The foreign exchange market assists international trade and investments by enabling currency conversion. When one currency is traded for another a foreign exchange market is established.

exchange rate mechanism work in international market

exchange rate mechanism work in international market is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in exchange rate mechanism work in international market content depends on the source site. We hope you do not use it for commercial purposes.

The london foreign exchange market is the worlds single largest international exchange market.

Exchange rate mechanism work in international market. The economic and social outlook of a country will influence its currency exchange rate compared to other countries. The foreign exchange market or fx market is the largest market in the world. The equilibrium exchange rate is the rate which equates demand and supply for a particular currency against another currency.

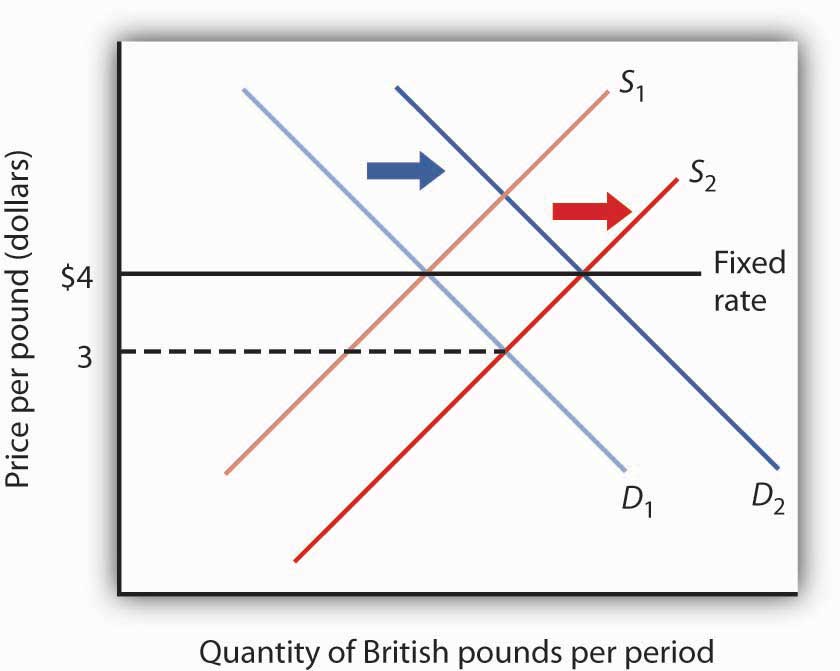

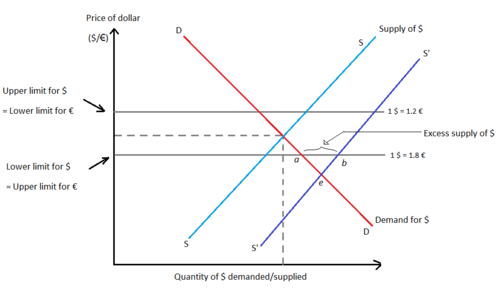

The currencies are allowed to fluctuate with respect to one another within a specified limit. The most popular example of an exchange rate mechanism is the european exchange rate mechanism which was designed to reduce exchange rate variability and achieve monetary stability in europe prior to the introduction of the euro on january 1 1999. An exchange rate is a price specifically the relative price of two currencies.

A floating exchange rate is a regime where the currency price of a nation is set by the forex market based on supply and demand relative to other currencies. If the exchange rate between any two currencies reaches the limit the central. For example it permits a business in the united states to import goods from european union member states especially eurozone members and pay euros even though its income is in united states dollars.

For example the us. An exchange rate is how much of your countrys currency buys another foreign currency. This is in contrast to a fixed.

A large proportion of short term trade in currencies is by dealers who work for financial institutions. Process by which member countries of an economic community such as the european union maintain exchange rate parity among their currencies. Exchange rate mechanism erm.

Dollarmexican peso exchange rate is the price of a peso expressed in us. An exchange rate mechanism erm is a way that central banks can influence the relative price of its national currency in forex markets. On march 23 2015 this exchange rate was usd 10945 per eur or in market notation 10945 usdeur.

For some countries exchange rates constantly change while others use a fixed exchange rate. The erm allows the central bank to tweak a currency peg in. The exchange rate system evolves from the nations monetary order which is the set of laws and rules that establishes the monetary framework in which transactions are conducted.

