The goal is for businesses to pay premiums based on their workers risk of injury. Insurance companies give a variety of term insurance premium payment options to their customers to pay their premium on time.

Insurance Premium Calculation Youtube

Insurance Premium Calculation Youtube

how to calculate premium rate insurance

how to calculate premium rate insurance is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to calculate premium rate insurance content depends on the source site. We hope you do not use it for commercial purposes.

1 net premium and 2 gross premium.

How to calculate premium rate insurance. A pure premium rate is an estimate of the amount an insurance company needs to collect to offset any potential claim on your policy. Formula to calculate your car insurance basic premium for west malaysia the basic premium for a new car of each category comprehensive rate for first rm1000 sum insured from the table above rm26 for each rm1000 or part thereof on value exceeding the first rm1000. How insurance premiums are set rate making aka insurance pricing also spelled ratemaking is the determination of what rates or premiums to charge for insurance.

The insurance buyers can determine the premium rate of the policy with the help of term insurance calculator. Rate on line is the ratio of premium paid to loss recoverable in a reinsurance contract. Insurance premiums usually have a base calculation and then based on your personal information location and other company determined information will have discounts that are added to the base premium in order to get preferred rates or more competitive or cheaper insurance premiums based on information which we outline in greater detail in the 4 factors that determine premium listed below.

To estimate this take your potential loss and divide by the insurances exposure unit. I single premium and ii level premium. Estimate your pure premium.

How to calculate insurance premium. The two premiums are further sub divided into two parts. The term insurance premium payment options can be annual half yearly quarterly and monthly.

An insurance premium is the amount of money you pay for an insurance policy. You pay insurance premiums for policies that cover your health car home life and others. Rate on line represents how much an insurer has to pay to obtain reinsurance coverage with a higher rol.

Essentially the more extensive the coverage the higher your car insurance premium rates will be. By comparing premium rates of different insurance companies one can easily find out the most beneficial insurance. Employers in hazardous industries such as logging generally pay higher insurance rates than employers engaged in retail store operations.

A rate is the price per unit of insurance for each exposure unit which is a unit of liability or property with similar characteristics. The premium is of two types. To calculate car insurance premium rates every insurance company uses its own method.

Heres how li calculates the premium rate for each of the businesss risk classifications.

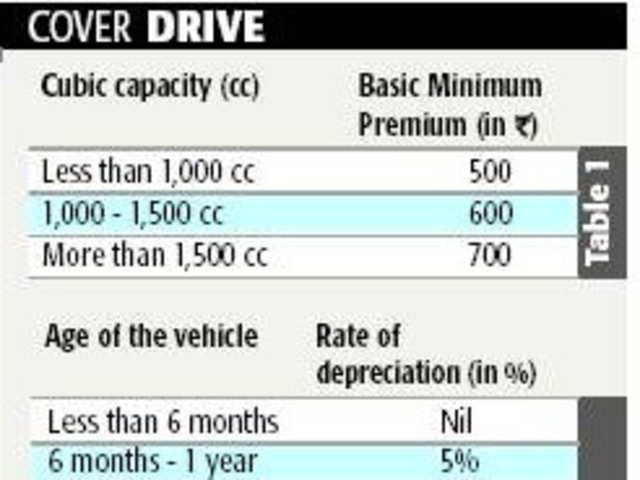

How Do Companies Calculate Car Insurance Premium The Economic Times

How Do Companies Calculate Car Insurance Premium The Economic Times

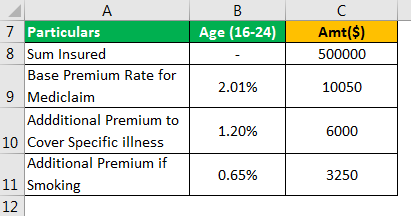

Insurance Expense Formula Examples Calculate Insurance Expenese

Insurance Expense Formula Examples Calculate Insurance Expenese

How Do Companies Calculate Car Insurance Premium The Economic Times

How Do Companies Calculate Car Insurance Premium The Economic Times

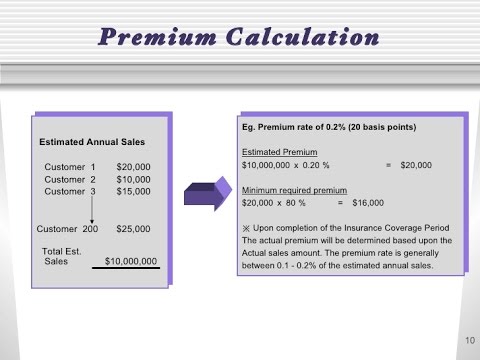

Life Fire And Auto Insurance Ppt Download

Life Fire And Auto Insurance Ppt Download

Items Considered When Calculating Premium Rates Download

Items Considered When Calculating Premium Rates Download

Solved Use The Table Below To Calculate The Minimum Premi

Solved Use The Table Below To Calculate The Minimum Premi

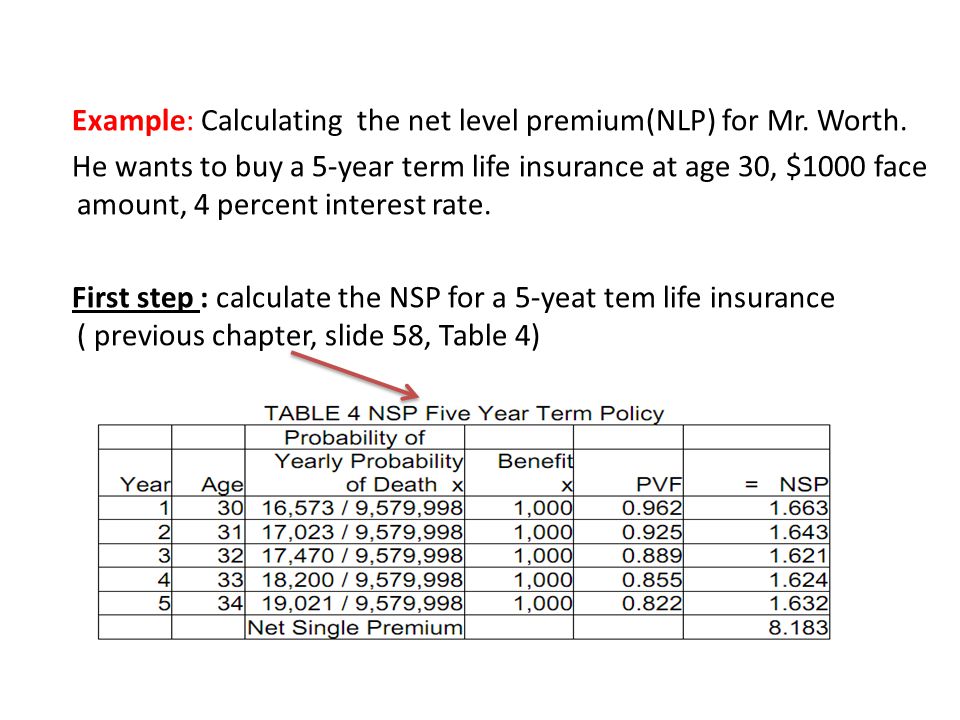

Chapter 27 Levelling The Net Single Premium Ppt Video Online

Chapter 27 Levelling The Net Single Premium Ppt Video Online

Calculating The Equity Risk Premium

How Health Rebates Affect Workers Comp Insurance Thought Leadership

The Association S Insurance Premiums Introduction To Hia Ibm