In 2012 president obama announced plans to raise the two top tax rates from 35 to 396 and from 33 to 36. So history suggests that tax rates will soon start going up.

Corporate Tax In The United States Wikipedia

Corporate Tax In The United States Wikipedia

highest tax rate in the us history

highest tax rate in the us history is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in highest tax rate in the us history content depends on the source site. We hope you do not use it for commercial purposes.

State and local tax rates ranging from 0 to 12 averaging out to 75.

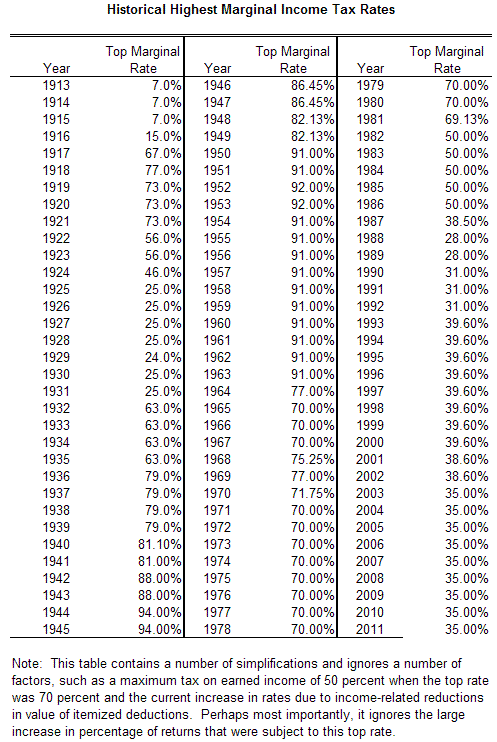

Highest tax rate in the us history. The top rate was hiked last in 1993 to 35 percent. Based on the summary of federal tax income data in 2009 with a tax rate of 35 the highest earning 1 of people paid 367 of the united states income tax revenue. In 1944 45 the most progressive tax years in us.

Federal individual income tax rates history nominal dollars income years 1913 2013 nominal married filing jointly married filing separately single head of household marginal marginal marginal marginal tax rate over but not over tax rate over but not over tax rate over but not over tax rate over but not over. What was the highest tax rate in us history. The effective tax rate for large corporations is 186.

History the 94 rate applied to any income above 200000 24 million in 2009 dollars given. Starve the beast policy taxation in the united states. The united states corporate tax rate was at its highest 528 percent in 1968 and 1969.

Wiki user october 20 2008 144pm. That top tier marginal rates were so high for so many decades which included such notable periods of america growth obviously doesnt prove that the tax rate should be 70 percent again. The 2017 effective rate was 40.

Federal tax rate of 35 for the highest income brackets. The highest income tax rate jumped from 15 percent in 1916 to 67 percent in 1917 to 77 percent in 1918. Lets begin with a look at the top income tax bracket since the federal income tax was started in 1913.

The top marginal tax rate was reduced to 58 in 1922 to 25 in 1925 and finally to 24 in 1929. Thats why the system is called progressive the percentage rate progresses upward with income but the higher percentage applies only to new marginal income above each break point. Historical highest marginal personal income tax rates.

Income tax in the united states. Under the tax cuts and jobs act of 2017 the rate adjusted to 21 percent. After the war federal income tax rates took on the steam of the roaring 1920s dropping to 25 percent from 1925 through 1931.

Dont take our word for it though. Had one of the highest tax rates in the world before president trumps tax reform.

Taxes On The Rich Were Not Much Higher In The 1950s Tax Foundation

Taxes On The Rich Were Not Much Higher In The 1950s Tax Foundation

History Of Taxation In The United States Wikipedia

History Of Taxation In The United States Wikipedia

How Do Current Tax Rates In The U S Compare To Different Times

Federal Tax History Chart Barta Innovations2019 Org

Federal Tax History Chart Barta Innovations2019 Org

For The First Time In History U S Billionaires Paid A Lower Tax

For The First Time In History U S Billionaires Paid A Lower Tax

File Usa Historical Marginal Tax Rate For Highest And Lowest

File Usa Historical Marginal Tax Rate For Highest And Lowest

History Of Taxation In The United States Wikipedia

History Of Taxation In The United States Wikipedia

Is Bernie Sanders Proposing The Largest Tax Increase In American

Is Bernie Sanders Proposing The Largest Tax Increase In American

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

History Of American Income Tax Rates

History Of American Income Tax Rates