Follow these six steps to estimate the weighted average interest rate. Understanding the average interest method.

Average Interest Rate Vs Compound Interest Rate Personal Finance

Average Interest Rate Vs Compound Interest Rate Personal Finance

how to calculate average interest rate

how to calculate average interest rate is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to calculate average interest rate content depends on the source site. We hope you do not use it for commercial purposes.

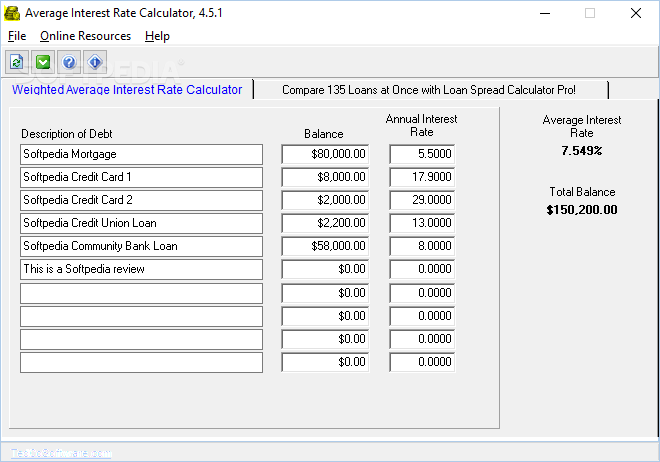

This simple weighted average interest rate calculator allows student loan borrowers to calculate the weighted average interest rate of their student loans.

