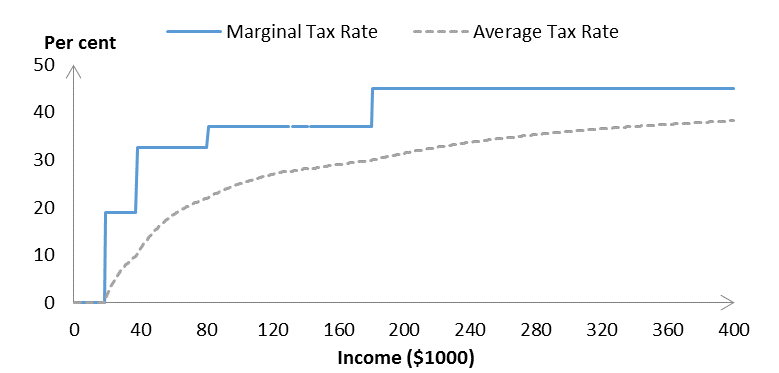

A marginal tax rate is the rate at which tax is incurred on an additional dollar of income. The page makes sense.

Individual Income Tax Rates Australia And Uk Compared 2015 16

Individual Income Tax Rates Australia And Uk Compared 2015 16

how to calculate marginal tax rate australia

how to calculate marginal tax rate australia is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to calculate marginal tax rate australia content depends on the source site. We hope you do not use it for commercial purposes.

Individual income tax rates.

How to calculate marginal tax rate australia. This calculator helps you estimate your average tax rate for 2019 your 2019 tax bracket and your marginal tax rate for the 2019 tax year. Our role is to manage and shape the tax excise and superannuation systems that fund services for australians. Your average tax rate is and your marginal tax rate is this marginal tax rate means that your immediate additional income will be taxed at this rate.

In the united states the federal marginal tax rate for an individual will increase as income rises. A simple tax calculator is available to help you calculate the tax on your taxable income. A marginal tax rate is a rate incurred on each additional dollar of income.

It had the information i was looking for. The highest marginal tax rate in australia is currently 45. The information is balanced and unbiased.

The ato is the governments principal revenue collection agency. So for contractors earning 50000 have entered the higher rate tax band and their marginal rate of income tax is 40 because the contractor will be paying 40 on the next pound earned. The highest rate of tax a taxpayer will pay on their income.

Tax and corporate australia. The income tax estimator gives you an estimate of the amount of your tax refund or debt and takes into account. Do you find this page useful.

Marginal tax rate calculator 2019. For the 2016 17 financial year the marginal tax rate for incomes over 180000 includes the temporary budget repair levy of 2. Find out your marginal tax rate.

In most cases your employer will deduct the income tax from your wages and pay it to the ato. If you earned between 87001 and 180000 then your marginal tax rate would be 37. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

The percentage rate of tax you pay is known as the marginal tax rate. Using the table provided by the ato if you earned between 18201 and 37000 your marginal tax rate would be 19. The definition of the marginal rate of tax paid is the percentage of tax paid on earnings for the next pound earned.

If you make 50000 a year living in australia you will be taxed 000that means that your net pay will be 000 per year or 4167 per month. These calculations do not take into account any tax rebates or tax offsets you may be entitled to. Marginal tax rates are higher for higher income individuals as this method of taxation looks to tax individuals based.

Brief Progressive And Regressive Taxes Austaxpolicy The Tax

Brief Progressive And Regressive Taxes Austaxpolicy The Tax

Solved Calculate Income Tax Liability Jack Married To Mar

Solved Calculate Income Tax Liability Jack Married To Mar

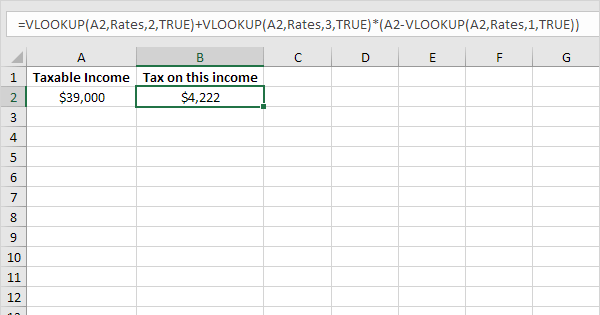

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Your First Look At 2020 Tax Rates Projected Brackets Standard

Your First Look At 2020 Tax Rates Projected Brackets Standard

Budget 2018 Income Tax Brackets And How The Government S Plan

Budget 2018 Income Tax Brackets And How The Government S Plan

Tax Rates In Excel Easy Excel Tutorial

Tax Rates In Excel Easy Excel Tutorial

Wacc Weighted Average Cost Of Capital Wacc Formula And Real

Wacc Weighted Average Cost Of Capital Wacc Formula And Real

Australian Federal Budget Analysis 2019 2020 Gilbert Tobin Lawyers

Australian Federal Budget Analysis 2019 2020 Gilbert Tobin Lawyers

Individual Income Tax Rates Australia And Uk Compared 2015 16

Individual Income Tax Rates Australia And Uk Compared 2015 16

Effective Marginal Tax Rates Part 1 Austaxpolicy The Tax And

Effective Marginal Tax Rates Part 1 Austaxpolicy The Tax And