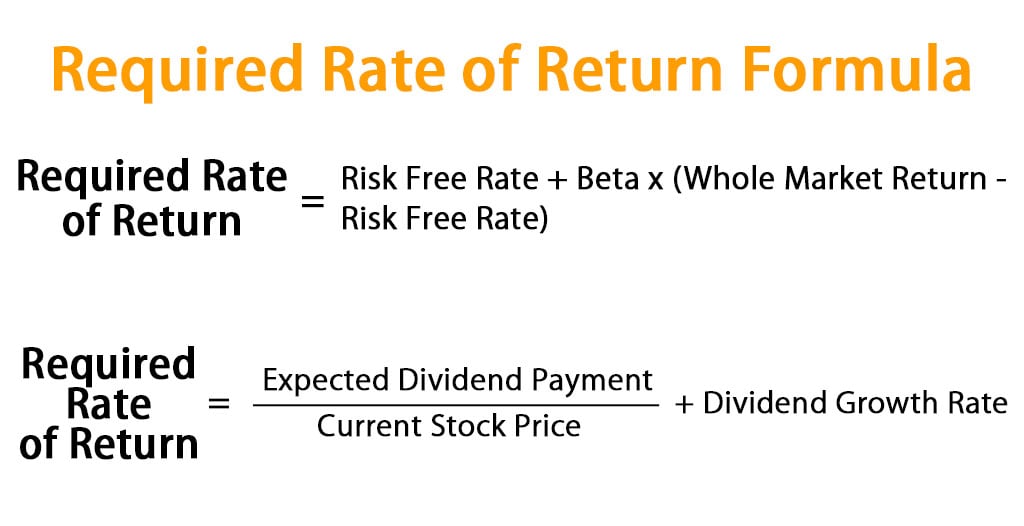

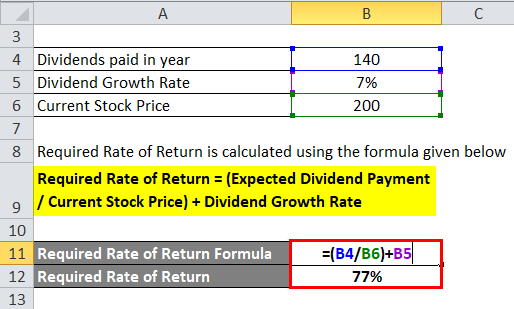

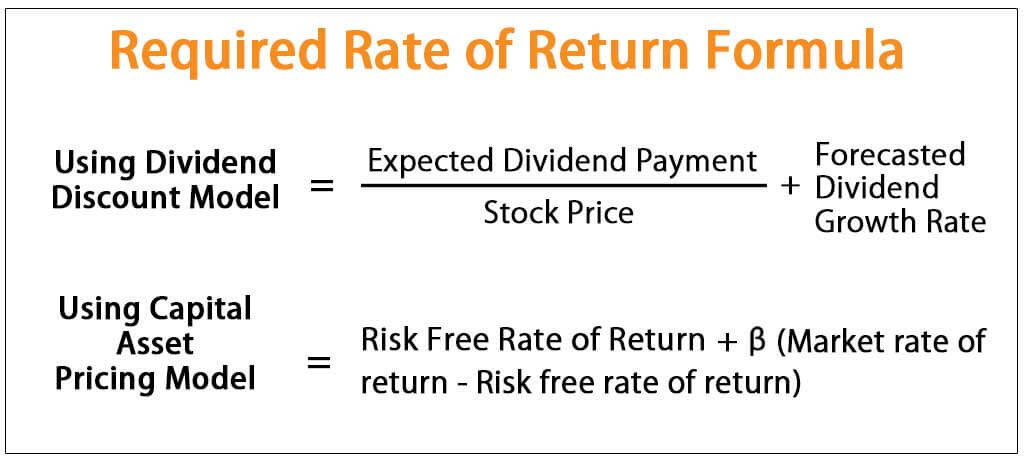

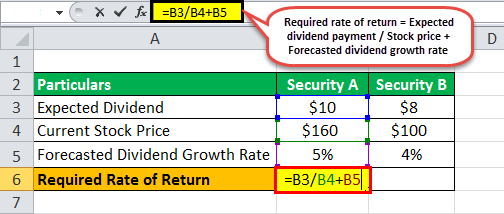

Required rate of return expected dividend payment current stock price dividend growth rate. Code to add this calci to your website just copy and paste the below code to your webpage where you want to display this calculator.

