Corporate tax rate in bangladesh averaged 3034 percent from 1997 until 2018 reaching an all time high of 40 percent in 1998 and a record low of 25 percent in 2016. Personal income tax rate in bangladesh averaged 2667 percent from 2004 until 2018 reaching an all time high of 30 percent in 2014 and a record low of 25 percent in 2005.

National Board Of Revenue Nbr Bangladesh

income tax rate in bangladesh 2016 17

income tax rate in bangladesh 2016 17 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in income tax rate in bangladesh 2016 17 content depends on the source site. We hope you do not use it for commercial purposes.

It is a progressive tax system.

Income tax rate in bangladesh 2016 17. Income tax is imposed on the basis of ability to pay. Banks financial institutions and insurance companies are taxed at 40 whilst all other non publicly traded companies are taxed at the 35 rate. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22.

Here i will discuss only how to calculate tax rebate on your investment allowance. Income tax at a glance among direct taxes income tax is the main source of revenue. For the 201516 tax year 1 july 2015 to 30 june 2016 the top corporate tax rate was 45 however publicly traded companies registered in bangladesh are taxed at a lower rate of 25.

Taxes on directors fee consultation fees and all other income. The national board of revenue nbr is the apex authority for tax administration in bangladesh. Most of the people share with me a huge amount is deducting each month from their salary.

1 the income tax ordinance 1984 chapters and sections 4 2 different tax rates 6 3 tax exempted ceiling of income for person 6 4 charge of minimum tax section 16ccc 7 5 small and cottage industries 7 6 tax rates for companies 7 7 inter corporate tax rate tax rate on dividend for assessment years 2016 17 8. If you want to know the areas of investments and donations then you may read the article where to invest for tax rebate in income tax of bangladesh. The income tax department has introduced new income tax disclosure norms under which individuals with a yearly income of more than rs 50 lakhs are required to disclose the cost of acquisition of any assets such as property jewellery precious metals apparels etc in their tax return forms for the assessment year 2016 17.

This page provides bangladesh corporate tax rate actual values historical data forecast chart statistics economic calendar and news. It aims at ensuring equity and social justice. Bangladesh government have recently published finance bill 2016 which includes the proposed budget for 2016 17.

This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. In the finance bill finance minister suggested several changes in existing taxation laws. Individual and corporate tax rates and rebates will be reformed if the proposed bill is passed in the national assembly.

It was established by the father of the nation bangabandhu sheikh mujibur rahman under presidents order no. In bangladesh income tax is. The more a taxpayer earns the more he should pay is the basic principle of charging income tax.

This page provides bangladesh personal income tax rate actual values historical data forecast chart statistics economic calendar and news. However tax experts.

Finance Bill 2015 Major Changes To Income Tax Lightcastle Partners

Finance Bill 2015 Major Changes To Income Tax Lightcastle Partners

National Budget 2018 19 No Cheers In Tax Measures

National Budget 2018 19 No Cheers In Tax Measures

National Board Of Revenue Nbr Bangladesh

Ace Advisory Bangladesh Tax Insights 2016

Ace Advisory Bangladesh Tax Insights 2016

Salient Features Of Income Tax Of Bangladesh In 2017 18

Ace Advisory Bangladesh Tax Insights 2016

Ace Advisory Bangladesh Tax Insights 2016

Finance Bill 2015 Major Changes To Income Tax Lightcastle Partners

Finance Bill 2015 Major Changes To Income Tax Lightcastle Partners

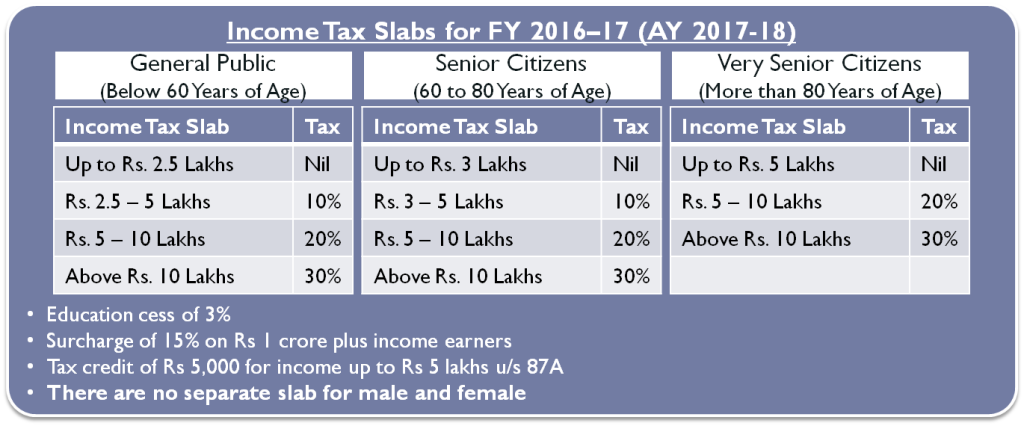

Download Income Tax Calculator For Fy 2016 17 Ay 2017 18

Download Income Tax Calculator For Fy 2016 17 Ay 2017 18

5 Reasons Why Bangladesh Budget 2017 18 Is Not Industry Friendly

Chad Personal Income Tax Rate 2013 2018 Data 2019 2020

Chad Personal Income Tax Rate 2013 2018 Data 2019 2020