The minimum combined 2020 sales tax rate for kirkland washington is. The combined rate used in this calculator 101 is the result of the washington state rate 65 the kirkland tax rate 36.

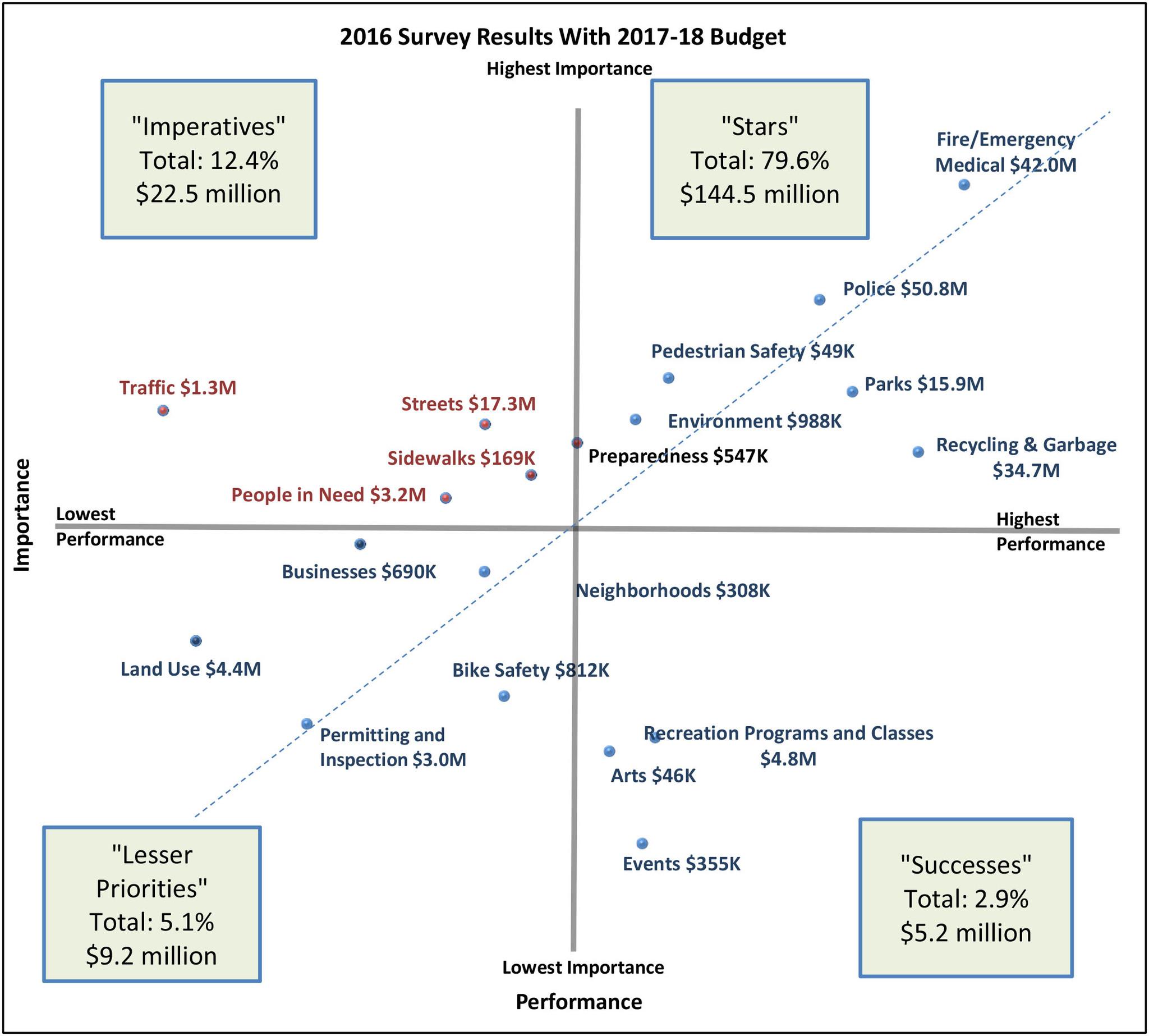

Kirkland Plans To Stay Steady With 2017 18 Budget Kirkland

Kirkland Plans To Stay Steady With 2017 18 Budget Kirkland

kirkland wa sales tax rate 2016

kirkland wa sales tax rate 2016 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in kirkland wa sales tax rate 2016 content depends on the source site. We hope you do not use it for commercial purposes.

