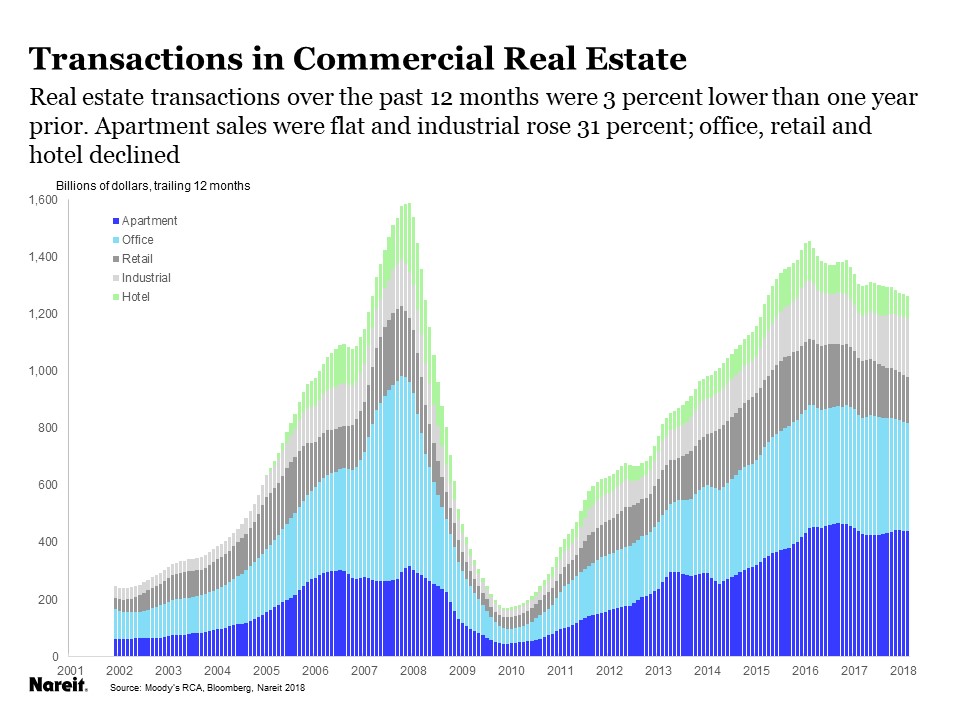

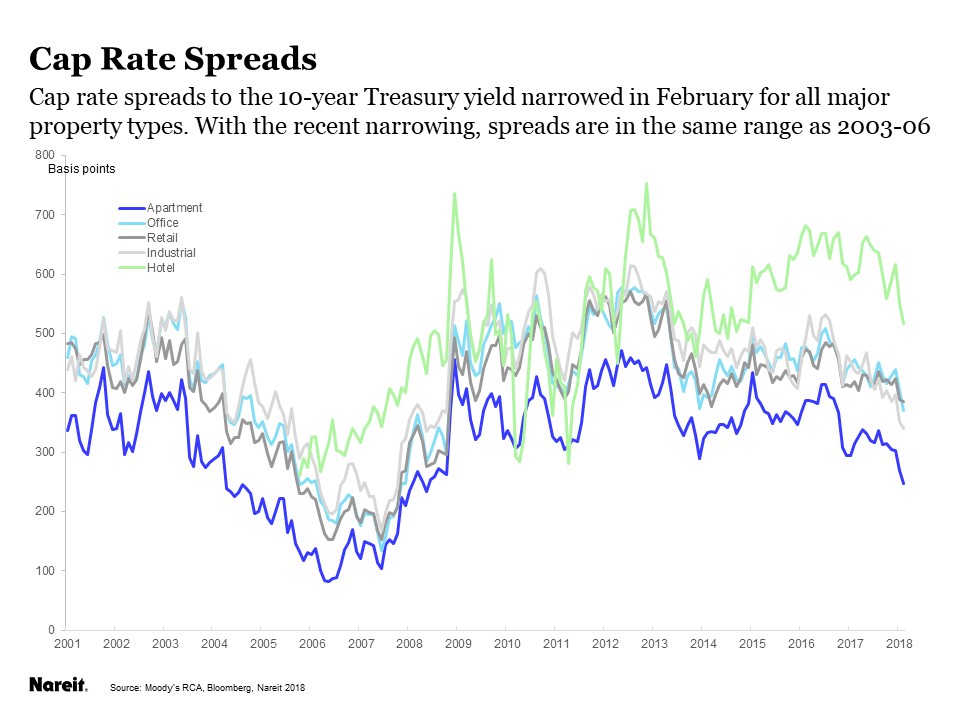

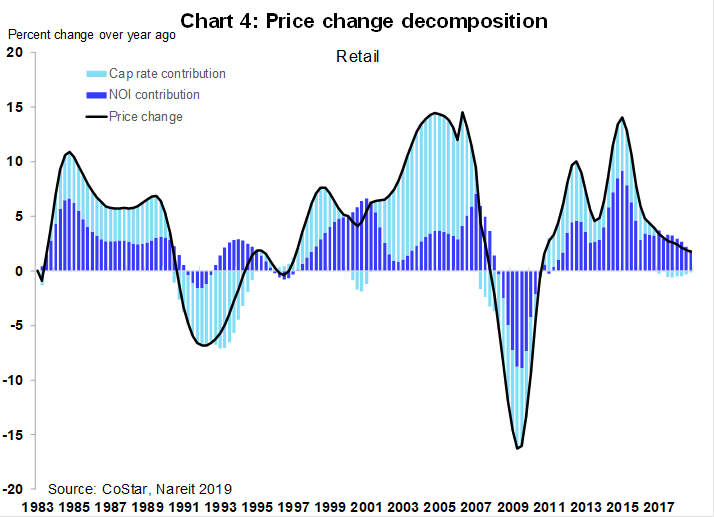

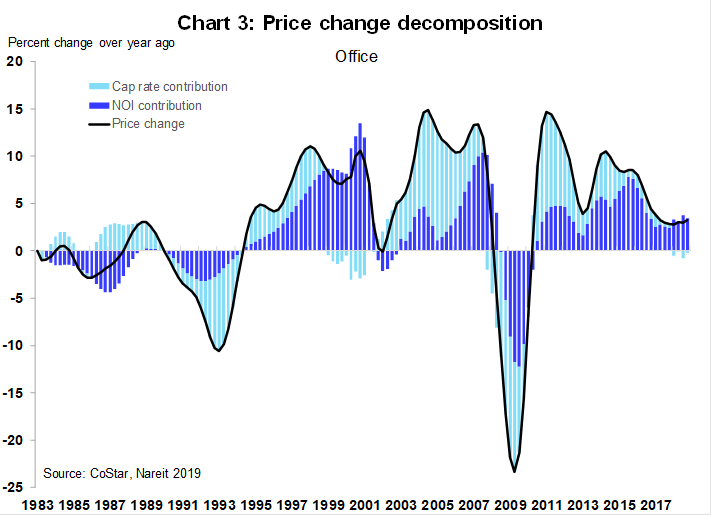

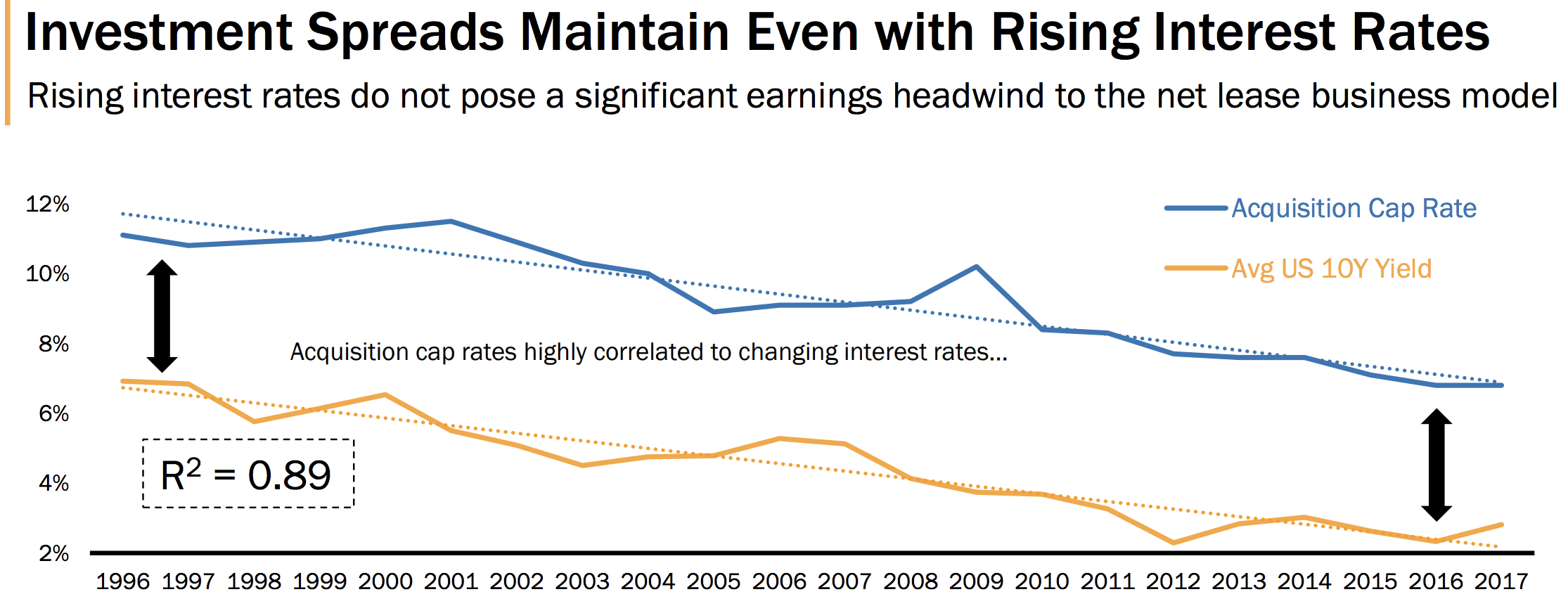

Do cap rates rise with interest rates. Only recently in fact have spreads to treasuries moved back into the range where they were in the mid. The continued downtrend of cap rates should not be that surprising however as the spread between cap rates and treasury yields has been much wider than normal giving the real estate market a healthy cushion against rising interest rates. Interest rates have a profound impact on the value of income producing real estate property.

The one to one relationship between interest rates and capitalization rates that i estimate is a bit higher than the estimates of others who use a different logic and empirical approach. I would think theoretically that as interest rates rise cap rates would follow. Competition for good rental properties increases and rents can be raised.

