Discount indicates the amount of reduction in the rate for having monthly payments automatically deducted from an account andor for having other relationship accounts with the. Get flexible access to funds at interest rates lower than most credit cards.

Analyzing A Bank S Financial Statements

line of credit rates comparison 2017

line of credit rates comparison 2017 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in line of credit rates comparison 2017 content depends on the source site. We hope you do not use it for commercial purposes.

Citibank custom credit line.

Line of credit rates comparison 2017. Cibc personal line of credit. Two royal credit line cheques may be written during each monthly cycle without charge. Home equity is the current market value of your home minus the remaining balance of your mortgage.

You must also have an annual income that starts at 10500. The citibank line of credit rates range from 899 percent to 2099 percent depending on your credit. Cibc home power plan line of credit.

Get flexible access to funds for everyday expenses or big ticket items at interest rates lower than most credit cards. If youre disciplined in paying off your line of credit you could potentially save thousands of dollars in interest. A 200 royal credit line cheque fee applies to each cheque thereafterand a charge for cheque orders that depends on the design and quantity of the cheques you choose.

Have a personal consultation with a td specialist to discuss your options today. There may be times in life where you require a large sum of cash relatively quickly. Refer to your royal credit line agreement for details.

Get a lower interest rate by using the equity in your home. Lines of credit term. Learn about line of credit home loans with canstar.

Hello i applied for a personal line of credit with td i bank with td and my score is excellent i got approved right away for 10k but the interest rate is 994. A td personal line of credit is a smart borrowing option to finance purchases and paying off debt. Home equity line of credit heloc a home equity line of credit heloc is a revolving line of credit that allows you to borrow the equity in your home at a much lower interest rate than a traditional line of credit.

Essentially its the amount of ownership of a property you have built up. Learn about line of credit home loans with canstar. Home equity line of credit rates are based on a variable rate second lien revolving home equity line of credit washington for an owner occupied residence with an 80 loan to value ratio for line amounts of 50000.

To qualify for this line of credit youll need a citibank deposit account with a minimum balance of 500 and the account must be at least 3 months old. Line of credit loans typically have much lower interest rates than personal loans. A business line of credit combines some of the advantages of both a term loan and a business credit card and tends to offer a higher credit limit than a credit card for example depending on the lender you can borrow up to 500000 or more but generally offers lower interest rates than a credit card.