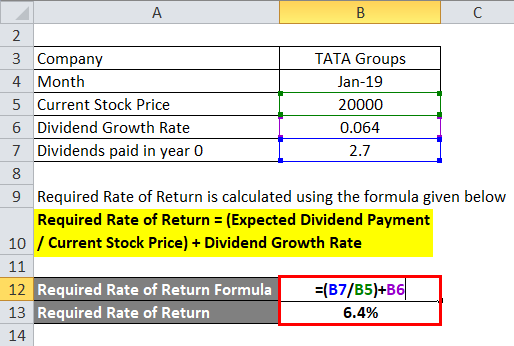

Required Rate Of Return Formula Calculator Excel Template

Required Rate Of Return Formula Calculator Excel Template

calculate stock price from dividend and required rate of return

calculate stock price from dividend and required rate of return is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in calculate stock price from dividend and required rate of return content depends on the source site. We hope you do not use it for commercial purposes.

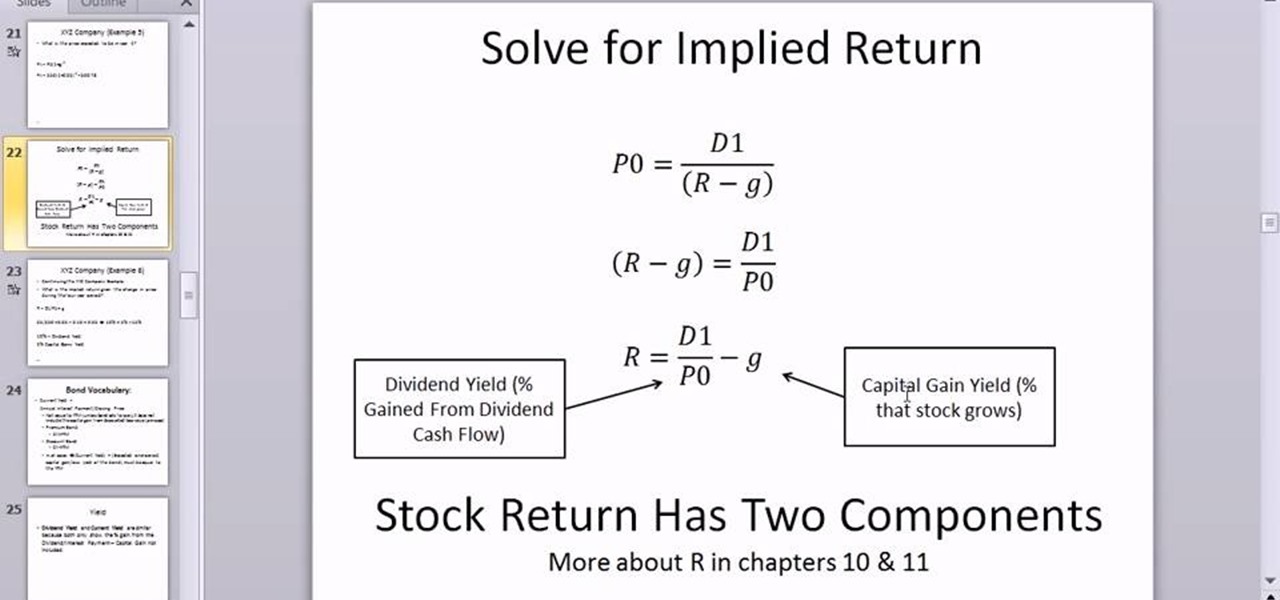

We can determine the intrinsic value of a stock based on its dividend growth.