Cap rates commercial real estate and multi family investors use capitalization rates to value. What will happen to cap rates when interest rates increase. The one possible connection.

Find out how the rise and fall of interest rates affect property value. No longer can the market rely on the unusually large premium between treasury rates and cap rates to buffer the impact of higher interest. When interest rates rise fewer people buy and more people rent.

Understanding the relationship between interest rates and the stock market can help investors understand how changes may affect their investments and how to make better financial decisions. This increases cash flow and noi net operating income. I do think over time we will continue to see a rise in 10 year rates although i certainly dont think the magnitude of the rise is going to mirror the increase in fed fund rates says.

Other markets will see increases somewhere in between. Meanwhile cap rates in boston and los angeles are expected to remain relatively flat even falling a few basis points over the same period. Logically if interest rates rise then borrowing to purchase a property will become more expensive.

Which leads to investors accepting less return thus compressing cap rates. Cbre about real estate june 24 2013.

What S Ahead For Cap Rates And Interest Rates Nareit

What S Ahead For Cap Rates And Interest Rates Nareit

U S Marketflash Rising Interest Rates No Immediate Threat To

U S Marketflash Rising Interest Rates No Immediate Threat To

What S Ahead For Cap Rates And Interest Rates Nareit

What S Ahead For Cap Rates And Interest Rates Nareit

U S Marketflash Rising Interest Rates No Immediate Threat To

U S Marketflash Rising Interest Rates No Immediate Threat To

Singapore Reits Time For Some Caution Exploring The World

3q13 The Fed Interest Rates Cap Rates

How Higher Interest Rates Impact Reits Intelligent Income By

How Higher Interest Rates Impact Reits Intelligent Income By

U S Marketflash Rising Interest Rates No Immediate Threat To

U S Marketflash Rising Interest Rates No Immediate Threat To

Rising Interest Rates Threaten Further Cap Rate Compression Real

Rising Interest Rates Threaten Further Cap Rate Compression Real

Capital Markets Outlook Ccim Institute

Capital Markets Outlook Ccim Institute