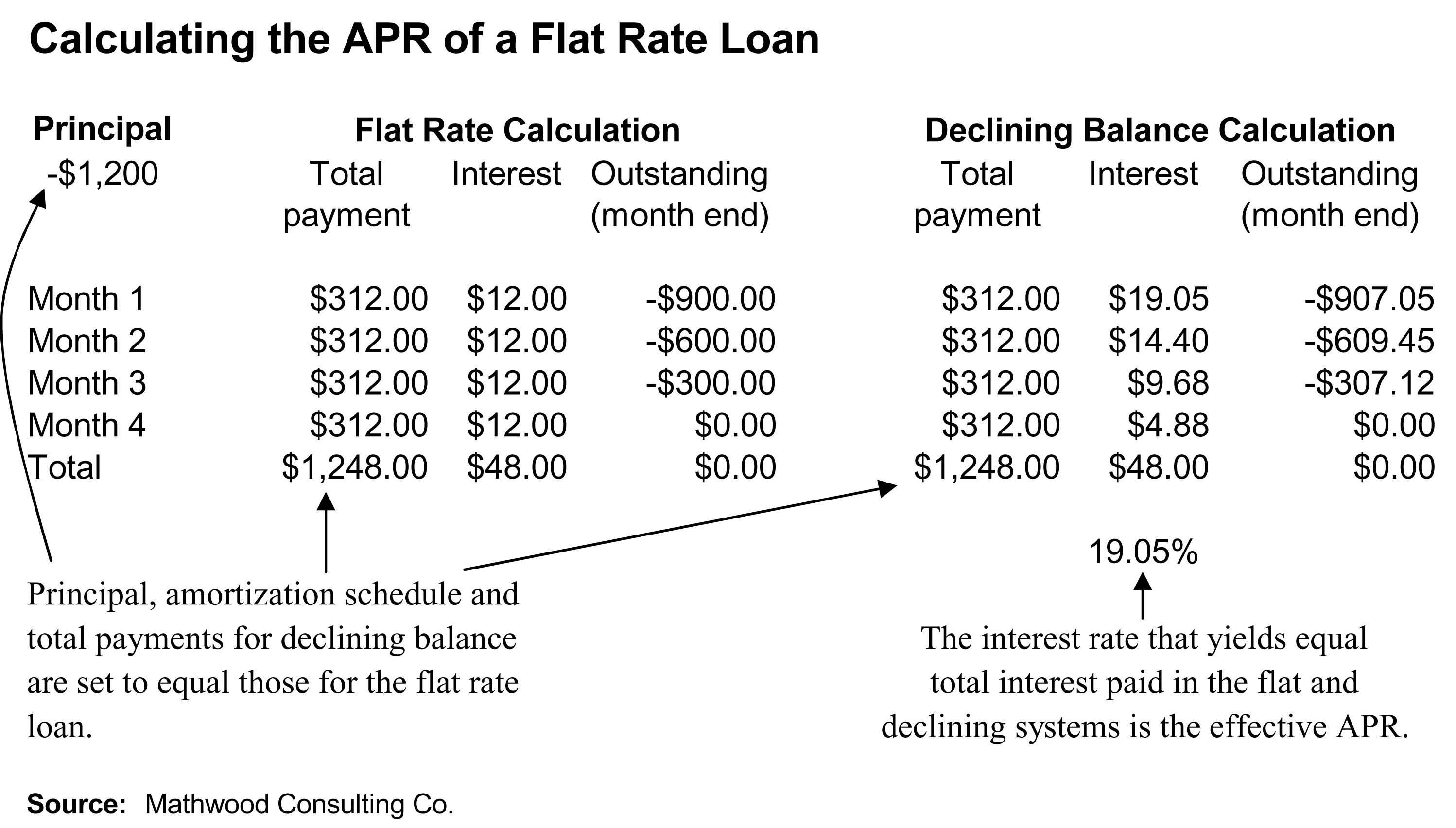

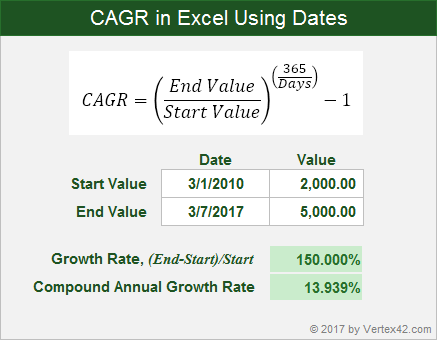

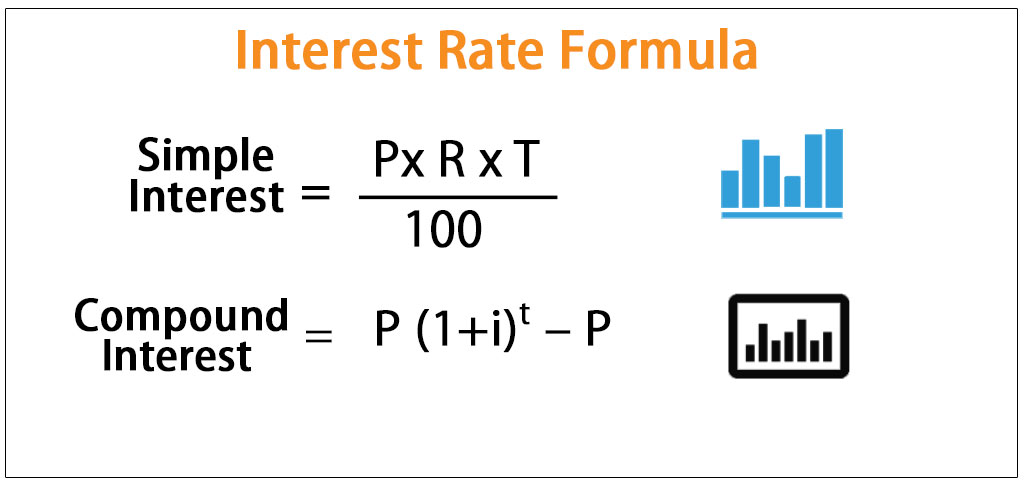

How to calculate average interest rate. There are various methods banks use to calculate interest rates and each method will change the amount of interest you pay. Write that number down then divide the amount of paid interest from that month or year by that number. To calculate interest rate start by multiplying your principal which is the amount of money before interest by the time period involved weeks months years etc.

This calculator will help you compute the average combined interest rate you are paying on up to fifteen of your outstanding debts. A weighted average interest rate is used when consolidating federal student loans with a direct consolidation loan. How to calculate the average interest rate on your debt.

Line up all your debts and interest rates. The weighted average combines the interest rates into a single interest rate that yields a combined cost that is about the same as the cost of the original separate loans. The weighted average interest rate is the aggregate rate of interest paid on all debt.

The answer is your interest rate but it will be in decimal format. Total owed 31000 but at what rate. Free interest calculator to find the interest final balance and accumulation schedule using either a fixed starting principal andor periodic contributions.

Multiply each loan amount by its interest rate to obtain the per loan weight factor. The interest rate on a direct consolidation loan uses the weighted average interest rate from the loans you want to consolidate. Also explore hundreds of other calculators addressing investment finance math fitness health and many more.