Analyzing A Bank S Financial Statements

New Car Loan Loans Installment Financing Banks Sgcarmart

New Car Loan Loans Installment Financing Banks Sgcarmart

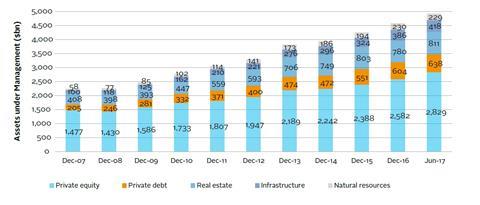

An Overview Of Private Debt Reports Guides Pri

An Overview Of Private Debt Reports Guides Pri

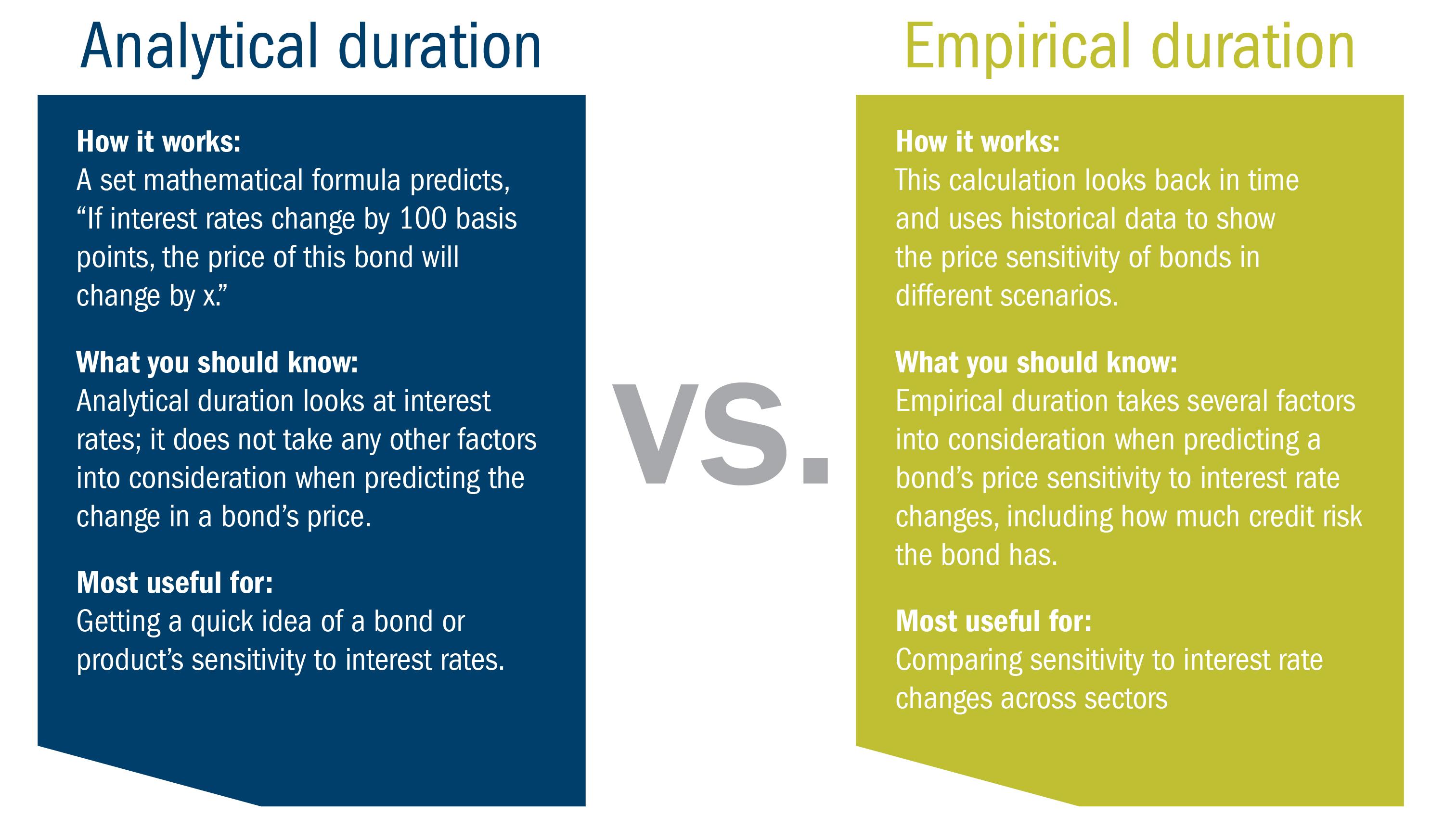

Empirical Duration A Better Way To Compare Interest Rate

Empirical Duration A Better Way To Compare Interest Rate

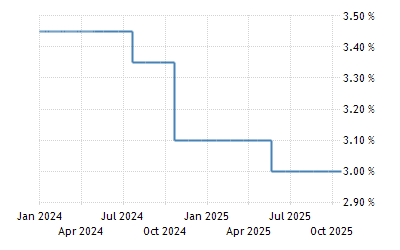

Russian Financial Crisis 2014 2017 Wikipedia

Russian Financial Crisis 2014 2017 Wikipedia

S P Experian Consumer Credit Default Indices Show Composite Rate

Why You Should Never Borrow From Unauthorized Lenders

Why You Should Never Borrow From Unauthorized Lenders

Home Equity Line Of Credit In Canada Vs Reverse Mortgages

Home Equity Line Of Credit In Canada Vs Reverse Mortgages

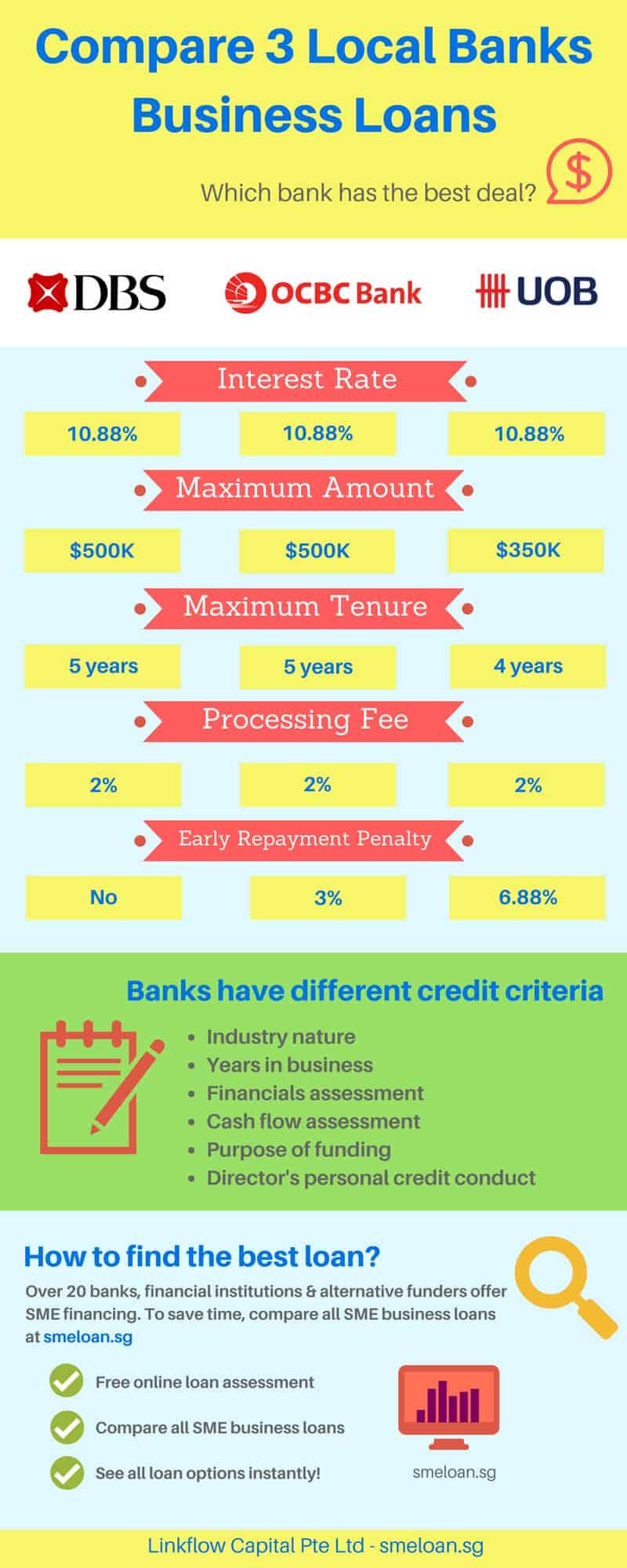

Compare Business Loan Singapore 2020 See Best Options

Compare Business Loan Singapore 2020 See Best Options