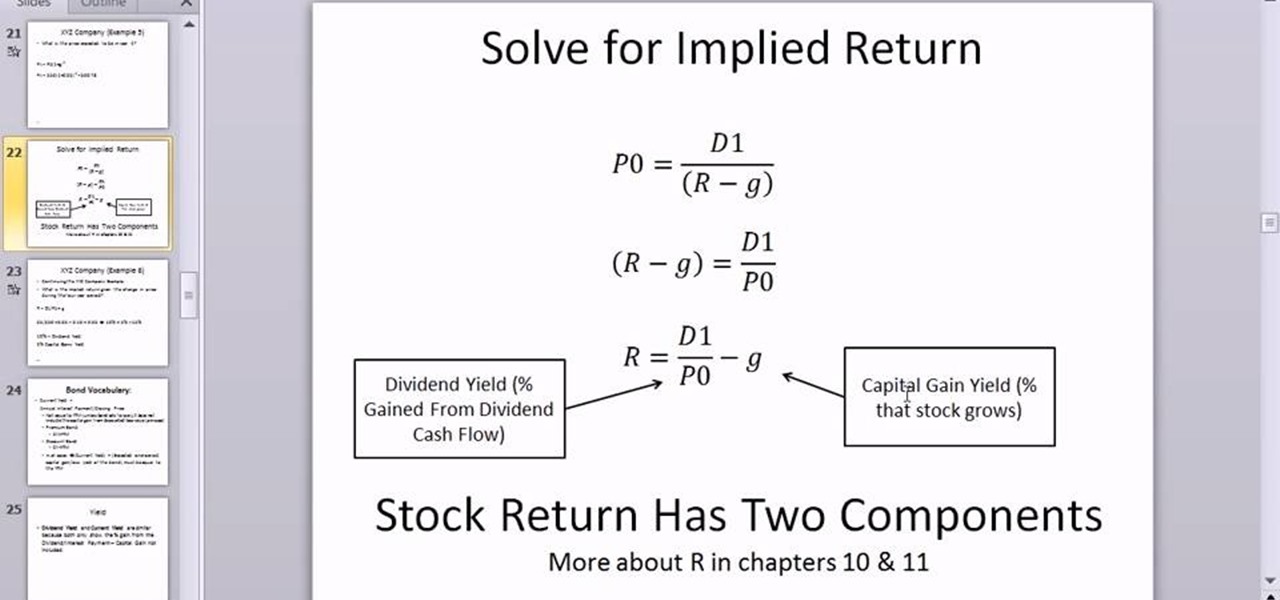

Calculate stock price from dividend and required rate of return. The required rate of return is the minimum return an investor will accept for owning a companys stock as compensation for a given level of risk associated with holding the stock. Finally the required rate of return is calculated by applying these values in the below formula. To illustrate how to calculate stock value using the dividend growth model formula if a stock had a current dividend price of 056 and a growth rate of 1300 and your required rate of return was 7200 the following calculation indicates the most you would want to pay for this stock would be 961 per share.

How to calculate the share price based off dividends. Or 11 for my required rate of return. For example the dividend discount model uses the rrr to discount the periodic payments and calculate the value of the stock.

The required rate of return formula is a key term in equity and corporate finance. Gordon model calculator helps to calculate the required rate of return k on the basis of current price current annual dividend and constant growth rate g. Relevance and uses of required rate of return formula.

Please note that the stock investment calculator assumes that future dividends will be paid and will grow on a constant basis and that the company will grow on a constant basis. You may find the required rate of return by using the capital asset. The minimum amount of return an investor requires to make it worthwhile to own a stock also referred to as the cost of equity generally the dividend discount model is best used for larger blue chip stocks because the growth rate of dividends tends to be predictable and consistent.

The rrr is also. Based on your entries this is the expected rate of return for the stock you are considering investing in. Required rate of return.

It uses a discount rate to convert all of the stocks expected future dividend payments into a single theoretical stock price which you can compare to the actual market price. The dividend discount model values a stock based on its dividends. How to calculate the share price based on dividends.

If the market.

Required Rate Of Return Formula Calculator Excel Template

Required Rate Of Return Formula Calculator Excel Template

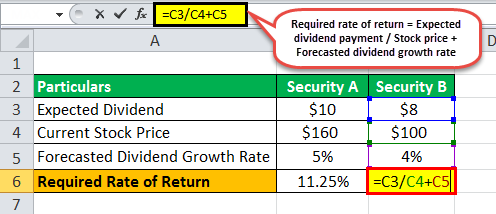

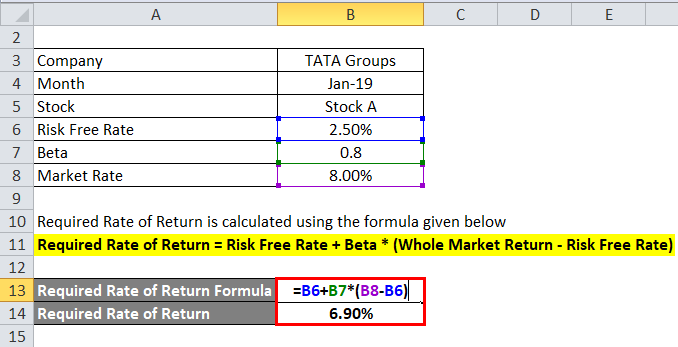

Required Rate Of Return Formula Step By Step Calculation

Required Rate Of Return Formula Step By Step Calculation

Required Rate Of Return Formula Calculator Excel Template

Required Rate Of Return Formula Calculator Excel Template

Required Rate Of Return Formula Step By Step Calculation

Required Rate Of Return Formula Step By Step Calculation

How To Calculate The Share Price Based On Dividends The Motley Fool

How To Calculate The Share Price Based On Dividends The Motley Fool

Required Rate Of Return Formula Calculator Excel Template

Required Rate Of Return Formula Calculator Excel Template

Present Value Of Stock With Constant Growth Formula With

Present Value Of Stock With Constant Growth Formula With

Required Rate Of Return Formula Step By Step Calculation

Required Rate Of Return Formula Step By Step Calculation

Calculating Preferred Stock Price And Required Rate Of Return

Calculating Preferred Stock Price And Required Rate Of Return

How To Calculate The Share Price Based On Dividends The Motley Fool

How To Calculate The Share Price Based On Dividends The Motley Fool

How To Calculate Implied Return Using The Dividend Growth Model In

How To Calculate Implied Return Using The Dividend Growth Model In