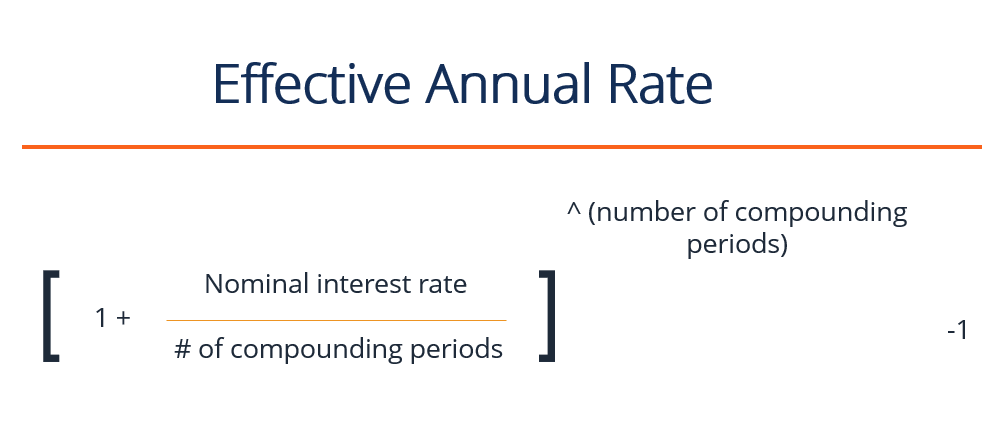

Included are options for tax compounding period and inflation. Aggregate interest payments aggregate de. If you have a number of loans and want to understand the total interest rate across them you will calculate the weighted average or blended interest rate of the loansthis gives you a sense of what you are paying in total in terms of interest rate on all of your debt.

If you know how to calculate interest rates you will better understand your loan contract with your bank. The calculation for this percentage is to aggregate all interest payments in the measurement period and divide by the total amount of debt. What is your estimated new interest rate.

For a direct consolidation loan the weighted average of the interest rates of all loans will be rounded up to the nearest. This can be very helpful when deciding whether or not to move the balances of several credit cards to another card or to another form of debt loans etc. You also will be in a better position to negotiate your interest rate.

Debt c 25000 at 7. Debt a 1000 at 5. The interest rate on a federal consolidation loan is based on the weighted average of the interest rates on the federal student loans that are combined into the consolidation loan.

Calculating it is pretty easy. Debt b 5000 at 3. Multiply the amount owed by the interest and sum it.

Interest Rate Formula Calculate Simple Compound Interest

Interest Rate Formula Calculate Simple Compound Interest

3 Ways To Calculate Daily Interest Wikihow

3 Ways To Calculate Daily Interest Wikihow

Bank Interest Loan And Investment Computation Ppt Download

Bank Interest Loan And Investment Computation Ppt Download

Solved Attempts Average 2 4 Calculating Interest Rate

Solved Attempts Average 2 4 Calculating Interest Rate

Effective Annual Rate Definition Formula What You Need To Know

Effective Annual Rate Definition Formula What You Need To Know

Download Free Average Interest Rate Calculator 4 5 1

Download Free Average Interest Rate Calculator 4 5 1

How To Use The Excel Rate Function Exceljet

How To Use The Excel Rate Function Exceljet

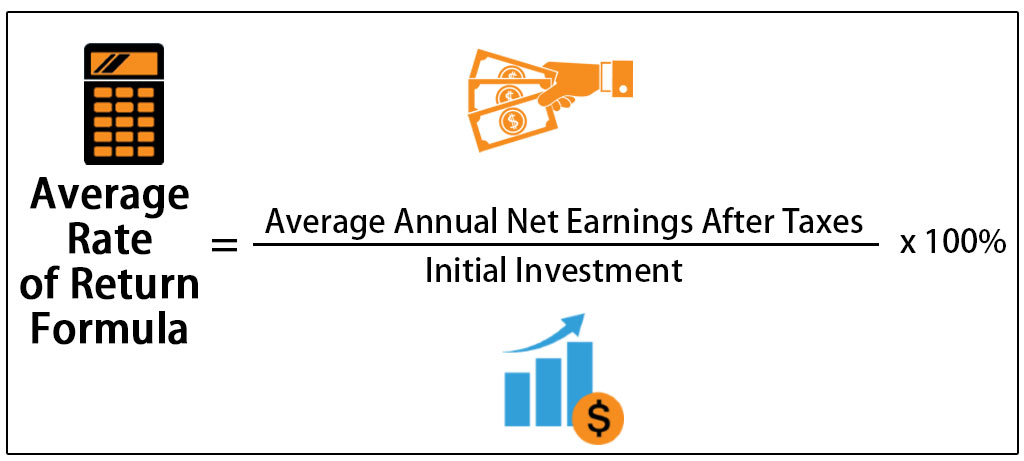

Average Rate Of Return Formula Definition Examples

Average Rate Of Return Formula Definition Examples

/dur1-5c0b038cc9e77c0001543188.jpg)