Rate variation the 98033s tax rate may change depending of the type of purchase.

Kirkland wa sales tax rate 2016. With a median value of 516000 a property owner in kirkland will pay 5110 in 2018 property taxes. There is no applicable county tax or special tax. Rates include state county and city taxes.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The latest sales tax rate for kirkland wa. The king county sales tax rate is.

Kirkland doesnt collect sales tax on purchases of most groceries. Local sales and use tax addendum. You can print a 1010 sales tax table herefor tax rates in other cities see washington sales taxes by city and county.

2019 rates included for use while preparing your income tax deduction. Use to report additional sales and use tax pdf if not enough room on the tax return. The kirkland sales tax rate is.

The washington sales tax rate is currently. This is the total of state county and city sales tax rates. Median tax burden the most recent data available from the king county assessors office lists the median value of a residence in kirkland as 516000.

Kirkland washington sales tax exemptions in most states essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate. 2019 rates included for use while preparing your income tax deduction. Thurston county transportation tax.

The combined rate used in this calculator 95 is the result of the washington state rate 65 the kirkland tax rate 3. The 1010 sales tax rate in kirkland consists of 650 washington state sales tax and 360 kirkland tax. Washington has a 650 sales tax and king county collects an additional na so the minimum sales tax rate in king county is 65 not including any city or special district taxesthis table shows the total sales tax rates for all cities and towns in king county including.

Prepared food is subject to special sales tax rates under washington law. The 98033 kirkland washington general sales tax rate is 101. This was the median value from the 2016 survey which established the 2017 tax rate.

This rate includes any state county city and local sales taxes. Tax rate information for car dealers and leasing companies. The latest sales tax rates for cities in washington wa state.

The 98034 kirkland washington general sales tax rate is 95. How 2016 sales taxes are calculated for zip code 98034.

11226 Ne 94th St Kirkland Wa 98033 Mls 1040394 Redfin

11226 Ne 94th St Kirkland Wa 98033 Mls 1040394 Redfin

10120 Ne 62nd St Unit A Kirkland Wa 98033 Mls 1031383 Redfin

10120 Ne 62nd St Unit A Kirkland Wa 98033 Mls 1031383 Redfin

12212 83rd Place Ne Kirkland Wa 98034 Mls 933666 Redfin

12212 83rd Place Ne Kirkland Wa 98034 Mls 933666 Redfin

State And Local Sales Tax Rates In 2017 Tax Foundation

State And Local Sales Tax Rates In 2017 Tax Foundation

10707 Ne 60th St Kirkland Wa 98033 5 Bed 5 Bath Single Family

10707 Ne 60th St Kirkland Wa 98033 5 Bed 5 Bath Single Family

1335 3rd St Kirkland Wa 98033 Mls 914975 Redfin

1335 3rd St Kirkland Wa 98033 Mls 914975 Redfin

12036 87th Ave Ne Kirkland Wa 98034 Mls 1521270 Zillow

12036 87th Ave Ne Kirkland Wa 98034 Mls 1521270 Zillow

Kirkland Washington Wa 98033 Profile Population Maps Real

Kirkland Washington Wa 98033 Profile Population Maps Real

Pre Owned 2016 Audi A5 Premium Plus 2dr Car In Kirkland 196188a

Pre Owned 2016 Audi A5 Premium Plus 2dr Car In Kirkland 196188a