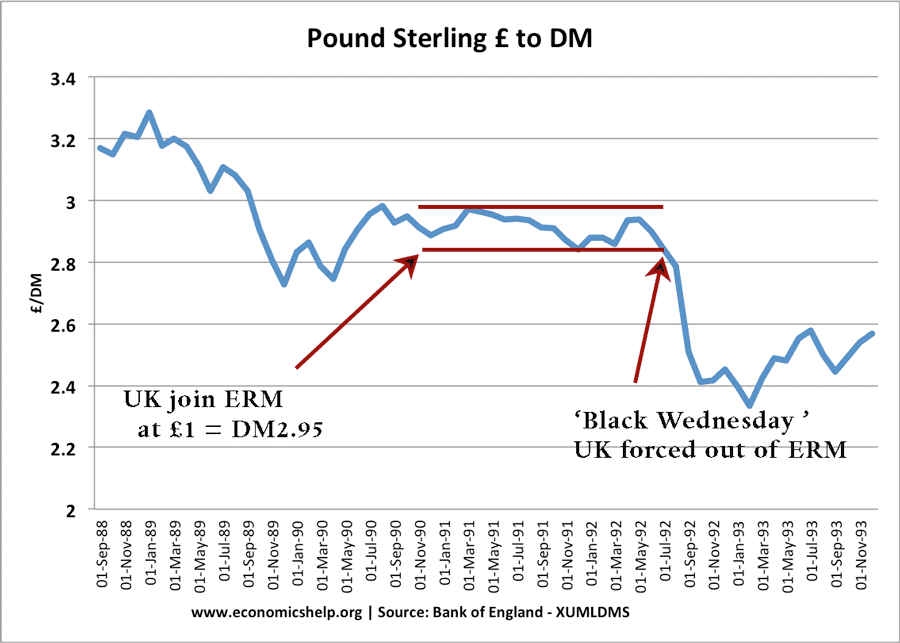

The european exchange rate mechanism erm was a system introduced by the european economic community on 13 march 1979 as part of the european monetary system ems to reduce exchange rate variability and achieve monetary stability in europe in preparation for economic and monetary union and the introduction of a single currency the euro which took place on 1 january 1999. The price of milk and the price of foreign currency.

Fixed Exchange Rate System Wikipedia

Fixed Exchange Rate System Wikipedia

Fixed Exchange Rate System Wikipedia

Fixed Exchange Rate System Wikipedia

Fixed Exchange Rate System Wikipedia

Fixed Exchange Rate System Wikipedia

Exchange Rates Currency Systems Economics Tutor2u

Exchange Rates Currency Systems Economics Tutor2u

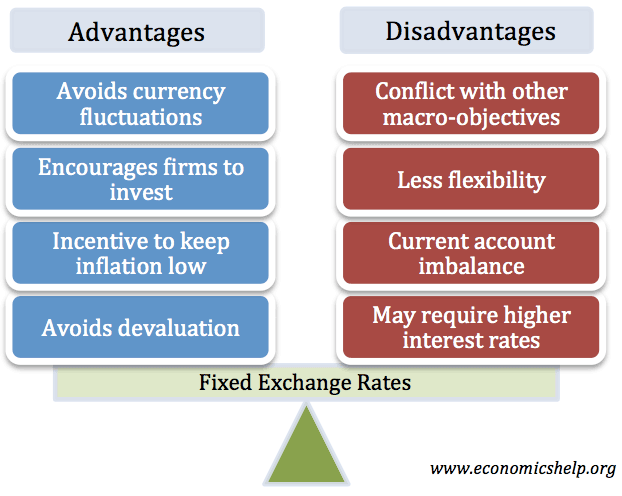

Advantages Of Fixed Exchange Rates Economics Help

Advantages Of Fixed Exchange Rates Economics Help

Foreign Exchange Markets Forex Economics Online

Foreign Exchange Markets Forex Economics Online

Foreign Exchange Markets Forex Economics Online

Foreign Exchange Markets Forex Economics Online

/GettyImages-97615590-57a5af625f9b58974aee7803.jpg) What Is An Exchange Rate Mechanism Erm

What Is An Exchange Rate Mechanism Erm

:max_bytes(150000):strip_icc()/currency_shutterstock_274220507-5bfc31ac46e0fb00517d0d20.jpg) Exchange Rate Mechanism Erm Definition

Exchange Rate Mechanism Erm Definition

Fixed Exchange Rate An Overview Sciencedirect Topics

Fixed Exchange Rate An Overview Sciencedirect Topics