20190 until the reduction is eliminated resulting in an additional 356 of provincial tax on income between 20190 and 33702. The combined federal and provincial marginal tax rate is 4980 which is paid on the income above 210371.

Taxtips Ca Canada And Provinces Territories 2018 And 2019

Taxtips Ca Canada And Provinces Territories 2018 And 2019

combined federal and provincial tax rates 2019

combined federal and provincial tax rates 2019 is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in combined federal and provincial tax rates 2019 content depends on the source site. We hope you do not use it for commercial purposes.

Corporate tax rates 2 current as of march 31 2019 75 combined federal and provincialterritorial tax rates for income earned by a ccpc2019 and 2020 small business income up to 5000002 active business income3 investment income4 provincial rates british columbia 110 270 507 alberta 110 270 507 saskatchewan8 110 170270 507.

Combined federal and provincial tax rates 2019. Calculate your combined federal and provincial tax bill in each province and territory. Other non refundable and refundable credits may be available. This table lists the most common non refundable tax credits.

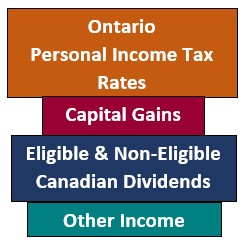

Federal and provincial personal tax credits 20191 1. The federal and ontario tax brackets and personal amounts are increased for 2020 by an indexation factor of 1019 except for the ontario 150000 and 220000 bracket amounts. 2019 includes all rate changes announced up to june 15 2019.

Important to note that you can reduce the amount of the bc personal income tax you owe with several. Please read the article understanding the tables of personal income tax rates. British columbia tax brackets and personal marginal income tax rates 2019.

The calculator reflects known rates as of june 15 2019. The marginal tax rates show the percentage of tax that would be paid on additional income. 2019 personal tax calculator.

Choose your province or territory below to see the combined federal provincialterritorial marginal tax rates. For 2018 and previous tax years you can find the federal tax rates on schedule 1for 2019 and later tax years you can find the federal tax rates on the income tax and benefit returnyou will find the provincial or territorial tax rates on form 428 for the. Canadian corporate tax rates for active business income.

The tax value of each provincial tax credit includes the reduction in provincial surtax as it would apply to taxpayers in the highest tax bracket except for the age. 2020 includes all rate changes announced up to january 15 2020. Ontario tax rates current marginal tax rates ontario personal income tax rates ontario 2020 and 2019 personal marginal income tax rates.

British columbia combined federal and provincial personal income tax rates 20191. Calculate your annual federal and provincial combined tax rate with our easy online tool. Income tax calculator for individuals 2019 view this page in.

Tax rates for previous years 1985 to 2019 to find income tax rates from previous years see the income tax package for that year. Tax rates marginal personal income tax rates for 2020 and 2019 2020 and 2019 tax brackets and tax rates canada and provincesterritories. Shows combined federal and provincial or territorial income tax and rates current to november 1 2019.

2019 Top Personal Marginal Tax Rates

Canadian Marginal Tax Rates 2019 Calor Software

Canadian Marginal Tax Rates 2019 Calor Software

2019 Corporate Income Tax Rates Bdo Canada

2018 2019 Corporate Income Tax Rates In Canada Combined Federal

2018 2019 Corporate Income Tax Rates In Canada Combined Federal

Prosperiguide Income Tax Rates And Tables

Taxtips Ca Manitoba Personal Income Tax Rates

Taxtips Ca Manitoba Personal Income Tax Rates

Tax Tables N I Cameron Inc Chartered Professional Accountants

Tax Tables N I Cameron Inc Chartered Professional Accountants

2016 Taxable Income Chart Barta Innovations2019 Org

Canadian Marginal Tax Rates 2019 Calor Software

Canadian Marginal Tax Rates 2019 Calor Software